USD Central Rate Remains at Peak

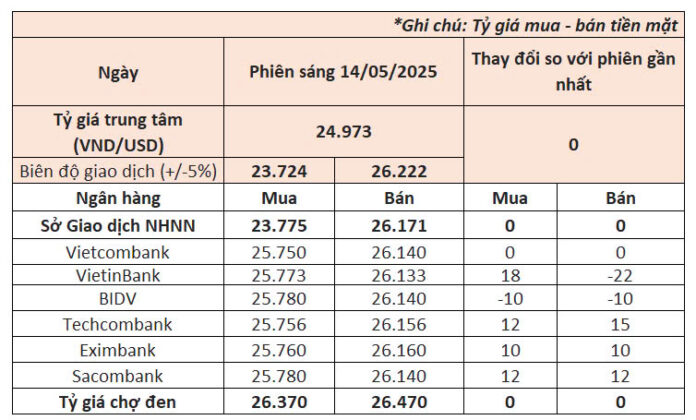

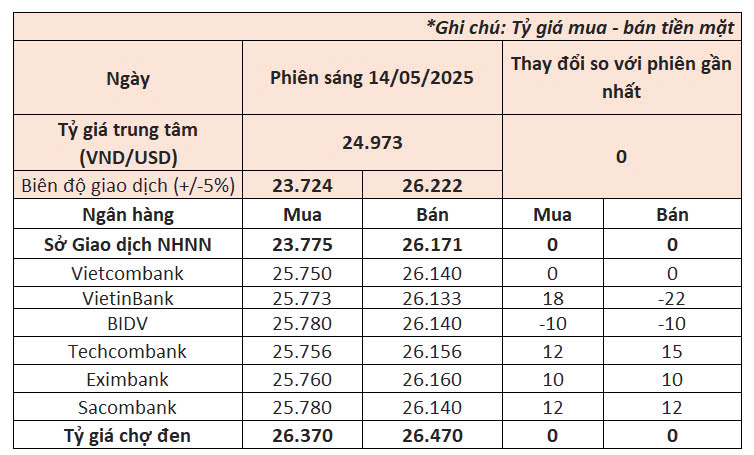

Today (May 14th), the State Bank of Vietnam announced the USD central exchange rate at 24,973 VND/USD, unchanged from the previous day’s listing and pegged at the highest level since the beginning of this rate regime in early 2016.

With a 5% margin, the allowable trading range for commercial banks is now 23,724 – 26,222 VND/USD.

The State Bank of Vietnam’s Trading Center also kept the reference buying and selling rates unchanged at 23,775 – 26,171 VND/USD.

This morning, USD rates at banks fluctuated, with state-owned banks showing a decrease and private banks an increase compared to yesterday.

At 9:00 am, Vietcombank, the bank with the largest foreign exchange volume in the system, listed USD rates at 25,750 – 26,140 VND/USD, unchanged from the previous day.

Meanwhile, BIDV decreased by 10 VND in both buying and selling rates. VietinBank increased by 18 VND in the buying rate and decreased by 22 VND in the selling rate.

In the group of private banks, USD rates tended to increase compared to the previous day. Specifically, Techcombank raised the buying rate by 12 VND and the selling rate by 15 VND. Eximbank increased both buying and selling rates by 10 VND. Sacombank, on the other hand, increased both buying and selling rates by 12 VND.

In the interbank market, the exchange rate closed at 25,962 VND/USD on May 13th, an 11 VND decrease compared to the previous session on May 12th.

In the “black market,” surveys at 9:00 am today showed that the USD is currently traded at 26,370 – 26,470 VND/USD, unchanged from the previous day’s rate.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against other major currencies, is hovering around 101 points.

The DXY fell 0.67% in the previous session after the US Bureau of Statistics announced that the core CPI and overall CPI in the country both rose 0.2% in April, lower than the forecast of a 0.3% increase. Although lower than expected, analysts still believe that inflation is likely to rise in the coming months as US tariffs increase the cost of imported goods.

“Although the headline inflation figure was better than expected, there are signs that tariffs have pushed prices higher,” said Brian Jacobsen, chief economist at Annex Wealth Management.

Previously, the greenback had risen more than 1% on Monday as markets were optimistic that the tariff agreement between the US and China could ease the trade war between the world’s two largest economies, which had increased the risk of a global recession.

Since late April, the US dollar has gradually recovered against other major currencies as trade tensions between the US and China have eased.

Currently, the US dollar is still nearly 3% lower than its level on April 2nd when President Donald Trump began announcing tariffs, causing foreign investors to flee the US stock and bond markets.

Gold Ring Prices Vary Significantly Among Brands

Domestic gold bar prices this morning, May 14, 2025, fell slightly, while gold ring prices remained stable with significant differences among brands.

A survey at 10 am this morning showed that gold bars were traded by major gold companies at the buying and selling levels of 118-120 million VND/tael, a decrease of 500,000 VND/tael compared to the end of the previous day.

Meanwhile, gold ring prices quoted by different brands varied significantly, with a difference of up to 3.5 million VND/tael.

Bao Tin Minh Chau Company listed gold ring prices at 116-119 million VND/tael (buying-selling). SJC, DOJI, and PNJ quoted gold ring prices at 113-115.5 million VND/tael (buying-selling).

The Exchange Rate in Vietnam: An Unusual Development

The US Dollar Index, a measure of the greenback’s strength against a basket of foreign currencies, fell nearly 9% in the first four months of the year on global markets. However, in Vietnam, the story is different, with the USD exchange rate appreciating. Since the beginning of the year, the USD has gained around 2.2% at commercial banks in the country.

A Strategic Stake: CII Invest Acquires Over 10 Million Shares in NBB, Now Holding a Commanding 47% Stake

“In two sessions held between May 9 and May 12, 2025, CII Invest, a renowned private trading and investment company, successfully acquired over 10 million shares of NBB, a leading investment company listed on the HOSE, from My Steel Trading and Services Co., Ltd. This strategic move was executed without the need for a public offering, as per the resolution of the 2025 Annual General Meeting of Shareholders.”

The Rising Dollar: A Sustained Surge

“The US dollar continued its upward trajectory last week, bolstered by two key factors: The Federal Reserve’s decision to maintain interest rates and the US-UK trade deal which eased concerns about global trade tensions. This week’s forex review highlights the greenback’s resilience and sets the stage for an interesting period ahead as markets react to these developments.”

The Golden Rush: When Gold Prices Tumble

The gold market witnessed a dramatic turnaround on May 6th, with bullion prices plummeting by a staggering 1.1 million VND per tael during the afternoon session, following a sharp surge in the morning. This sudden reversal caught investors off guard, as the buy-sell spread widened significantly. However, gold jewelry prices remained resilient, showing no signs of fluctuation and maintaining their stability throughout the day’s volatile trading session.