Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 915 million shares, equivalent to a value of more than 22.7 trillion dong; HNX-Index reached over 87.7 million shares, equivalent to a value of more than 1.3 trillion dong.

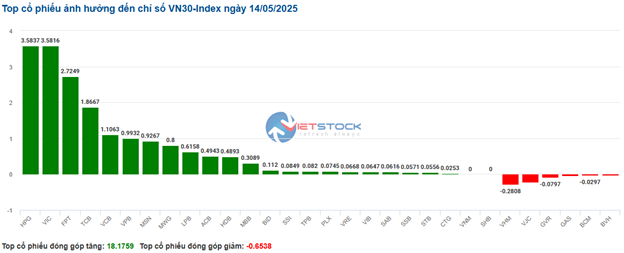

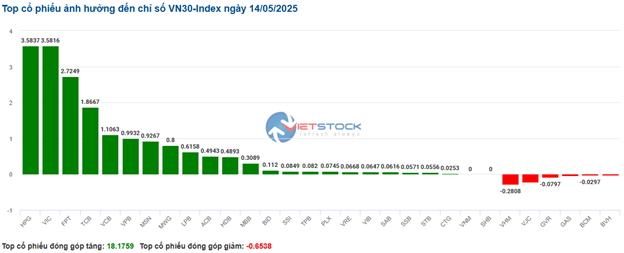

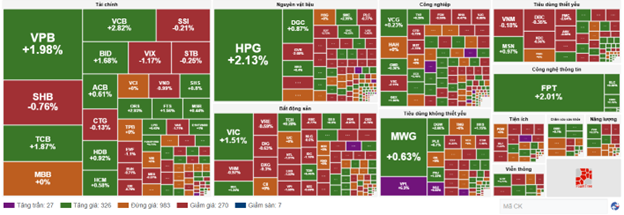

VN-Index fluctuated in the first half of the afternoon session, but the buying side gradually gained the upper hand, helping the index surge and close in the positive territory. In terms of impact, VCB, BID, VPL, and FPT were the most positive influences on the VN-Index, contributing over 11.5 points to the rise. On the other hand, VHM, GVR, VRE, and HVN continued to face selling pressure, taking away more than 2.6 points from the overall index.

| Top 10 stocks with the highest impact on the VN-Index on May 14, 2025 |

Similarly, the HNX-Index also witnessed a rather optimistic performance, with positive contributions from stocks such as MBS (+1.85%), DTK (+3.17%), HUT (+2.34%), and SHS (+2.4%)…

|

Source: VietstockFinance

|

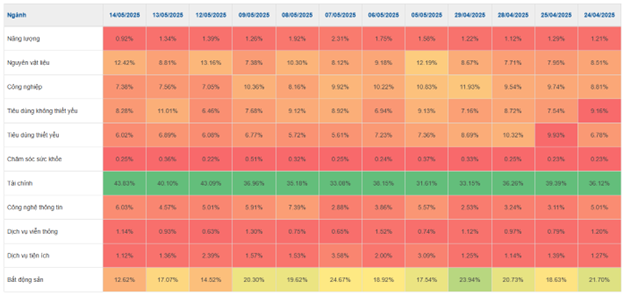

The information technology sector was the top-performing group, surging by 5.65%, mainly driven by stocks such as FPT (+5.69%), CMG (+5.4%), PIA (+9.92%), and SMT (+7.95%). This was followed by the non-essential consumer goods sector and the telecommunications sector, which rose by 2.86% and 2.5%, respectively. On the other hand, the real estate sector was the worst-performing group in the market, declining by 0.41%, mainly due to losses in stocks such as VHM (-2.58%), VRE (-2.76%), VPI (-1.58%), and SIP (-1.27%).

In terms of foreign investors’ activities, they continued to be net buyers on the HOSE exchange, focusing on stocks such as FPT (540.57 billion dong), VPB (321.48 billion dong), MWG (284.54 billion dong), and HPG (181.46 billion dong). On the HNX exchange, foreign investors net bought over 6 billion dong, mainly investing in IDC (20.75 billion dong), SHS (5.99 billion dong), PVI (3.43 billion dong), and NTP (1.4 billion dong).

| Foreign investors’ net buying and selling activities |

Morning Session: Foreign Investors Continue Net Buying

VN-Index maintained its upward momentum, supported by strong demand from foreign investors. At the midday break, the VN-Index stood at 1,303.83 points, up 0.8%. However, the HNX-Index turned red, losing 0.27% to close at 217.35 points. The market breadth was positive, with 338 gainers and 308 losers.

Large-cap stocks continued to play a pivotal role in this rally. The VN30-Index was up nearly 12 points, with 8 out of 10 stocks having the most positive impact on the VN-Index belonging to this group. VCB, FPT, VIC, and BID contributed a total of more than 7 points to the rise. On the flip side, VHM and GVR were the main drags on the index, taking away over 1 point.

Most sectors traded in positive territory, but half of them witnessed relatively modest movements with mixed performances. Information technology and non-essential consumer goods continued their strong advance, led by FPT (+3.6%), CMG (+4.23%); GEX (+3.2%), DGW (+2.66%), PET (+3.59%), MSH (+4.1%), while VPL and HAX hit the daily limit-up.

Although the financial sector posted a more modest gain, it remained crucial in maintaining the market’s momentum thanks to its large market capitalization. In particular, the strong performance of “king” stocks such as VCB (+2.99%), BID (+1.96%), VPB (+2.82%), and TCB (+1.7%) stood out. However, most securities and insurance stocks witnessed slight corrections.

The real estate sector followed a similar pattern, with most stocks in the industry trading in negative territory, but the gains in VIC (+1.63%), NVL (+0.83%), SSH (+0.69%), and others helped the sector index barely stay in the green.

Foreign investors remained net buyers, injecting nearly 1.1 trillion dong into the three exchanges in the morning session alone. FPT was the most net bought stock, followed by VPB, HPG, and MWG, with net purchases of over 130 billion dong each. Meanwhile, VNM topped the net selling list with a value of approximately 69 billion dong.

| Foreign investors’ net buying and selling activities (as of the morning session on May 14, 2025) |

10:40 AM: Money Flows into Financial Stocks, VN-Index Stays in the Green

Investor sentiment was somewhat mixed as the VN-Index broke above the 1,300-point threshold, but trading volume lacked “consensus.” Financial and non-essential consumer goods stocks led the market’s upward trend.

The breadth among the VN30 constituents was positive, with gainers outnumbering losers. Specifically, on the upside, HPG contributed 3.58 points, VIC added 3.58 points, FPT brought 2.72 points, and TCB contributed 1.87 points to the VN30-Index. Conversely, selling pressure persisted in a few stocks, including VHM, VJC, GVR, and GAS, but their negative impact was not significant.

Source: VietstockFinance

|

Although the current rally stands at a modest 1.34%, financial stocks are spreading the positive sentiment across the sector, with large-cap banks such as VCB up 2.99%, BID gaining 1.68%, TCB rising 2.04%, MBB up 0.2%, and VPB climbing 2.26%. As the sector with the largest market capitalization, the financial industry continued to lead the overall market higher, posting positive performances in the last three sessions as large fund flows returned.

Source: VietstockFinance

|

Additionally, the non-essential consumer goods sector was the top-performing group in the market, surging by 2.36%. Specifically, VPL continued to hit the daily limit-up after its listing on the HOSE exchange, while MWG rose 0.63%, PLX climbed 0.28%, and PNJ advanced by 0.85%…

On the opposite side, the energy sector witnessed a mixed performance, with selling pressure dominating. Notably, stocks such as MGC declined by 3.59%, and ITS dropped by 1.67%. The majority of the remaining stocks remained unchanged, while only five managed to stay in the green, including PVD (+0.27%), PVS (+0.73%), NBC (+1.01%), and MDC (+1.82%)…

The market breadth remained positive, with over 320 gainers outnumbering around 260 losers. At this point, the VN-Index climbed more than 8.7 points to 1,302 points, while the HNX-Index dipped 0.19% to around 217 points, and the UPCoM-Index rose 0.38%.

Source: VietstockFinance

|

Opening: Green Dominates Most Sectors

On May 14, as of 9:30 AM, the VN-Index posted a solid gain, climbing to 1,301.03 points. Meanwhile, the HNX-Index edged slightly higher, reaching 218.73 points.

According to the US Bureau of Labor Statistics, the Consumer Price Index (CPI) rose less than expected in April 2025 as President Donald Trump’s trade war began to impact the economy. Specifically, in April 2025, CPI increased by 2.3% year-over-year, lower than the previous month’s reading of 2.4% and falling short of economists’ forecast of 2.4%. On a monthly basis, CPI rose by 0.2%, in line with expectations.

As of 9:30 AM, the majority of VN30 constituents traded in positive territory, with 17 gainers, 8 losers, and 5 unchanged stocks. Among them, VRE, GVR, SHB, and VHM were the top losers. Conversely, VCB, BID, FPT, and ACB were the top gainers.

Additionally, the information technology sector was the top-performing group in the market this morning, rising by 1.7%. Notably, stocks such as FPT climbed by 1.67%, CMG surged by 2.63%, and ITD advanced by 1.45%…

Following closely was the financial sector, where most stocks traded in the green from the opening bell, including VCB (+2.99%), BID (+1.82%), ACB (+1.02%), HDB (+1.15%), FTS (+1.7%), and HCM (+0.58%)…

– 3:30 PM, May 14, 2025

Raising the Bar: Foreign Investors Scoop Up Millions of VPB Shares

The Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) witnessed a remarkable trading session on May 14th, with its shares surging to the upper limit of VND 18,900 per share. The session witnessed a staggering volume of nearly 107 million shares being traded.

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.

“Vietnam Stock Market: Real Estate Shines Amidst Dull April Performance”

The Ho Chi Minh Stock Exchange (HOSE) ended the trading session on April 30, 2025, with key indices, including the VN-Index, VNAllshare, and VN30, posting losses compared to the end of March. Sectoral indices also witnessed declines, with the exception of the real estate sector, which managed to stay afloat.

“Vingroup’s Total Value Surges to Nearly $43 Billion as Tycoon Pham Nhat Vuong Drops His 5th Billion-Dollar ‘Blockbuster’ IPO”

With a staggering valuation of $5 billion, Vinpearl has cemented its place among Vietnam’s most valuable companies, securing a spot in the top 15 on the stock exchange. This achievement places them just behind VPBank and ahead of notable non-banking giants such as Vinamilk, GVR, and Masan.