VPL made its debut on the HSX today, and while VIC and VHM experienced some initial wobbles, they managed to stay relatively stable with minimal losses. The broader index’s stability encouraged more active trading in mid- and small-cap stocks.

The best part about today’s session was the widespread gains across high-liquidity stocks. The combined matching value of the two exchanges reached approximately 22.9k billion, with twice as many stocks advancing as declining. Initially, VIC and VHM faced selling pressure, but other large-caps eventually strengthened and provided a more noticeable boost.

Foreign investors unexpectedly recorded another strong net buying session today, with approximately 970 billion on the HSX. Last week, they also had a day of net buying exceeding 900 billion. In the past two weeks, the main ETFs have not experienced significant outflows, especially the foreign ones. The first week of May saw a slight net inflow, while the outflows at the end of April were negligible. In fact, even during the most intense period of foreign investors’ net selling, there were buyers on the other side, but the matching volume was not equal to the selling, resulting in a net outflow position. Domestic capital has effectively balanced the outflows from foreign investors, so a reduction in foreign selling pressure will act as a positive catalyst for supply and demand.

The current movement of the VNI is not as important as its stability. The increasing liquidity indicates that investors are becoming more confident and aggressive in their investments. The trade tensions between the US and China remain the most significant hurdle, and a resolution or de-escalation would ease concerns with other markets. While the 90-day deadline is still quite far off and the outcome uncertain, the market is pricing in a favorable scenario.

In this scenario, stocks that have plummeted due to retaliatory tariffs will likely rebound, and liquidity will naturally flow towards them. The midcap and smallcap segments have many such stocks, and money is rotating out of early gainers and strong performers into new opportunities. This is a typical capital rotation, providing a “reason” to maintain the intensity of continuous movement.

With this capital rotation, if a stock hasn’t risen yet, it eventually will, provided it’s not a “write-off.” Agile traders can engage in short-term “branch transmissions,” or they can simply hold on for the long-term gains. Given the improving overall picture, any fluctuations are merely short-term supply and demand influences, not indicators of a trend reversal.

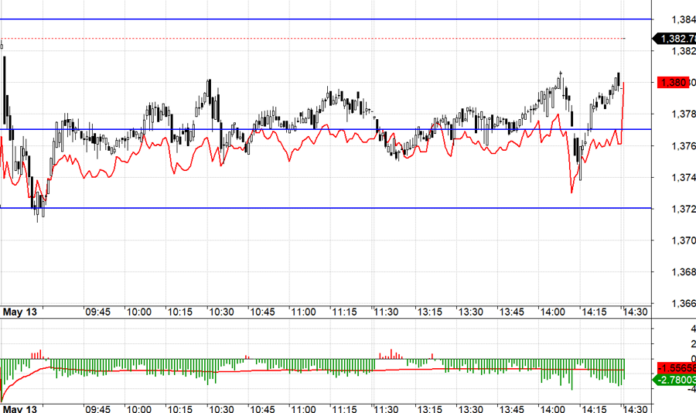

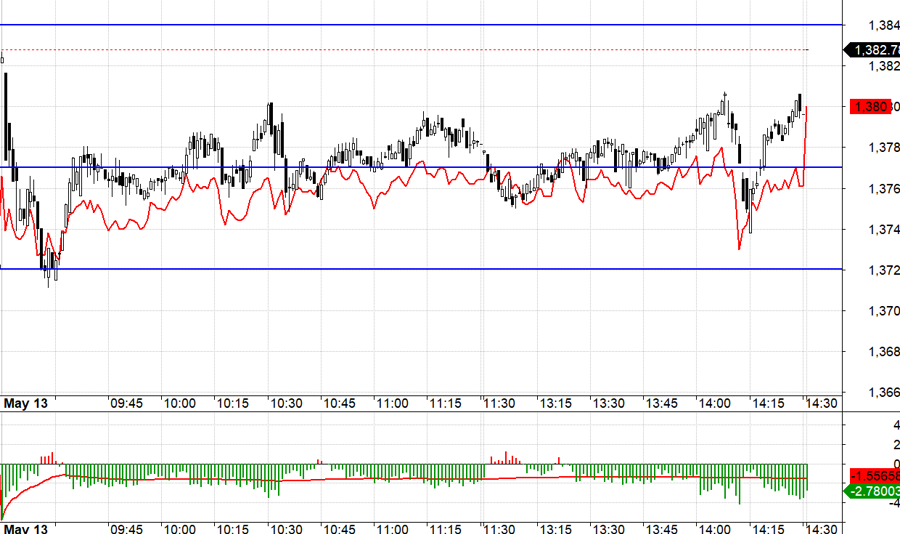

Today, the derivatives market offered limited opportunities as the VN30 index traded within a narrow range. The leading index oscillated around 1377.xx, dipping to 1372.xx in the early session and climbing to nearly 1384.xx towards the close. The only advantage is the approaching expiration, eliminating basis concerns. However, the extremely narrow range also limits profit potential, despite low risk.

The market’s uptrend (both the index and individual stocks) remains robust, and there are no significant distribution signals, only localized moments of profit-taking. This stable market is characterized by increasing liquidity and investor confidence. The strategy remains to hold stocks and employ a dynamic Long/Short approach with derivatives.

The VN30 closed today at 1382.78. Tomorrow’s resistances are 1384; 1391; 1403; 1407; 1416; 1425. Supports are at 1377; 1373; 1365; 1359; 1351; 1344.

“Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The assessments and opinions of the author are his own, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and opinions.

The Big Buy: Foreign Investors Snap Up Nearly a Trillion Dong, Targeting Blue-Chip Stocks

In the afternoon trading session, MBB stock witnessed a significant surge in buying activity, making it the most actively bought stock across the market. The value of the net buying reached an impressive peak of VND 348 billion.

The Bank Stock Boom: Foreign Capital Sweeps In

“The market was stunned this afternoon by the sheer volume of foreign investor purchases. HoSE alone saw an additional 3.4 trillion VND injected, with a net buy of nearly 1,153 billion VND on top of the already substantial 1,112 billion VND net buy in the morning. This marks the highest net buying session since November 29, 2022. Notably, the VN30 basket of stocks witnessed an additional net buy of approximately 531 billion VND…”

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.