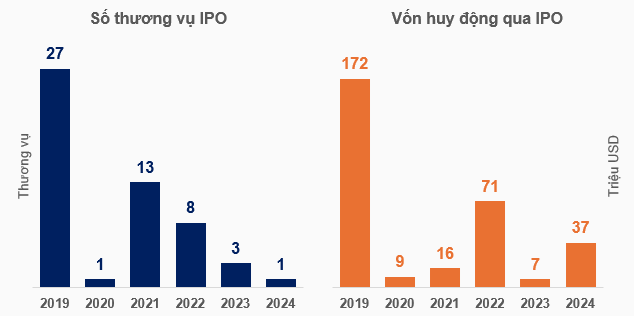

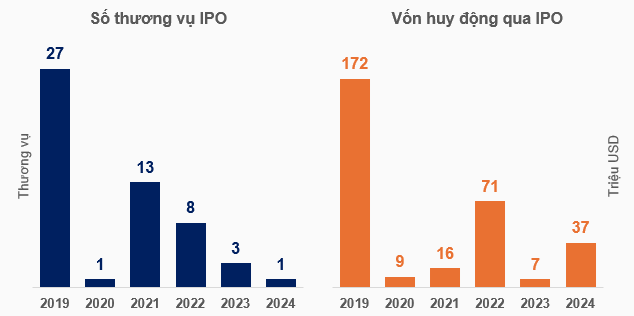

The Vietnamese IPO market witnessed 27 deals in 2019, amounting to 172 million USD. This number declined in subsequent years, with 13 deals raising nearly 16 million USD in 2021 and eight deals raising over 71 million USD in 2022. The market hit a low with three deals in 2023, raising over 7 million USD, and just one deal in 2024, raising approximately 37 million USD. However, this “dry spell” in IPOs is predicted to end soon.

Source: Deloitte’s report on the IPO market in Southeast Asia, compiled by the author

|

Recently, General Secretary To Lam emphasized the important role of private enterprises in economic growth, indicating a positive shift in orientation.

According to Nguyen The Minh, Director of Research and Development at Yuanta Securities Vietnam, statistics on enterprises’ plans for the 2025-2027 period reveal numerous anticipated IPO deals worth a total of 47.5 billion USD (excluding state-owned enterprises). The market may witness the Vinpearl (VPL) deal in 2025, followed by Techcom Securities (TCBS)’ IPO and subsequent listing in early 2026, potentially attracting capital back to the market.

|

The projected IPO and listing pipeline is valued at 47.5 billion USD over the next three years

Source: Yuanta Securities Vietnam

|

For state-owned enterprises, the Yuanta expert points to several factors that could boost the IPO and listing market. In 2024, Vietnam introduced and passed several laws, notably the Law on State Budget and the Law on Management and Use of Public Assets, which are crucial for IPO implementation and subsequent listing.

Between 2016 and 2018, the Vietnamese stock market experienced a boom in listing and privatization deals involving state-owned enterprises. Foreign ownership reached 22% during 2018-2019 due to these deals. However, the IPO market then entered a drought.

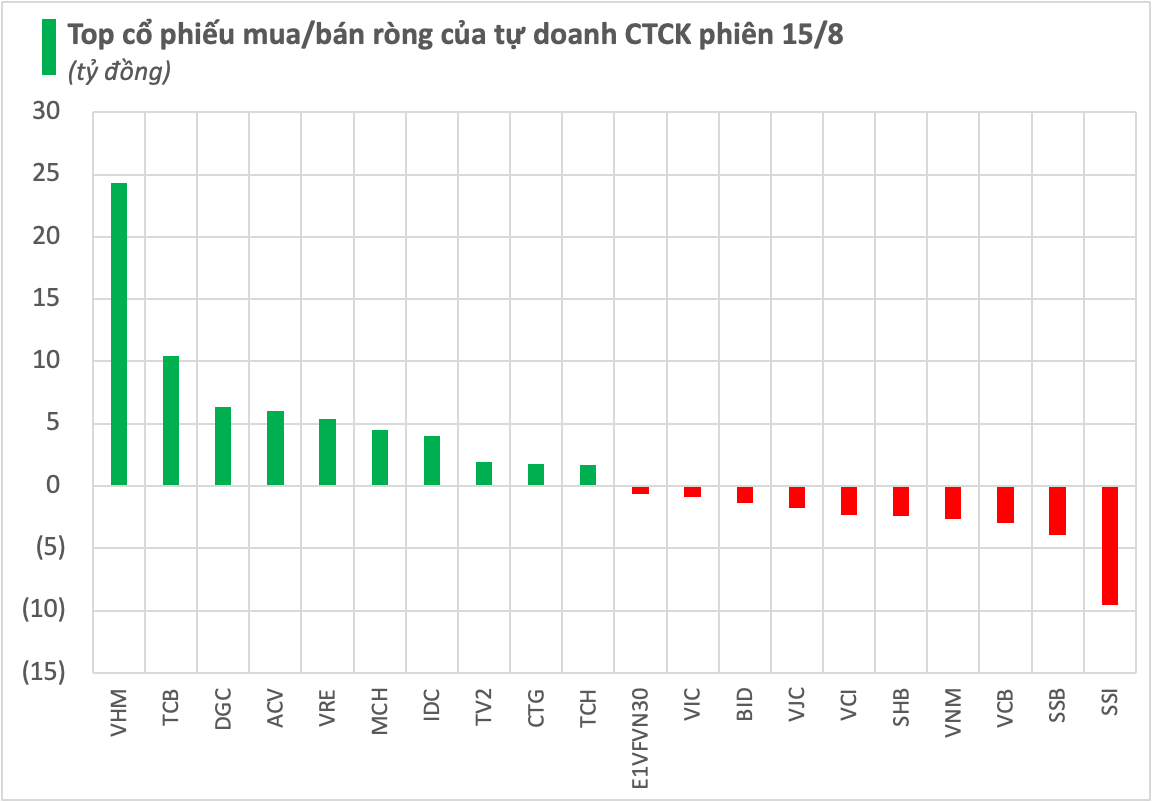

Additionally, the wave of upgrades from UPCoM to HOSE is noteworthy. In preparation for the merger of HOSE and HNX into a single exchange, many enterprises, particularly state-owned ones, have planned to move from UPCoM to HOSE. A notable example is Binh Son Refining and Petrochemical Company (BSR) earlier this year, and this trend may continue with Vietnam Airports Corporation (ACV) and Masan Consumer (MCH).

In fact, some investment funds only execute deals on HOSE and HNX, so this shift presents an opportunity for them to invest in new products.

Mr. Minh emphasized that these catalysts would attract foreign capital, along with other frequently mentioned factors such as market upgrades, the KRX system implementation, and FDI waves.

The wave of IPOs and stock listings will positively impact the stock market. According to Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities, facilitating more upgrades to HOSE, IPOs, and listings of state-owned enterprises will increase the stock market’s scale, offering a wider range of quality stock options and diversifying listed stocks by industry. Fundamentally, vibrant IPO activities are a driving force for the sustainable development of the stock market in the long term.

The standards and requirements for information transparency have significantly improved, and the stocks awaiting IPO are from prospective enterprises with high-quality assets, attracting investment flows into the market, including foreign capital. Additionally, investors will have more comprehensive information to assess the asset values of conglomerate stocks when their subsidiaries are also listed and have specific reference prices. Another factor attracting investment flows into conglomerate stocks is the presence of large-cap stocks in the VN30.

Immediate listing post-IPO is essential to keep up with the trend.

To promote IPOs, administrative procedures should be streamlined. Speaking at the “Investment Opportunities in the New Context” seminar on March 19, Pham Thi Thuy Linh, Head of Market Development Department, SSC, shared that the SSC has worked to link IPOs with enterprises’ listing activities. Previously, these two activities were separate, with IPOs licensed by the SSC and listings approved by the stock exchanges. Now, the SSC closely coordinates with the exchanges to help enterprises list immediately after their IPOs.

The SSC representative emphasized that this process requires cooperation from securities consulting companies and enterprises in preparing adequate and suitable dossiers. If enterprises do their part well, the SSC can expedite dossier processing, enabling stocks to be listed and traded promptly.

Mr. Truong Hien Phuong, Senior Director of KIS Vietnam Securities Company, stated that immediate listing post-privatization is a global trend aimed at enhancing liquidity and making stocks accessible to a broader range of investors.

In the primary market, investors, especially foreign investors, often face challenges in purchasing stocks, and even if they succeed, they may struggle to find buyers when they want to sell. This is why major markets emphasize IPOs, and Vietnam has embraced this trend.

Secondly, listing on the secondary market makes it easier for investment funds to buy and sell stocks. This catalyst could encourage foreign investors to invest in the Vietnamese stock market.

– 08:00 14/05/2025

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

Market Beat: Foreigners Ramp Up Buying, VN-Index Surges Past 1,300 Points

The trading session concluded with impressive gains, as the VN-Index surged by 16.3 points (+1.26%), closing at 1,309.73. Simultaneously, the HNX-Index displayed a notable increase of 0.95 points (+0.44%), finishing the day at 218.88. The market breadth tilted strongly in favor of advancers, with 426 tickers in the green and only 322 in the red. Within the VN30 basket, bullish momentum prevailed, evidenced by 22 gainers, 7 losers, and 1 unchanged stock.

“Vietnam Stock Market: Real Estate Shines Amidst Dull April Performance”

The Ho Chi Minh Stock Exchange (HOSE) ended the trading session on April 30, 2025, with key indices, including the VN-Index, VNAllshare, and VN30, posting losses compared to the end of March. Sectoral indices also witnessed declines, with the exception of the real estate sector, which managed to stay afloat.

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.