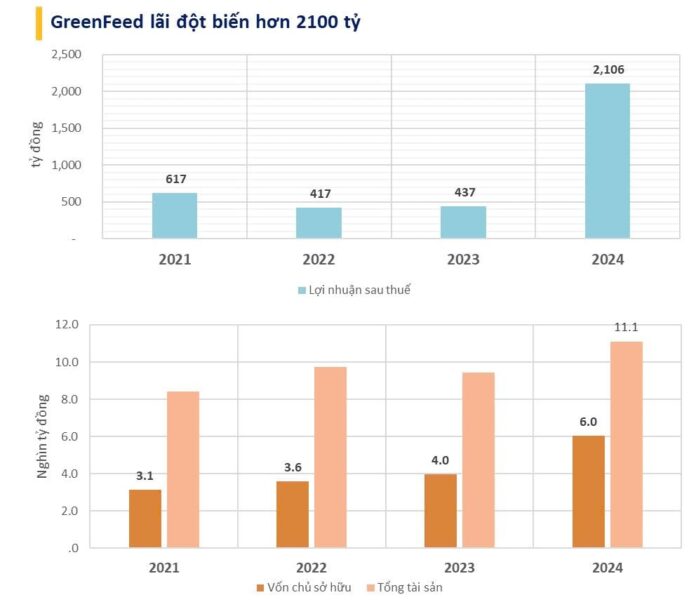

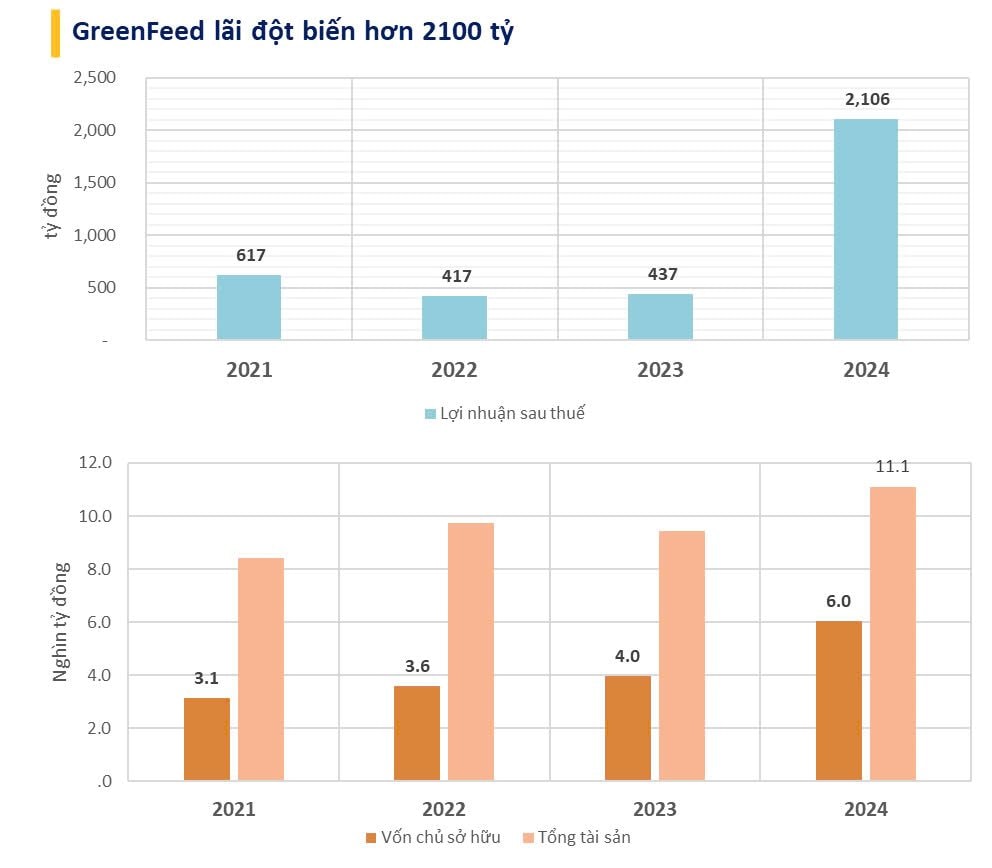

According to statistics released by the Hanoi Stock Exchange, in 2024, GreenFeed Vietnam JSC (GreenFeed) recorded an after-tax profit of over VND 2,106 billion, a remarkable increase of 382% compared to 2023 (4.8 times higher), setting a record high for the company. The return on equity (ROE) reached nearly 35%.

As of December 31, 2024, GreenFeed’s equity reached over VND 6,040 billion, a 52% increase compared to the beginning of the period. The company’s payables amounted to more than VND 5,069 billion, a decrease of approximately VND 401 billion compared to 2023.

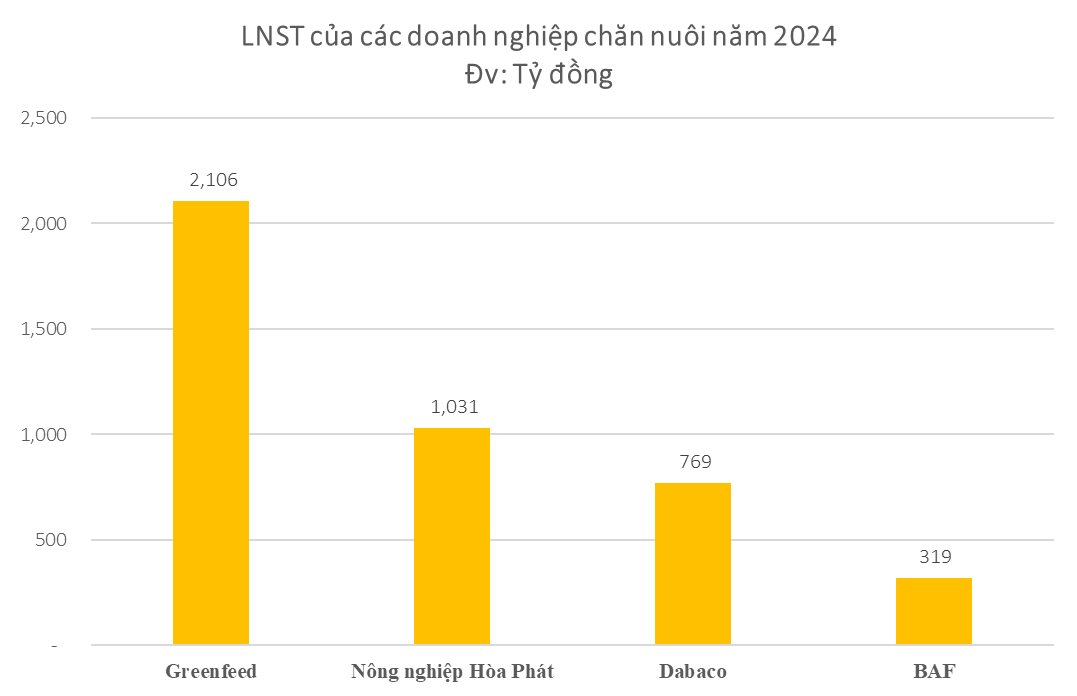

With an extraordinary profit of VND 2,106 billion in 2024, GreenFeed surpassed numerous leading livestock companies such as Dabaco (VND 769 billion), Hoa Phat Agriculture (VND 1,031 billion), and BaF Vietnam (VND 319 billion).

GreenFeed Vietnam was established by Mr. Ly Anh Dung in 2003 and is headquartered in Long An Province. The company operates under a closed-chain model of Feed – Farm – Food, encompassing feed production for livestock, poultry, and aquaculture; provision of livestock breeds; livestock farming; and food processing.

In 2009, the company transitioned into a joint-stock company and began operating feed production plants in Vietnam and neighboring countries such as Cambodia, Myanmar, and Laos, with a total designed capacity of over 2 million tons per year.

GreenFeed has also made significant investments in its pig breeding farm systems and meat processing plants. In 2018, the company introduced its G brand of clean meat and G Kitchen retail stores, completing its 3F value chain. In 2022, GreenFeed increased its charter capital from VND 1,000 billion to over VND 1,500 billion. The main shareholders include Oriental Ford Holding Company Limited (holding 63.3%) and GreenFeed (Thailand) Co., Ltd. (holding 3.4%).

“Licogi 13 Establishes Subsidiary for Phase 3 of the Quan Ngang Industrial Park Project”

The management of Licogi 13 Joint Stock Company (HNX: LIG) has approved a resolution to contribute capital to establish Industrial Park Infrastructure Investment and Business Company Limited, named Quan Ngang 3. This new venture will focus on investing in the construction and business of infrastructure in the Quan Ngang 3 Industrial Park, located in the province of Quang Tri.

“Steady as She Goes: DCDC CEO Group Aims for Sustainable Growth Over Aggressive Expansion in 2025”

On May 8, 2025, CEO Group Joint Stock Company (HNX: CEO) successfully held its 2025 Annual General Meeting of Shareholders, passing several key orientations.