According to the announcement, MBS will offer over 68.7 million new shares in 2025, with a subscription ratio of 100:12, meaning that for every 100 shares owned, shareholders will have the right to purchase 12 new shares. The subscription price is set at VND 10,000 per share, and the new shares will be fully transferable.

MBS expects to raise over VND 687 billion from this issuance, with more than VND 537 billion allocated to supplement margin trading activities and VND 150 billion for proprietary trading and underwriting activities. The capital raised will be disbursed starting in 2025.

In the event that the proceeds fall short of the planned amount, MBS will prioritize allocating capital to the proprietary trading and underwriting segments, followed by margin trading.

The company noted that any remaining unallocated shares, including those resulting from unexercised subscription rights and fractional shares arising from rounding adjustments, will be offered to the Board of Directors, who are authorized to sell them to the Military Commercial Joint Stock Bank (HOSE: MBB) and/or other investors at the subscription price of VND 10,000 per share.

Notably, the subscription price of VND 10,000 per share represents a 60% discount to MBS’s current market price. As of the market close on May 14, MBS’s share price stood at VND 27,600 per share.

| MBS Share Price Performance in 2025 |

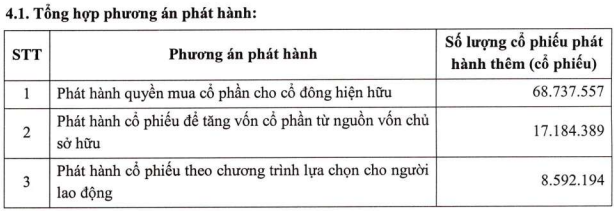

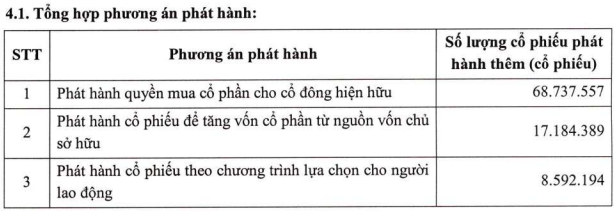

This issuance of subscription rights to existing shareholders is part of a series of capital-raising plans approved by the Annual General Meeting of Shareholders in 2025. The other plans include issuing nearly 17.2 million shares to increase charter capital from the owner’s equity source and issuing approximately 8.6 million shares under an employee stock ownership plan. In total, the company aims to issue over 94.5 million new shares, increasing its charter capital from over VND 5,728 billion to over VND 6,673 billion.

Source: MBS’s 2025 Annual General Meeting of Shareholders Documents

|

MBS’s plan to increase its charter capital in 2025 heavily relies on the success of this share issuance to existing shareholders. However, given the volatile stock market conditions triggered by the US tariff policies, MBS shareholders expressed concerns about the feasibility of this plan during the meeting.

Addressing these concerns, Chairman of the Board of Directors, Le Viet Hai, emphasized that MBS’s largest shareholder, MB, currently holds 76.35% of the company’s capital. Prior to the Annual General Meeting, MB’s representative managing MBS’s capital reported the proposed share issuance plan to MB, and MB agreed to participate in the subscription rights offering. Additionally, the planned 12% cash dividend, to be paid out before the new share issuance, was also highlighted by MBS’s leadership.

According to the Chairman, the MBS Board of Directors is confident that the share issuance will be successful. In recent years, MBS has consistently increased its capital through share offerings to existing shareholders. Following the completion of the necessary procedures, the share issuances to increase charter capital have been smoothly approved by the state management agency and executed according to the planned schedule.

Chairman Le Viet Hai providing information at the meeting – Photo: MBS

|

– 16:28 14/05/2025