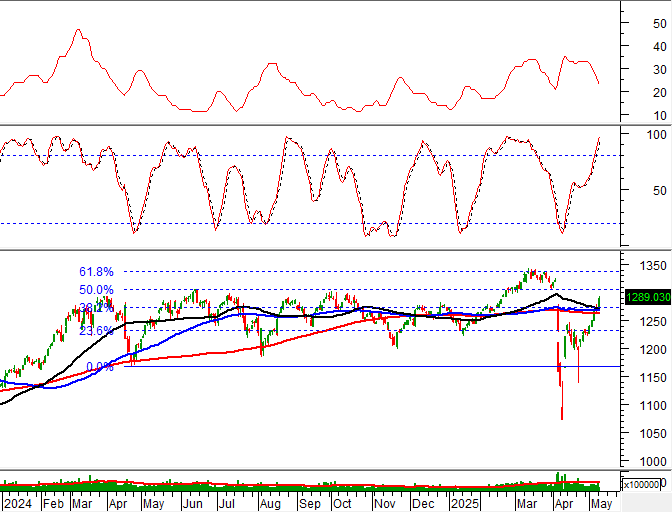

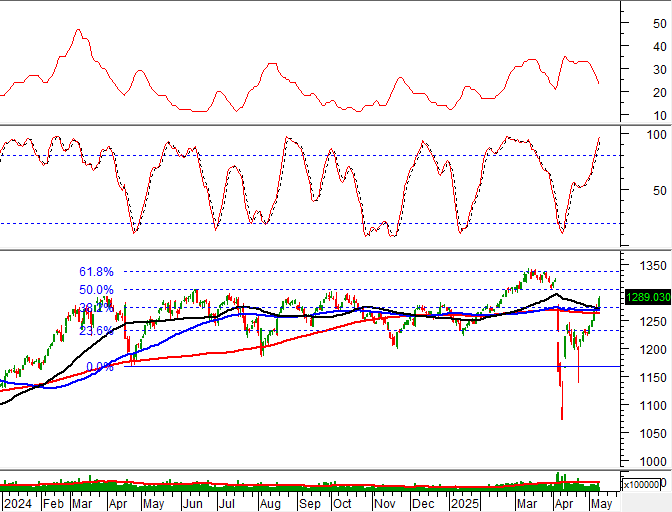

Technical Signals for VN-Index

During the trading session on the morning of May 13, 2025, the VN-Index witnessed a surge in points, accompanied by a significant spike in trading volume. This indicates a positive sentiment among investors.

Presently, the ADX indicator portrays signs of weakness and is navigating within the gray zone (20 < ADX < 25)

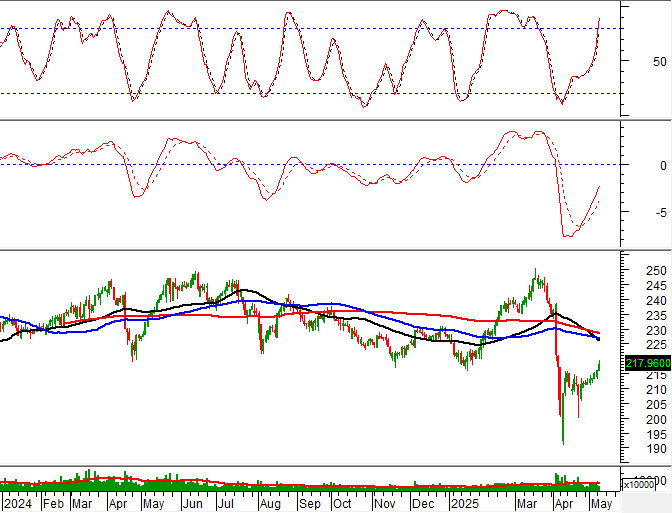

Technical Signals for HNX-Index

On May 13, 2025, the HNX-Index witnessed a surge in points, accompanied by a notable increase in liquidity during the morning session, reflecting improved investor sentiment.

However, a Death Cross formation has emerged in the HNX-Index, with the 50-day SMA crossing below the 100-day and 200-day SMA groups, indicating a diminishing medium and long-term outlook.

MWG – Mobile World Investment Joint Stock Company

On the morning of May 13, 2025, MWG witnessed a significant price increase and formed a White Marubozu candlestick pattern, accompanied by above-average trading volume. This indicates active participation from investors.

Currently, the stock price is in the process of retesting the 200-day SMA, while the MACD indicator maintains its previous buy signal. Should the stock price successfully surpass this resistance level, the long-term upward potential may resurface in upcoming sessions.

VIX – VIX Securities Joint Stock Company

On the morning of May 13, 2025, VIX witnessed a price increase and formed a Rising Window candlestick pattern, indicating investor optimism.

Additionally, the stock price continued its upward trajectory after successfully testing the Middle Band of the Bollinger Bands, while the Stochastic Oscillator maintained its previous buy signal. This suggests that the recovery scenario is gradually materializing.

Technical Analysis Department, Vietstock Consulting

– 12:07, May 13, 2025

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.

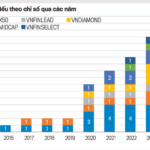

The Evolution of HOSE: Crafting a Robust Index System for the Stock Market

The evolution of the stock index system at HOSE over the past 25 years has been a remarkable journey. What started as a solitary VN-Index has now blossomed into a comprehensive ecosystem of indices. These indices have become the market’s guiding compass, providing direction and facilitating the development of a diverse range of financial products. They have played a pivotal role in enhancing investment tools and risk management strategies, shaping the financial landscape in Vietnam.

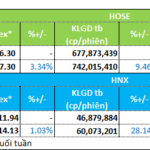

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.