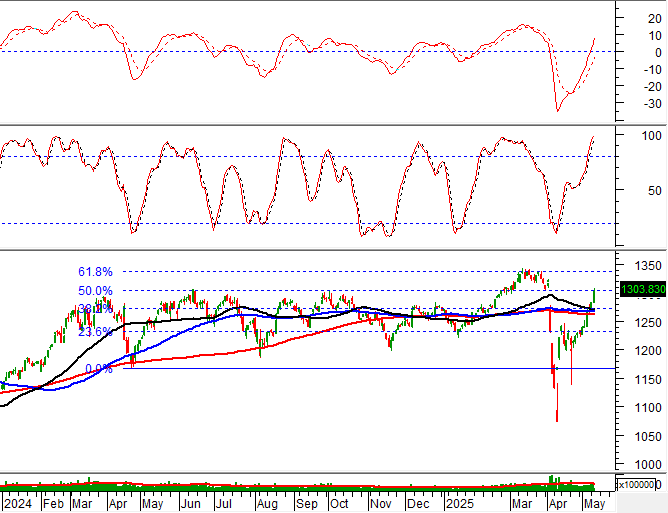

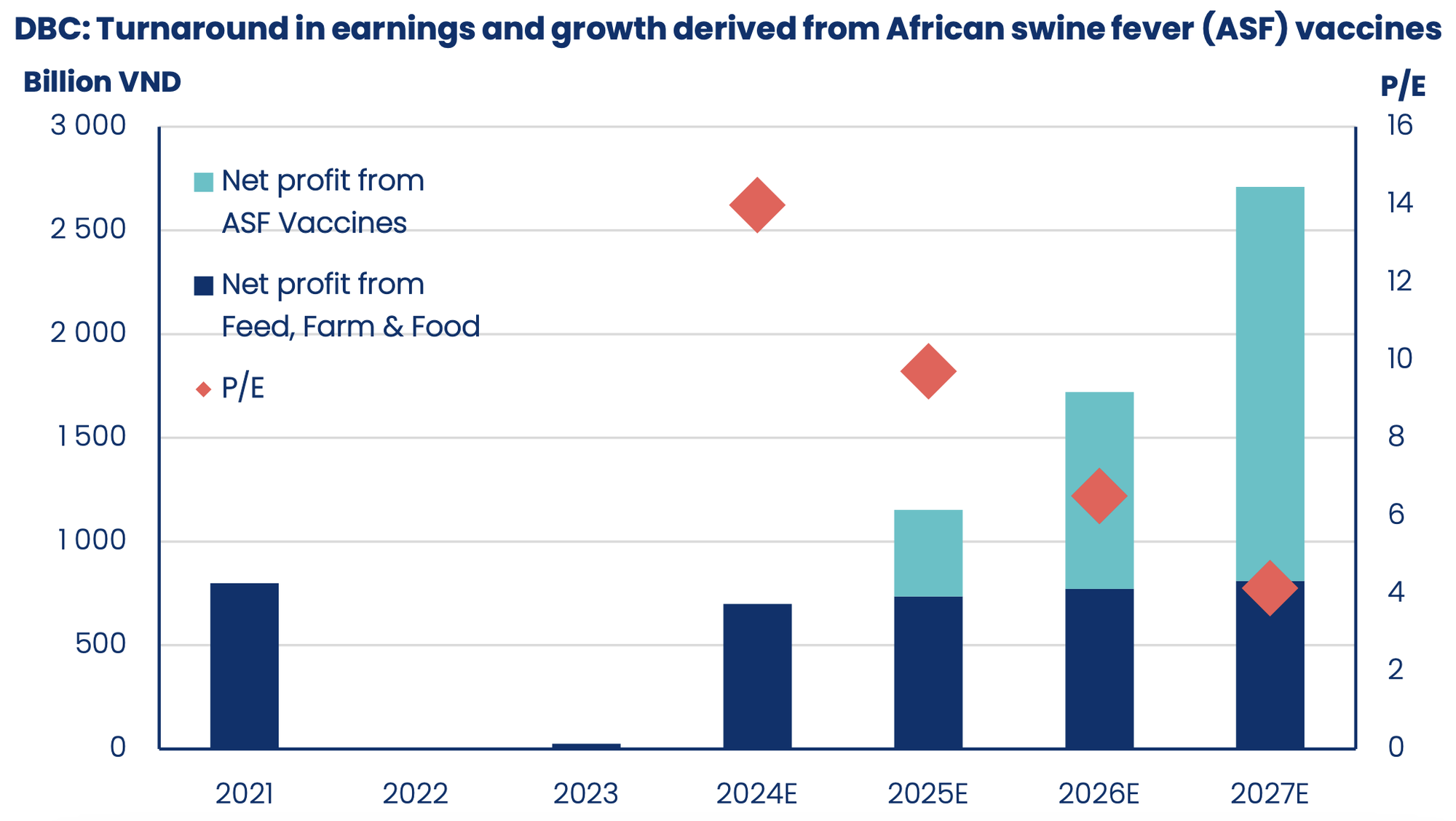

Technical Signals for VN-Index

In the trading session on the morning of May 14, 2025, the VN-Index gained points, but liquidity did not show a clear improvement, indicating that investors were somewhat hesitant.

In addition, the VN-Index successfully surpassed the 100-day SMA and 20-day SMA groups, while the MACD indicator maintained its previous buy signal, suggesting that medium- and long-term optimism is present.

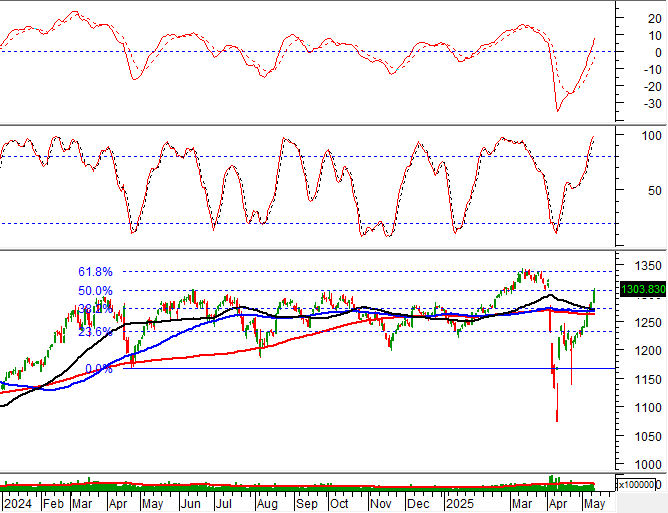

Technical Signals for HNX-Index

On May 14, 2025, the HNX-Index fell, and trading volume decreased significantly in the morning session, reflecting investors’ cautious sentiment.

Currently, the HNX-Index continues to test the 50% Fibonacci Retracement threshold (equivalent to the 210-215 point region) while the ADX indicator is showing signs of weakening and returning to the gray area (<>

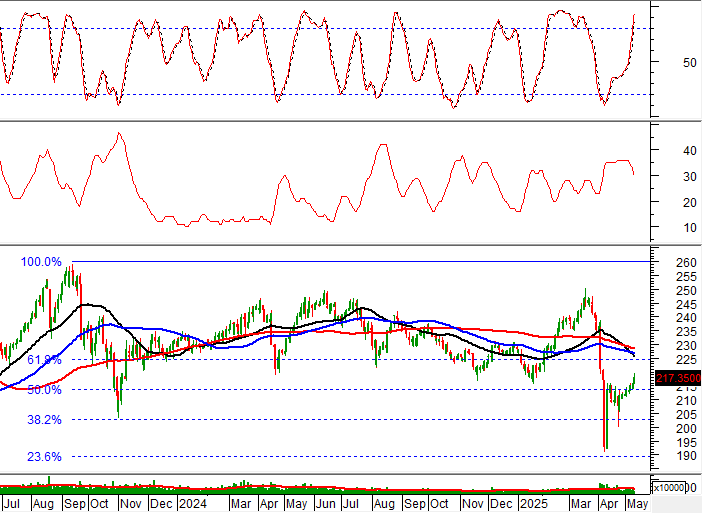

GEX – GELEX Joint Stock Group

In the morning session of May 14, 2025, GEX rose, closely following the upper band (Upper Band) of Bollinger Bands, reflecting investors’ optimistic sentiment.

In addition, the stock price continuously formed new higher peaks and troughs (Higher High, Higher Low) while the MACD indicator continued to rise after the previous buy signal, further strengthening the long-term upward potential of the stock.

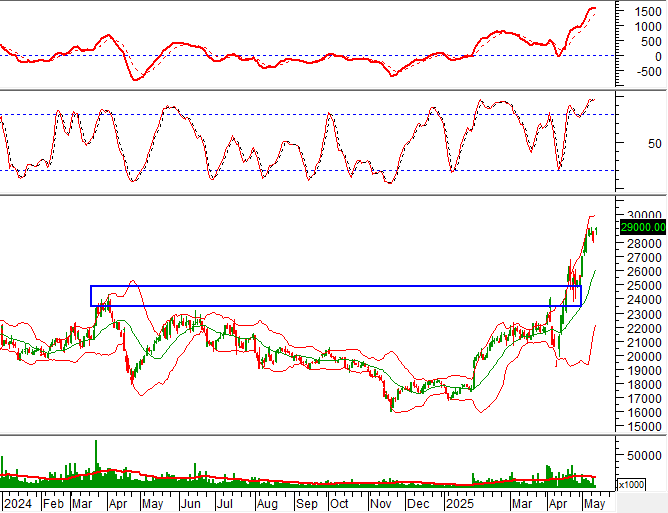

HAX – Hang Xanh Automobile Service Joint Stock Company

On the morning of May 14, 2025, HAX hit the ceiling price, accompanied by a White Marubozu candle pattern, and liquidity exceeded the 20-session average, indicating vibrant investor activity.

Moreover, the stock price is testing the 50% Fibonacci Retracement threshold (equivalent to the 14,200-14,800 range) while the MACD indicator is constantly widening the gap with the Signal line after providing a buy signal. If the stock price successfully surpasses this resistance level, the short-term uptrend may continue in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

– 12:07 May 14, 2025

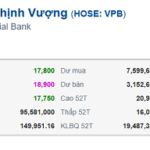

Raising the Bar: Foreign Investors Scoop Up Millions of VPB Shares

The Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) witnessed a remarkable trading session on May 14th, with its shares surging to the upper limit of VND 18,900 per share. The session witnessed a staggering volume of nearly 107 million shares being traded.

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.

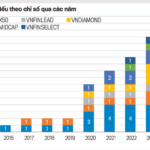

The Evolution of HOSE: Crafting a Robust Index System for the Stock Market

The evolution of the stock index system at HOSE over the past 25 years has been a remarkable journey. What started as a solitary VN-Index has now blossomed into a comprehensive ecosystem of indices. These indices have become the market’s guiding compass, providing direction and facilitating the development of a diverse range of financial products. They have played a pivotal role in enhancing investment tools and risk management strategies, shaping the financial landscape in Vietnam.

The Energy Sector’s Renaissance: Unlocking Capital Flows and Opportunities

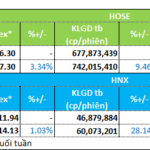

The week of May 5th to 9th saw a return of cash flow into the market, with a particular focus on two industry groups: energy and construction.