As of May 3rd, over 320 listed companies on the HOSE have published their first-quarter 2025 financial results, representing nearly 98% of the total market capitalization. Net profit reached approximately VND 120 trillion, an 18% increase compared to the same period last year. Notably, several sectors showed preliminary growth, including banking (up 12%), real estate (up 101%), utilities (up 44%), retail (up 60%), information technology (up 22%), and food and beverage (up 21%).

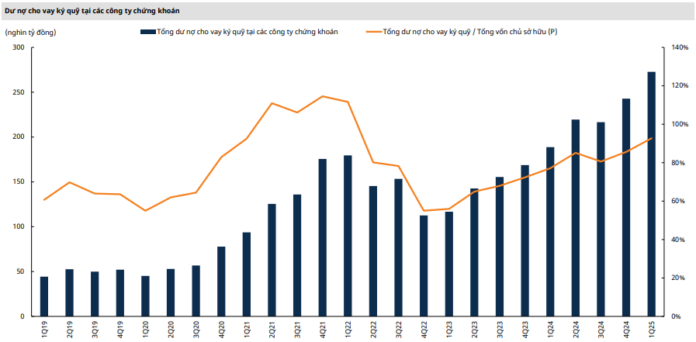

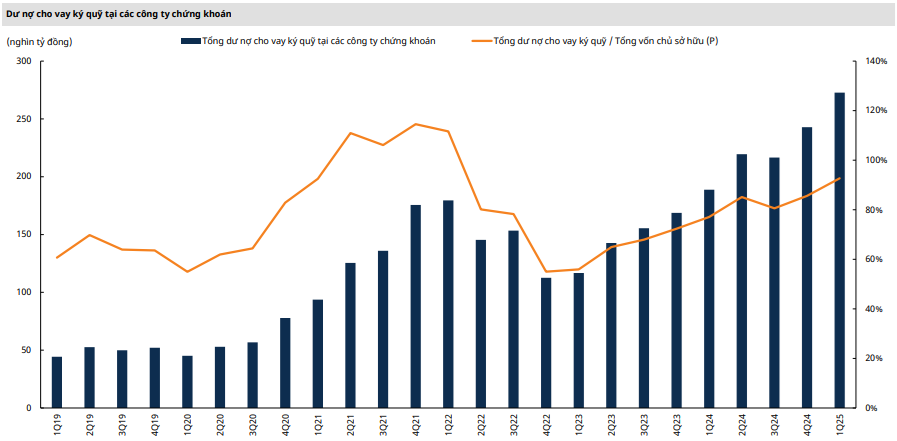

Regarding margin lending, data aggregated from 79 securities companies showed that total debt at the end of the first quarter of 2025 was about VND 273 trillion, a 12% increase from the beginning of the year and a 44% surge compared to the same period last year. However, the total debt-to-equity ratio stood at approximately 93%, still some distance from the 110% ratio observed in the fourth quarter of 2021 and the first quarter of 2022. This gap reflects the significant capital-raising efforts of securities companies since 2022.

Source: Mirae Asset Strategic Report

|

Nevertheless, the absorption of margin lending during this period may not fully capture the broader picture of market transactions. While liquidity improved in the first quarter of 2025, much of this increase occurred after the VN-Index broke through the 1,300-point threshold, triggering profit-taking as the index faced resistance at the 1,300-1,330 range.

Additionally, heightened caution ahead of the US reciprocity tax announcement contributed to higher liquidity but minimal market gains. This can be partly attributed to businesses’ demand for capital through pledging share collateral with securities companies, given the limitations in the corporate bond market and challenges in accessing bank credit.

Some market observers express concern that high margin lending levels amid a cautious market sentiment could lead to sudden market dips due to cross-margin calls to maintain safety ratios, especially if most of the margin debt is concentrated in contracts with pledged stocks as collateral. However, Mirae Asset believes it is still early to conclude that similar risks will materialize in the near future, and here’s why:

Firstly, the Vietnamese market has demonstrated resilience in the face of the reciprocity tax event. Despite a sharp and rapid 19% drop between April 2nd and 9th, the market recovered quickly, mitigating the risk of widespread margin calls in a potential liquidity crisis scenario.

Secondly, consecutive daily limit-down sessions of 3-4 days are relatively rare in the Vietnamese market, except for the 2000-2002 period and the initial COVID-19 outbreak.

Thirdly, securities companies have learned from the 2022 liquidity crisis, triggered by corporate bond issues and Fed rate hikes, and have since implemented enhanced risk management measures.

On the trade war front, potential candidates such as Japan, South Korea, India, and Singapore have yet to announce tariff agreements with the US. However, the conciliatory gestures between Beijing and Washington on tariffs in the last week of April position Vietnam as the next likely candidate for tariff negotiation. Mirae Asset forecasts a challenging process ahead, given Vietnam’s high economic openness and intricate trade linkages with China, which is the primary target of US trade strategy aimed at building alliances and isolating China in the region.

Consequently, Mirae Asset advises that Vietnam’s best course of action is to prolong the negotiation process, minimize the impact of reciprocity taxes, and simultaneously enhance trade cooperation with other economic blocs in the region through free trade agreements to diversify markets and reduce dependence on the US.

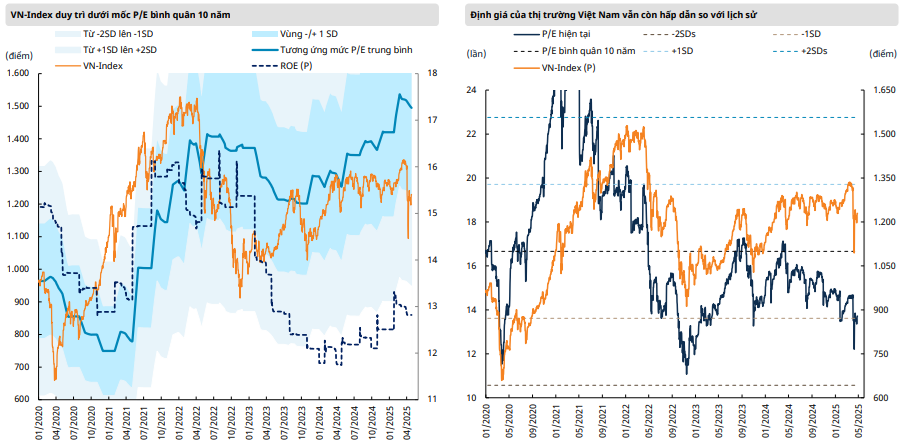

Mirae Asset anticipates a continued recovery for the VN-Index in May. Market sentiment is expected to turn positive as countries enter the negotiation phase, reducing the frequency of unpredictable news from the US.

Domestically, investor confidence is bolstered by the launch of the KRX trading system. However, the current volatility, coupled with information uncertainty, may lead to more abnormal trading sessions.

Source: Mirae Asset Strategic Report

|

– 13:25 05/14/2025

Technical Analysis for May 14: The Emergence of Diversification

The VN-Index and HNX-Index exhibited a contrasting performance, with one index rising while the other fell. This movement comes amidst a backdrop of the MACD indicator maintaining its previous buy signal, suggesting an improvement in the short-term outlook.

Market Beat: Foreigners Ramp Up Buying, VN-Index Surges Past 1,300 Points

The trading session concluded with impressive gains, as the VN-Index surged by 16.3 points (+1.26%), closing at 1,309.73. Simultaneously, the HNX-Index displayed a notable increase of 0.95 points (+0.44%), finishing the day at 218.88. The market breadth tilted strongly in favor of advancers, with 426 tickers in the green and only 322 in the red. Within the VN30 basket, bullish momentum prevailed, evidenced by 22 gainers, 7 losers, and 1 unchanged stock.

Raising the Bar: Foreign Investors Scoop Up Millions of VPB Shares

The Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) witnessed a remarkable trading session on May 14th, with its shares surging to the upper limit of VND 18,900 per share. The session witnessed a staggering volume of nearly 107 million shares being traded.

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.