A recent Vietravel survey revealed that 66.4% of Vietnamese travelers plan their trips less than a month before departure. This reflects a clear trend: consumers are increasingly seeking flexible and spontaneous travel options, but with a strong demand for autonomy in decision-making. In this context, controlling expenses is not just about bookkeeping; it requires support from smart and flexible financial tools, with credit cards being a prime example.

Beyond instant financial relief, the right card can unlock a host of benefits and privileges, from discounts and cashback to exclusive access to premium services.

Summer 2025 Promotions: Experience More, Spend Less

Eximbank is committed to accompanying its customers in every spending and travel experience, offering a range of special promotions. Whether it’s travel, leisure, or daily expenses, Eximbank’s carefully curated benefits are designed to help customers enjoy their experiences while staying within their budgets.

For instance, in the realm of travel and entertainment, customers can avail of discounts of up to 1 million VND when booking tours with BestPrice, as well as enjoy savings on flights via Trip.com and accommodations on Mytour.vn or Binh An Village Dalat Resort. Additionally, international spending with Eximbank Visa cards accrues Vietnam Airlines bonus miles and comes with a complimentary drink upgrade at Starbucks.

For tech enthusiasts and consumers of electronic products, Eximbank offers up to 300,000 VND in discounts when purchasing electronic and household appliances at Nguyen Kim with their Eximbank credit card. Simultaneously, shoppers can enjoy an 8% discount on their total bill at Vua Nem, enhancing their quality of life with essential products. But that’s not all; Eximbank cardholders can also relish discounts of up to 30% at numerous partner restaurants and enjoy privileged membership fee reductions at renowned fitness chains like Citigym and Vyoga World, helping them strike a balance between work and health.

Eximbank’s premium credit cardholders enjoy complimentary access to domestic airport lounges, elevating every journey.

For frequent travelers, Eximbank elevates the experience with exclusive access to premium domestic airport lounges for Visa Signature, JCB Ultimate, Mastercard One World, Platinum credit cardholders, and business credit cardholders. Each trip becomes not just more convenient but also a memorable journey, with every moment meticulously cared for.

Flexible Card Options for Double the Benefits

All the above benefits are applicable to holders of Eximbank’s international credit cards, including Eximbank Visa Platinum Cash Back, Eximbank JCB Platinum Travel Cash Back, Eximbank JCB Ultimate, and Eximbank Visa Signature. With a diverse and flexible range of cards, Eximbank enables customers to choose the product that best suits their individual needs, whether it’s for daily expenses, travel, or more sophisticated financial requirements.

With Eximbank’s card portfolio, customers can earn unlimited cashback alongside exclusive privileges.

The Eximbank JCB Platinum Travel Cash Back card offers unrestricted cashback and airport lounge access at over 60 destinations worldwide, making it perfect for international travelers. In contrast, the Eximbank Visa Platinum Cashback card is tailored for daily expenses, providing practical cashback on shopping, dining, and in-app purchases.

For those seeking a more premium experience, the Eximbank JCB Ultimate and Eximbank Visa Signature cards offer peace of mind and a sense of prestige. These cards come with golf privileges, global travel insurance, and 24/7 concierge services. Whether it’s a spontaneous trip, an extended vacation, or simply a desire for daily convenience, Eximbank’s credit cards empower users to enjoy more, save more, and take control of every experience.

Credit cards are more than just a means of payment; they represent a lifestyle choice and reflect an individual’s financial mindset and the value they place on their experiences. This summer, as you embark on your journey to create memorable trips, Eximbank, along with its diverse range of credit cards, promises to help you seize every moment with autonomy, intelligence, and style.

A Rewarding Career at Vinpearl: Earning a Competitive Salary of VND 20 Million per Month

Vinpearl, a leading hospitality group, boasts an impressive average monthly income of 19.9 million VND per employee in 2024. With a substantial workforce of 14,770 individuals, the company has established itself as a prominent player in the industry.

The Ultimate Guide to a Happy Holiday: Happy Lady Credit Card Offers up to 20% Cashback

Understanding the increased spending during the festive season and the upcoming Lunar New Year, Nam A Bank introduces an exclusive offer for its Happy Lady credit cardholders, with a focus on rewarding women. The promotion includes a generous cashback offer of up to 20%, along with a range of exciting benefits, ensuring a rewarding and advantageous experience for all cardholders.

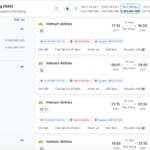

The Soaring Cost of Lunar New Year Flight Tickets Takes Off with Families’ Bonuses

The cost of air travel during the Lunar New Year period in 2025 can be astronomical for a family of four to five. They could end up spending tens of millions of Vietnamese Dong solely on plane tickets to return to their hometown for the festive season.