Vietnamese Stock Market Surges on Vinpearl (VPL) Momentum

The Vietnamese stock market witnessed a significant rally, propelled by the upward momentum of Vinpearl (VPL) shares. On May 13, the VN-Index closed above 1,293.43, marking a substantial gain of over 10 points. The session saw robust trading activity, with a remarkable turnover of 21,715 billion VND on the HoSE.

Foreign Investors Turn Net Buyers:

A notable shift occurred in foreign investor sentiment, as they aggressively snapped up Vietnamese stocks, resulting in a net buy value of approximately 985 billion VND across all markets. Here’s a breakdown by exchange:

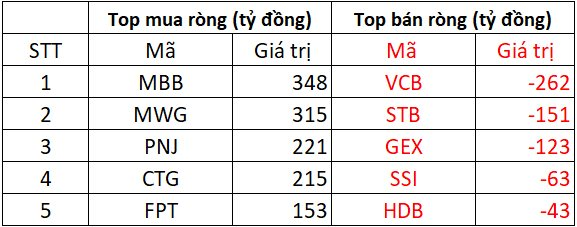

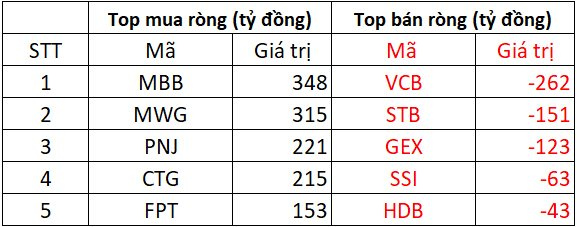

HoSE: Net Buy of nearly 977 billion VND

MBB shares topped the market in net buying, witnessing a staggering turnover of 348 billion VND. MWG shares followed suit with a net buy value of 315 billion VND. PNJ and CTG shares also saw substantial net buying, each surpassing 200 billion VND.

On the selling side, VCB shares witnessed a notable net sell value of 262 billion VND. STB and GEX shares also faced net selling pressure, with values of 151 billion and 123 billion VND, respectively. SSI and HDB shares witnessed net selling in the range of several billion VND, with values of 63 billion and 43 billion VND, respectively.

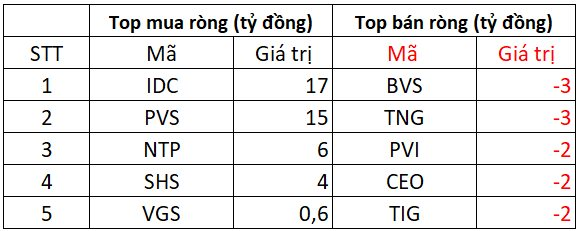

HNX: Net Buy of approximately 21 billion VND

IDC and PVS shares led the net buying on the HNX, with values of 17 billion and 15 billion VND, respectively. NTP and SHS shares also witnessed net buying in the range of several billion VND.

Conversely, BVS and TNG shares experienced net selling of 3 billion VND each. PVI, CEO, and TIG shares followed with net selling values of around 2 billion VND each.

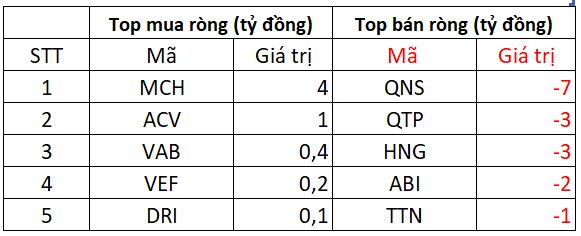

UPCOM: Net Sell of almost 13 billion VND

MCH shares attracted net buying interest, recording a turnover of around 4 billion VND. ACV, VAB, VEF, and DRI shares also witnessed modest net buying.

In contrast, QNS shares faced net selling pressure, with a net sell value of 7 billion VND. QTP, HNG, ABI, and TTN shares also experienced net selling in the range of several billion VND.

The Bank Stock Boom: Foreign Capital Sweeps In

“The market was stunned this afternoon by the sheer volume of foreign investor purchases. HoSE alone saw an additional 3.4 trillion VND injected, with a net buy of nearly 1,153 billion VND on top of the already substantial 1,112 billion VND net buy in the morning. This marks the highest net buying session since November 29, 2022. Notably, the VN30 basket of stocks witnessed an additional net buy of approximately 531 billion VND…”

Stock Market Blog: High Hopes, Reversal of Foreign Funds

Today’s robust rally was supported by strong liquidity, with foreign investors net buying over VND 2,200 billion. As bank stocks and other pillars soared, VIC and VHM’s retreat was not a big deal. On the other hand, when money flows broadly, opportunities remain ample.

Market Beat: Foreigners Net Buy Nearly VND 1 Trillion

The VN-Index extended its rally throughout today’s session, with a brief period of consolidation in the latter half of the afternoon. Despite this, strong upward momentum from CTG propelled the Ho Chi Minh Stock Exchange’s benchmark index to close higher. The VN-Index gained over 10 points, finishing at 1,293.43.

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

Mirae Asset: VN-Index to Extend its Recovery in May

In their latest strategic report, Mirae Asset Vietnam Securities predicts a continued recovery for the VN-Index in May. With countries entering trade negotiations, the market sentiment is expected to turn more positive as this could reduce the frequency of unpredictable news from the US, leading to a more stable environment.