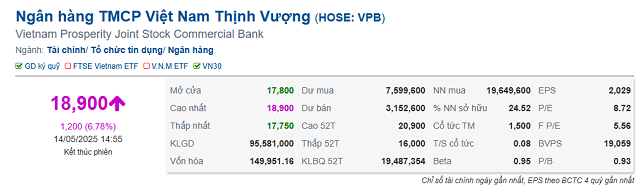

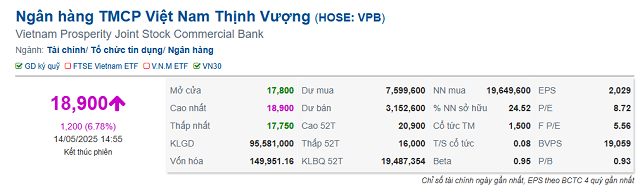

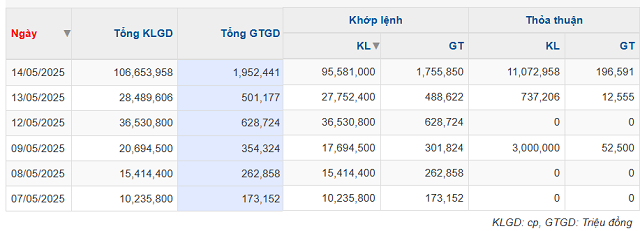

Nearly 107 million VPB shares were traded on May 14, with a total value of VND 1,952 billion, bringing the market capitalization of VPB shares to nearly VND 150,000 billion. Of these, more than 11 million shares were traded by agreement, with a value of nearly VND 197 billion, equivalent to VND 17,754 per share.

Source: VietstockFinance

|

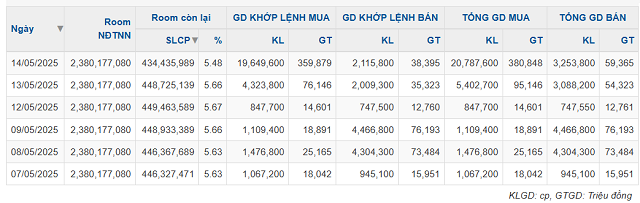

Notably, foreign investors bought nearly 20.8 million VPB shares and sold nearly 3.3 million shares in this session, resulting in a net purchase of over 17.5 million shares. As a consequence, the foreign room balance decreased to over 434 million shares, equivalent to 5.48% of capital.

The ceiling-hitting session on May 14 followed the previous two sessions. On May 13, foreign investors also net bought more than 2.3 million VPB shares, equivalent to VND 41 billion.

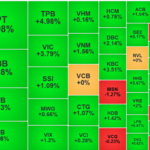

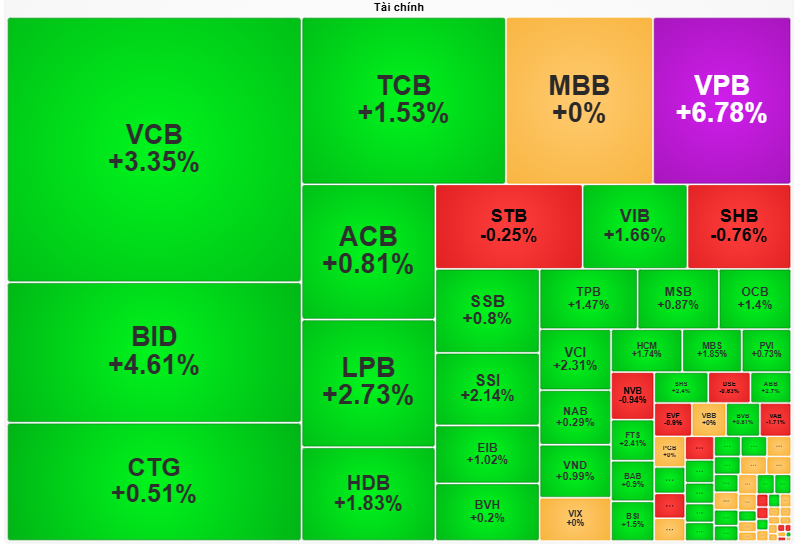

VPB shares moved in tandem with the “king stocks” as the VN-Index rose 16.3 points to 1,309.73 points. Bank stocks also gained simultaneously, including VCB (+3.35%), HDB (+1.83%), TCB (+1.53%), TPB (+1.47%), and OCB (+1.4%)…

Source: VietstockFinance

|

In other news, VPBank will allocate nearly VND 3,967 billion to pay cash dividends to shareholders at a rate of 5% on May 23. This is the third consecutive year that VPBank has paid dividends in cash. Previously, the VPBank leadership declared that they would maintain a cash dividend policy for five consecutive years (from 2023).

On May 13, VPBank also announced that the biggest music event of 2025 is ready to take place. On June 21, the VPBank K-Star Spark in Vietnam 2025 super concert, featuring top K-pop acts, will be headlined by G-Dragon and CL (Queen).

– 16:08 14/05/2025

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.

The Evolution of HOSE: Crafting a Robust Index System for the Stock Market

The evolution of the stock index system at HOSE over the past 25 years has been a remarkable journey. What started as a solitary VN-Index has now blossomed into a comprehensive ecosystem of indices. These indices have become the market’s guiding compass, providing direction and facilitating the development of a diverse range of financial products. They have played a pivotal role in enhancing investment tools and risk management strategies, shaping the financial landscape in Vietnam.

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

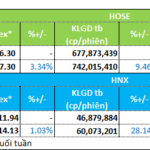

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.

Stock Market Outlook for the Week of May 12: What’s Next for Investors After KRX?

The stock market, after witnessing robust gains driven by the KRX system’s positive impact, might encounter profit-taking pressures as it ventures towards the psychological benchmark of 1,300 points.