PVGas City office. Source: PVGas City

|

The Hanoi Stock Exchange (HNX) on May 12th announced its consideration to forcibly delist PCG stock due to the auditor’s refusal to provide an opinion on the consolidated financial statements for the company’s fiscal year 2024.

According to the report audited by VACO Limited Company, the reason for the withheld opinion was the inability to obtain sufficient audit evidence, including confirmations of accounts receivable, inventory counts, and fixed assets as of the year-end. Additionally, several significant financial items lacked independent verification, while internal disputes among shareholders impacted the evaluation process.

The audit report revealed a series of issues regarding financial transparency. Specifically, the auditor was unable to verify bank deposits, accounts receivable, loans, and financial leases worth tens of billions of dong. Moreover, transactions with the major shareholder, Mr. Zhu ZhiLin, the former Director and Legal Representative of PVGas City, also lacked sufficient audit evidence.

Notably, several unsecured loans worth tens of billions of dong were past due and are currently being litigated by the company. The enterprise also failed to assess the recoverability of advances and other receivables and did not fully recognize the necessary provisions, which could negatively impact the financial results if adjusted.

Facing these challenges, PVGas City provided explanations to the regulatory authorities, outlining the reasons for the difficulties encountered during the past period. According to the enterprise, from October 2024 to March 2025, PVGas City lacked a legal representative as Mr. Zhu ZhiLin was absent. The company also faced obstacles in the procedure for changing the legal representative, disrupting related activities, including financial statement preparation.

The company stated that it had completed the change of legal representative by the end of March 2025 and is implementing solutions to address the issues raised by the auditor, including the recovery of transaction amounts with shareholders and the exclusion of inter-company balances in subsequent reports.

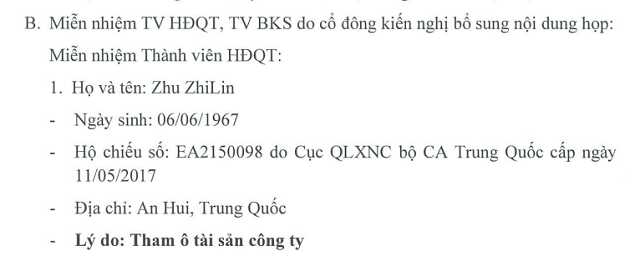

Mr. Zhu ZhiLin, a Chinese national, was previously involved in a dispute with other major shareholders of PVGas, leading to litigation. According to the extraordinary general meeting of shareholders (EOGM) resolution in October of last year, Mr. Zhu ZhiLin was removed from his role as a member of the Board of Directors due to “embezzlement of company assets.”

Source: PVGas City

|

PVGas City was once a joint venture between PV Gas and China’s ENN Energy, primarily engaged in the production and trading of liquefied petroleum gas (LPG). However, following major shareholder divestments in 2017 and 2018, the company became entangled in a vortex of disputes between new major shareholders and experienced a decline in business performance.

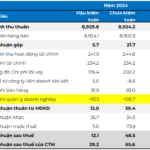

In 2024, PVGas City’s revenue increased by 12% year-on-year to nearly VND 348 billion, but the company still incurred a loss of nearly VND 8 billion, the deepest loss since 2019. In the first quarter of 2025, the enterprise continued to lose nearly VND 544 million, with revenue of just over VND 10 billion, a significant decrease from the previous year’s figure of over VND 90 billion. The cumulative loss as of the end of March exceeded VND 59 billion.

Previously, PCG stock had been placed under warning and control due to violations of information disclosure obligations and consecutive losses in 2022 and 2023 (loss figures considering the impact of the exception opinion from the auditing firm).

| PVGas City reported a loss in 2024, the lowest since 2019 |

|

|

Tu Kinh

– 15:28 13/05/2025

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

“Vicostone’s First Quarter Net Profit Down Nearly 20% Year-on-Year”

As of Q1 2025, Vicostone recorded a revenue of over VND 1,018 billion, a 5.2% decrease compared to the same period last year. Despite this, the company managed to maintain a strong profit with an after-tax profit of nearly VND 164.6 billion, reflecting a resilient performance in a challenging economic climate.

Unveiling Violations: Exposing Wrongdoings Across Entities Affiliated with the Ministry of Industry and Trade

The recent inspection by the Ministry of Finance has revealed financial irregularities within several units of the Ministry of Industry and Trade. These units have been found to be in breach of regulations regarding budget allocation, expenditure, and revenue collection. Furthermore, numerous instances of unauthorized rental of offices and headquarters, as well as exceeding the approved number of official vehicles, have been uncovered.