Techcombank shares (code TCB) owned by billionaire Ho Hung Anh have just had a strong breakout session, surging 6.5% to set a new peak at VND 29,400/share. As a result, the market capitalization also hit a new record of VND 208,000 billion ($8 billion), solidifying Techcombank’s position as the largest private bank in the Vietnamese stock market.

Despite this impressive performance, the bank’s chairman, Ho Hung Anh, has his eyes set on an even more ambitious goal. At the 2025 Annual General Meeting of Shareholders held on April 26th, he emphasized their commitment to achieving a market capitalization of $20 billion by the end of 2025.

Mr. Anh attributed this target to the bank’s successful IPO in 2018, when the market valued Techcombank at 4.5 times its initial offering price. With the bank’s equity currently nearing VND 170,000 billion, along with positive signs in the bond and real estate markets, he believes this goal is well within reach.

Additionally, Mr. Anh shared plans for the IPO of Techcombank Securities (TCBS) later this year, pending market conditions and the upgrade of Vietnam’s stock market status.

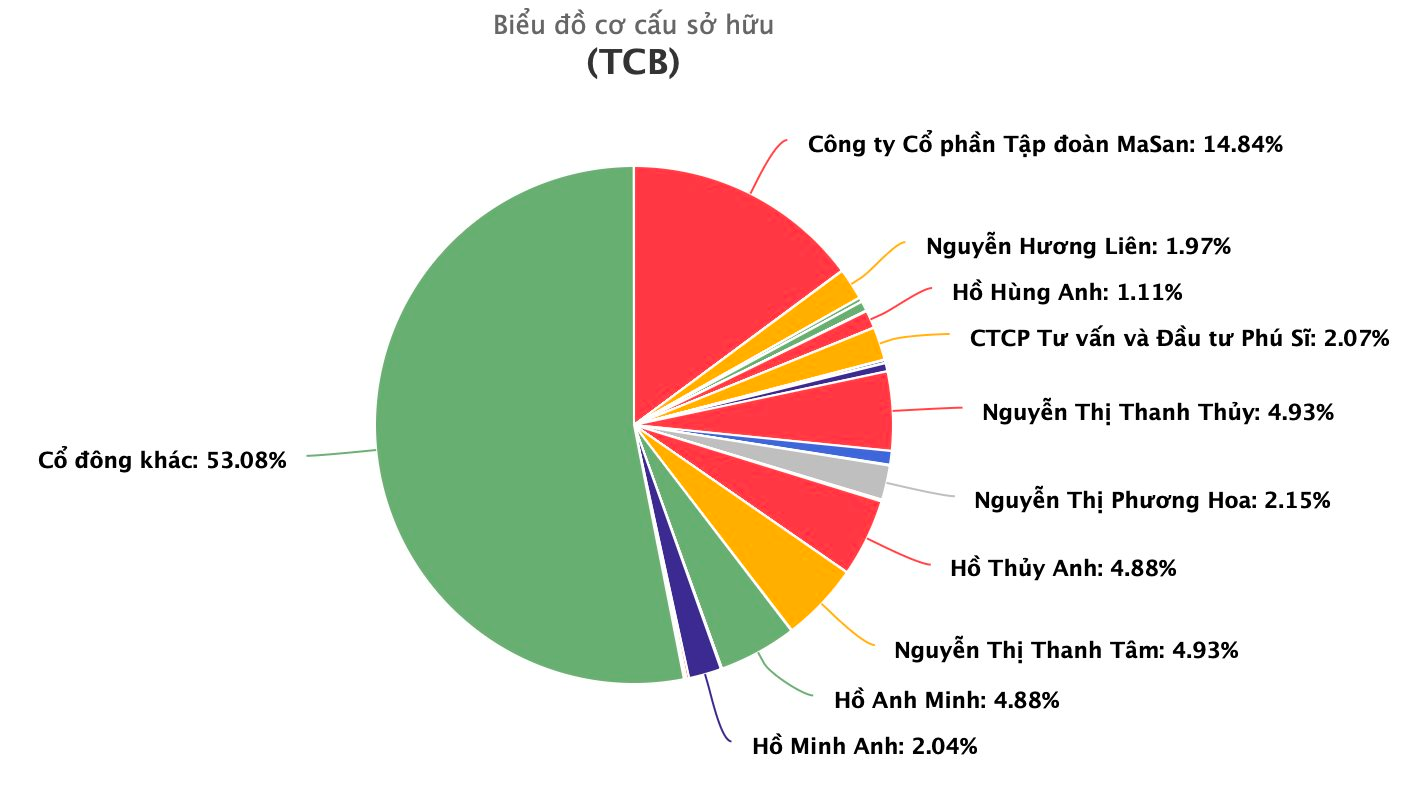

In just under two weeks since the AGM, TCB shares have climbed over 13%, adding nearly $1 billion to the bank’s market cap. This surge has significantly boosted Mr. Anh’s wealth, with his family’s stock assets now estimated to exceed VND 50,000 billion ($2 billion). Forbes also ranks him as Vietnam’s fourth-richest person, with a net worth of $1.9 billion.

Turning our attention back to Techcombank, the bank has set its sights on a pre-tax profit target of VND 31,500 billion for 2025, marking a 14.4% increase from the previous year. With the State Bank of Vietnam’s approval, Techcombank’s credit limit currently stands at VND 745,738 billion, a 16.4% jump from 2024, and the bank maintains a tight grip on non-performing loans, keeping them below 1.5%.

Notably, Techcombank’s shareholders have approved a 2024 dividend payout plan. The bank intends to distribute a 10% cash dividend, amounting to VND 1,000 per share. With nearly 7.065 billion shares in circulation, the total cash dividend payout is expected to reach nearly VND 7,065 billion.

“Cash Dividend Delights: Top Pick with a Whopping 60% Payout for Investors”

Introducing the top-performing stocks that shine with their generous cash dividends! A whopping 46 businesses shower their investors with cash dividends, with rates ranging from a substantial 61% to a modest yet meaningful 2%. These figures speak for themselves, showcasing the confidence these companies have in their success and their willingness to share the rewards with their valued shareholders.

“Techcombank: Aspiring to be the Leading Comprehensive Financial Group in the Region.”

“Techcombank is undergoing a remarkable transformation, positioning itself to become a leading financial services group. With a comprehensive range of financial products and services on offer, the bank aims to create an integrated ecosystem where customers can access all their financial needs from a single platform. This ambitious endeavor underscores Techcombank’s commitment to delivering unparalleled convenience and an enhanced customer experience.”