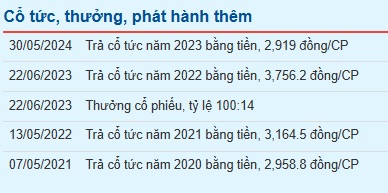

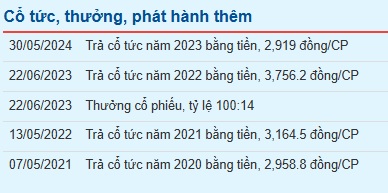

The company announced a dividend payout ratio of 28.1%, meaning that shareholders owning 1 share will receive VND 2,810. With 5.7 million shares currently in circulation, the company is estimated to spend approximately VND 16 billion on dividend payments. The dividends are expected to be distributed to shareholders by June 20, 2025. Half of the dividend amount will go to the parent company of BCB, the Northeast Corporation under the Ministry of Defense (holding a 51% stake).

What sets BCB apart is its share price. Since May 2024, the stock has had no trading volume, maintaining a price of just VND 700 per share, translating to a dividend yield of over 400%. The extraordinarily high yield is a result of the company’s consistent double-digit dividend payouts since its listing on the UPCoM in 2018, coupled with an extremely low share price.

Source: VietstockFinance

|

However, acquiring BCB shares is not an easy task. In addition to the parent company, there are two other major shareholders: Quang Thanh Construction Company (holding 20%) and Thố Huân Construction, Trading and Services JSC (11.46%). The concentrated ownership structure, coupled with the attractive dividend yield and low share price, explains why BCB often has no sellers in the market.

| BCB often experiences no trading volume due to its concentrated ownership structure and attractive dividend yield. |

Company 397, formerly known as Coal Mining Team No. 1, was established in June 1996 under the Northeast Corporation. In December 2017, Company 397 completed its equitization process and officially became a joint-stock company. It was listed on the UPCoM in October 2018 under the stock code BCB. The company’s main business activities include hard coal mining and collection, with a focus on the Nam Tràng Bạch mine, covering an area of 187.31 hectares and possessing a reserve of 4.8 million tons, expected to last for 7 years. Additionally, the company is engaged in wholesale fuel trading, pipeline cargo transportation, and equipment repair, among other activities.

BCB‘s business performance has been relatively stable. In 2024, despite a 30% decline in revenue to nearly VND 1,100 billion, net profit remained unchanged from the previous year at approximately VND 20 billion, exceeding the full-year plan.

| Financial performance of BCB |

– 13:43 13/05/2025

“Techcombank Sets Its Sights on a New Record: A $20 Billion Capitalization Goal as Shared by Ho Hung Anh”

As of May 15, 2025, just under two weeks since Techcombank’s Chairman, Ho Hung Anh, announced the bank’s ambitious $20 billion capitalization target at the 2025 Annual General Meeting, the bank’s market capitalization has surged by almost $1 billion.

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

The Energy Sector’s Renaissance: Unlocking Capital Flows and Opportunities

The week of May 5th to 9th saw a return of cash flow into the market, with a particular focus on two industry groups: energy and construction.