Skyrocketing Prices

According to data from PropertyGuru Vietnam Joint Stock Company (a real estate market analysis firm), the selling price of Hanoi’s street-front houses is surging. In the first quarter of 2025, street-front house prices increased by approximately 30% (rising from an average of VND 337 million/m2 to VND 437 million/m2) compared to the first quarter of 2023. This price range is on par with townhouses in the suburbs.

Specifically, in Ba Dinh district, on major roads such as Nguyen Cong Hoan, prices fluctuate between VND 430-520 million/m2; on Cao Ba Quat street, prices have increased from around VND 240-320 million/m2 to VND 280-370 million/m2; on Ngoc Ha street, prices have gone up from approximately VND 310-540 million/m2 to VND 360-620 million/m2; and on Kim Ma street, prices have risen from VND 400-680 million/m2 to VND 440-730 million/m2.

In Dong Da district, street-front house prices have also set a new benchmark. Within a year, house prices on Hoang Cau street increased from about VND 380-470 million/m2 to VND 425-516 million/m2. Street-front houses on Yen Lang street saw a rise from VND 330-490 million/m2 to VND 370-560 million/m2. Houses on Hoang Ngoc Phach street also experienced a price hike from VND 350-370 million/m2 to VND 380-440 million/m2.

As for houses on Huynh Thuc Khang street, despite already high base prices, they witnessed a modest increase of 7-10%, establishing a new price range from VND 520-710 million/m2 to VND 550-770 million/m2.

Hanoi’s street-front house prices have been continuously rising by 10 to 15% within a year. |

A similar price increase of 10-15% within a year was observed in Cau Giay district’s street-front houses. On Duy Tan street, depending on location and area, prices have climbed from around VND 230-520 million/m2 to VND 265-580 million/m2. Houses on Hoang Quoc Viet street have also appreciated from approximately VND 380-550 million/m2 to VND 420-600 million/m2. Street-front houses on Nguyen Van Huyen street have set a new benchmark, rising from VND 365-570 million/m2 to VND 400-620 million/m2.

Reasons Behind the Price Hike

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam Joint Stock Company, analyzed that Hanoi’s street-front houses always hold the most value in the real estate market, even during sluggish periods. Moreover, these properties are highly sought-after for rental purposes.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, shared a similar sentiment, stating that street-front houses and other commercial real estate in the capital’s core area are extremely expensive yet remain attractive to investors. They understand that over time, the scarcity of such properties will lead to a significant increase in their value.

However, investing in street-front houses is suitable for those with strong financial capacity and a long-term vision. Despite their potential for price appreciation and good liquidity, the high prices also come with a substantial risk of capital immobilization. Therefore, it is crucial not to borrow funds for this type of investment.

Another noteworthy aspect is that while street-front houses retain their value well, their rate of increase is typically lower compared to other real estate forms. For instance, when the market is vibrant, other segments might witness annual increases of 30-100%, whereas this particular segment usually only sees a 15-20% yearly rise.

According to numerous real estate experts, street-front houses are an excellent choice for preserving cash flow and ensuring safety as the real estate market gradually recovers.

Nevertheless, one drawback of this type of property is its high selling price, often reaching tens of billions of VND per unit, which significantly limits the number of potential buyers.

According to investor Tran Nguyen (Dong Da, Hanoi), with the Land Law, Law on Real Estate Business, and Housing Law officially taking effect, the legal changes will propel the real estate market towards enhanced transparency and health.

Mr. Nguyen believes that the market is gradually entering a new cycle, starting with a focus on civil real estate, which is gaining more attention. By early 2026, the market is expected to enter a development phase.

Ngoc Mai

– 17:05 13/05/2025

Danang – The Investment Hotspot: The Golden Opportunity Returns

As a central city, Danang boasts numerous advantages, from its strategic location and well-invested infrastructure to its burgeoning tourism potential and double-digit economic growth rates. These factors have paved the way for the robust development of the real estate market.

Riding the Real Estate Boom in 2024

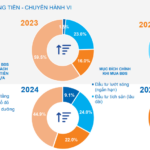

The year 2024 witnessed a significant shift in the behavior of real estate buyers. While owner-occupiers remain the dominant trend, their proportion has decreased notably, making way for a surge in property investors. Strikingly, the number of property speculators has soared to 9.1%, a remarkable increase from the mere 1.5% in the previous year.

“A Lane House Worth its Weight in Gold: $500k Now, ‘Won’t Sell for Less than $1M by Year-End’”

In less than a year, the price of a small alley house, inaccessible by car, can soar from 5.5 billion VND to 10 billion VND after just two changes of ownership and renovations.

The Great Apartment Price ‘Dance’: When Listings Leap to Premium Prices

In a market fraught with scarcity, brokers are continuously raising prices for apartments at a dizzying pace. Some real estate agents are allegedly taking advantage of the situation, demanding prices for apartments that are 500 million VND to 1 billion VND higher, just weeks after they were first advertised.