The market was in for another shock this afternoon as foreign investors continued to pump money into the economy. The HoSE floor alone saw an additional 3.4 trillion VND invested, with a net buy of nearly 1,153 trillion VND. This is a record-breaking buying spree not seen since November 29, 2022. The VN30 basket of stocks also witnessed a net buy of approximately 531 trillion VND.

HoSE also experienced a 16% increase in liquidity in the afternoon session compared to the morning, reaching 12,224 trillion VND. Including the HNX, today’s trading volume increased by 18.4% to 13,095 trillion VND.

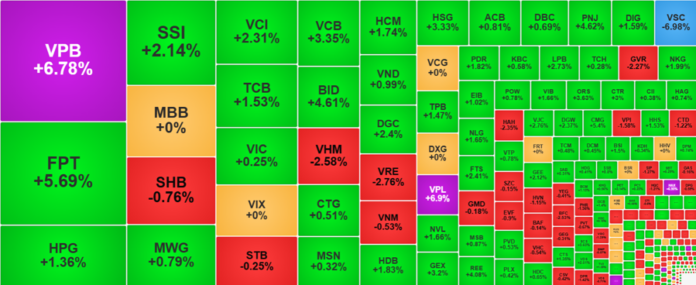

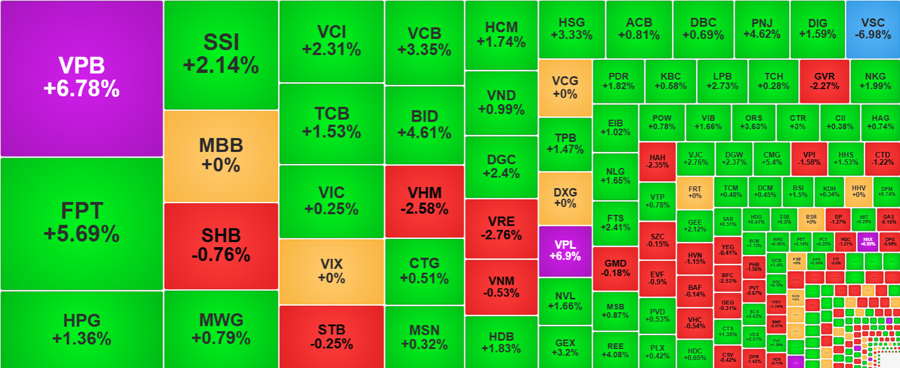

It’s no surprise that as money flowed in, stock prices rose. This was particularly evident in the blue-chip sector, with bank stocks leading the charge. The VN30-Index closed 1.09% higher, with 21 gainers and 7 losers, a significant improvement from the morning session. Furthermore, 18 stocks in the VN30 basket saw price increases from the morning session, while only 8 declined.

The most dramatic move was seen in VPB, which had already shown strength in the morning session with a 2.82% gain. A massive influx of buying pressure in the afternoon pushed liquidity up by an additional 1,010 trillion VND, driving the stock price up by 3.85% to its daily limit. VPB hit its intraday high at 1:54 pm but still had sell orders waiting to be filled. In the final minutes of continuous matching, VPB ran out of sell orders and closed with a limit buy of 1.76 million shares.

Other bank stocks also put on an impressive performance as they raced higher alongside VPB. BID took off around 2 pm and closed with a 4.61% gain over the reference price, equivalent to a 2.6% increase in the afternoon alone. LPB also joined the rally, ending the day 2.73% higher. VIB and TPB contributed to the sector’s strength, with VIB adding 1.66% to its morning reference price and TPB up 1.1%, closing 1.47% higher. It was slightly disappointing to see heavyweights like VCB and CTG only make minor moves, while TCB retreated. Nonetheless, out of the top 10 stocks driving the VN-Index higher, 6 were from the banking sector. Only 5 out of 27 stocks in this sector closed in the red, including SHB and STB from the VN30 basket, while 11 others posted gains of over 1%.

The strength in bank stocks overshadowed the performance of VIC and VHM. These two heavyweights weakened in the afternoon session, with VIC giving up 1.36% of its morning gains and closing just 0.25% higher. VHM lost 1.47%, sinking 2.58% from the reference price. VRE also felt the impact, dropping 2.76% from the reference price, equivalent to a 1.59% loss in the afternoon alone. Aside from the banking sector, several other stocks stood out, including FPT, which surged 5.69%, SSI up 2.14%, and VJC climbing 2.76%.

The impressive performance of many blue-chips, aside from VIC and VHM, indicates a broadening of the market rally. The market breadth at the end of the session showed 179 gainers and 121 losers, with 94 stocks rising more than 1%—a notable improvement from the morning session, which had 63 stocks in this category. Among these, 27 stocks boasted liquidity of over 100 billion VND, led by VPB with 1,755.8 billion and FPT with nearly 1,492 billion VND. Remarkably, the VN30 basket accounted for 70% of the total matched value on the HoSE floor, a ratio never seen before.

While mid and small-cap stocks had lower liquidity, several still stood out. VCI gained 2.31% with 599.3 billion in liquidity, HCM rose 1.74% with 355.4 billion, DGC climbed 2.4% with 317 billion, HSG surged 3.33% with 271.7 billion, PNJ jumped 4.62% with 224.8 billion, and DIG added 1.59% with 224.5 billion.

On the downside, VHM and VRE predictably led the losses. These two stocks had been on a strong upward trajectory recently, but their influence is waning. GVR, another blue-chip, also underperformed today, falling 2.27% with a liquidity of 155.8 billion VND. VSC plunged to its daily limit amid intense selling pressure, with a liquidity of 223.1 billion VND. GEX, HAH, VPI, CTD, and HVN also faced significant selling pressure.

Foreign investors are displaying their confidence in the market by continuing to buy aggressively, even as stock prices have risen following a prolonged recovery. This suggests that, in their view, the opportunities are just beginning to unfold. Stocks that saw significant net buying today include FPT (+540.6 billion VND), VPB (+322.1 billion), MWG (+284.5 billion), HPG (+182.2 billion), PNJ (+180.9 billion), CTG (+161.7 billion), BID (+139.5 billion), and MBB (+115.6 billion). On the other hand, stocks that were net sold include MSN (-156.1 billion), VHM (-155.8 billion), VRE (-114.1 billion), and VNM (-111.4 billion).

Stock Market Blog: High Hopes, Reversal of Foreign Funds

Today’s robust rally was supported by strong liquidity, with foreign investors net buying over VND 2,200 billion. As bank stocks and other pillars soared, VIC and VHM’s retreat was not a big deal. On the other hand, when money flows broadly, opportunities remain ample.

Mirae Asset: VN-Index to Extend its Recovery in May

In their latest strategic report, Mirae Asset Vietnam Securities predicts a continued recovery for the VN-Index in May. With countries entering trade negotiations, the market sentiment is expected to turn more positive as this could reduce the frequency of unpredictable news from the US, leading to a more stable environment.

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

Market Beat: Foreigners Ramp Up Buying, VN-Index Surges Past 1,300 Points

The trading session concluded with impressive gains, as the VN-Index surged by 16.3 points (+1.26%), closing at 1,309.73. Simultaneously, the HNX-Index displayed a notable increase of 0.95 points (+0.44%), finishing the day at 218.88. The market breadth tilted strongly in favor of advancers, with 426 tickers in the green and only 322 in the red. Within the VN30 basket, bullish momentum prevailed, evidenced by 22 gainers, 7 losers, and 1 unchanged stock.