The trading session on May 12th witnessed a lively performance from Techcombank’s TCB stock. At the end of the afternoon session, the share price settled at 29,400 VND, a 6.52% increase. TCB was the strongest gainer in the banking sector as well as the VN30 group for the day.

With its closing price of 29,400 VND, TCB officially broke its previous peak recorded in early July 2021 and established a new all-time high (adjusted for dividends). As a result, Techcombank’s market capitalization reached nearly VND 208,600 billion (equivalent to $8.3 billion).

Accompanying the price action, TCB’s liquidity also surged with more than 46.7 million units traded directly on the exchange, 2.7 times the average trading volume of the last 10 sessions.

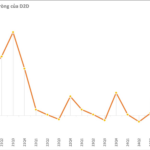

TCB’s share price has been on a continuous upward trend since Techcombank’s 2025 Annual General Meeting of Shareholders held on April 26th. Since then, the market price of the stock has increased by over 13%.

Mr. Ho Hung Anh – Chairman of the Board of Directors of Techcombank at the 2025 Annual General Meeting

At the recent shareholders’ meeting, Techcombank’s Chairman, Ho Hung Anh, reaffirmed the bank’s management’s commitment to achieving a market capitalization of $20 billion by the end of 2025.

Mr. Hung Anh stated that in 2018, when Techcombank first went public, the market valued the bank at 4.5 times its book value. Currently, Techcombank’s equity has reached nearly VND 170,000 billion.

“Existing shareholders of Techcombank may recall that in 2017, the bank’s share price was only in the range of VND 10,000 – 15,000 per share. But after a successful IPO, the share price reached VND 127,000 in just over a year,” he added.

“Of course, we are not saying that this feat will repeat itself, but with Techcombank’s current foundation, we are confident that we can attain such milestones (referring to the $20 billion target),”

According to Mr. Hung Anh, the bank also has some advantages this year, such as increased investor confidence, a rebounding bond market, and positive signals from the real estate sector—areas in which Techcombank has a strong presence. Additionally, the bank is developing comprehensive services to meet user needs and solidify its position. However, Techcombank needs time to build investor confidence in its ability to sustain long-term growth.

The Chairman acknowledged that factors like tariffs also significantly impact the bank’s strategy, but Techcombank remains hopeful that it will gradually achieve its goals, and “when the time comes, the value will explode.”

At a press conference following the 2025 Annual General Meeting of Shareholders on April 26th, Techcombank’s CEO, Jens Lottner, expressed his belief that the bank would attain its $20 billion market capitalization goal by the end of 2025 if the Vietnamese stock market is upgraded to emerging market status and tariff issues are relaxed.

According to Mr. Lottner, Techcombank aims to reach $8 billion in equity by the end of 2025, with a price-to-book ratio of 2 to 2.5, leading to the $20 billion target.

“Currently, we can achieve about $7.2-7.3 billion in equity by the end of 2025, and we have paid cash dividends of about $500 million in the past two years. The challenge now is to convince the market that our valuation is reasonable,” said the CEO of Techcombank.

Mr. Lottner also emphasized that one of the main drivers to achieve the $20 billion capitalization goal is the planned initial public offering (IPO) of Techcombank Securities (TCBS), expected to take place in 2025. Currently, TCBS contributes 10% to Techcombank’s profits and has the potential to be valued at $2.5 to $4 billion, thereby increasing the overall value of the bank.

“By demonstrating the value of our individual business segments, we hope to convince the market of our growth potential. Last year, TCB’s share price rose by 60%. If the Vietnamese stock market is upgraded to emerging market status and tariff issues are relaxed, we believe we can achieve our goal,” Mr. Jens Lottner added.

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

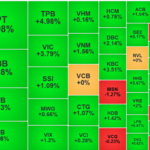

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.

“The Techcombank Princess: Unveiling Her Wealth at 24”

“Thủy Anh Hồ is the daughter of prominent businessman Hùng Anh Hồ, who serves as the Chairman of the Joint Stock Commercial Bank for Technical Trade of Vietnam (Techcombank). With a strong foundation in business and finance, she is poised to make her mark in the corporate world.”

“Techcombank: Aspiring to be the Leading Comprehensive Financial Group in the Region.”

“Techcombank is undergoing a remarkable transformation, positioning itself to become a leading financial services group. With a comprehensive range of financial products and services on offer, the bank aims to create an integrated ecosystem where customers can access all their financial needs from a single platform. This ambitious endeavor underscores Techcombank’s commitment to delivering unparalleled convenience and an enhanced customer experience.”

A Real Estate Company Prepares to Dish Out an 84% Cash Dividend in May

In the first quarter of 2025, the company witnessed a remarkable surge in profit, with a 707% increase in PAT reaching $10.5 billion, compared to the same period last year.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)