European Fashion and Cosmetics Co., Ltd. (ACFC) has just registered to sell 667,000 shares of Tan Son Nhat Aviation Service Joint Stock Company (SAS). According to ACFC, the purpose of this move is to balance its investment portfolio. The transaction is expected to take place from May 12 to June 12, 2025.

If the transaction is successful, the company’s ownership ratio in Sasco will decrease from 20.53 million shares to 19.87 million shares (equivalent to 14.89% of charter capital).

With SAS’s market price currently at VND 39,000 per share, the value of the sold shares is worth more than VND 26 billion.

ACFC is part of the ecosystem of “luxury king” Johnathan Hanh Nguyen, with him directly serving as the Chairman. Meanwhile, his wife, Le Hong Thuy Tien, is a member of ACFC’s Board of Directors.

Previously, in March, Duy Anh Trading Joint Stock Company, another enterprise related to the ecosystem of “luxury king” Johnathan Hanh Nguyen, also completed the sale of 667,000 Sasco shares. As a result, Duy Anh Company reduced its ownership in Sasco from 2.21% to 1.7% of capital.

Ms. Le Hong Thuy Tien is a member of the Board of Directors of Duy Anh Company.

The move to sell Sasco shares in the above two enterprises has attracted attention. After 10 years, this is the first time that Mr. Johnathan Hanh Nguyen has reduced his holdings in Sasco.

Sasco is known as a company specializing in retail, duty-free, and service business at Tan Son Nhat International Airport. Mr. Johnathan Hanh Nguyen officially took the position of Chairman of Sasco in 2017.

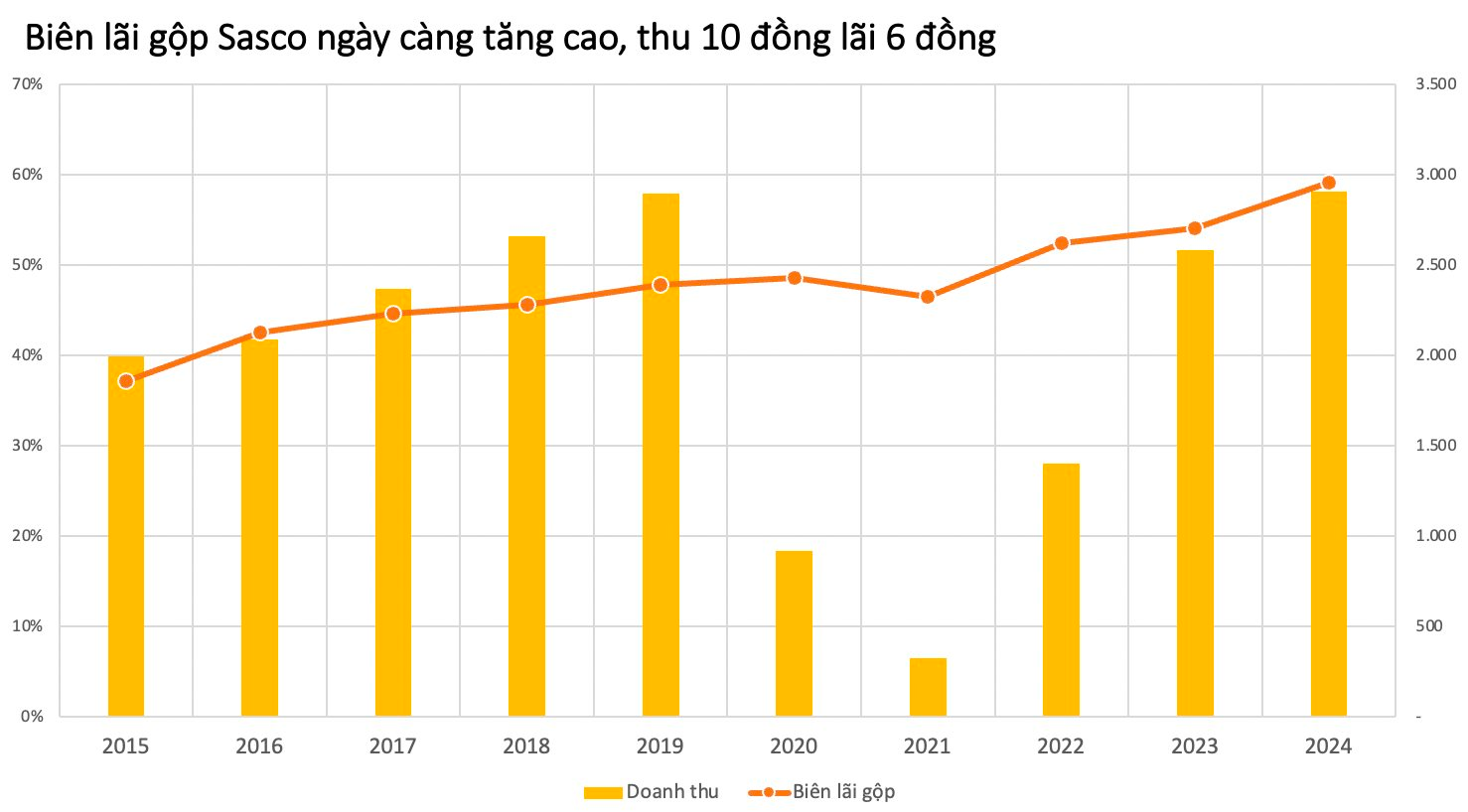

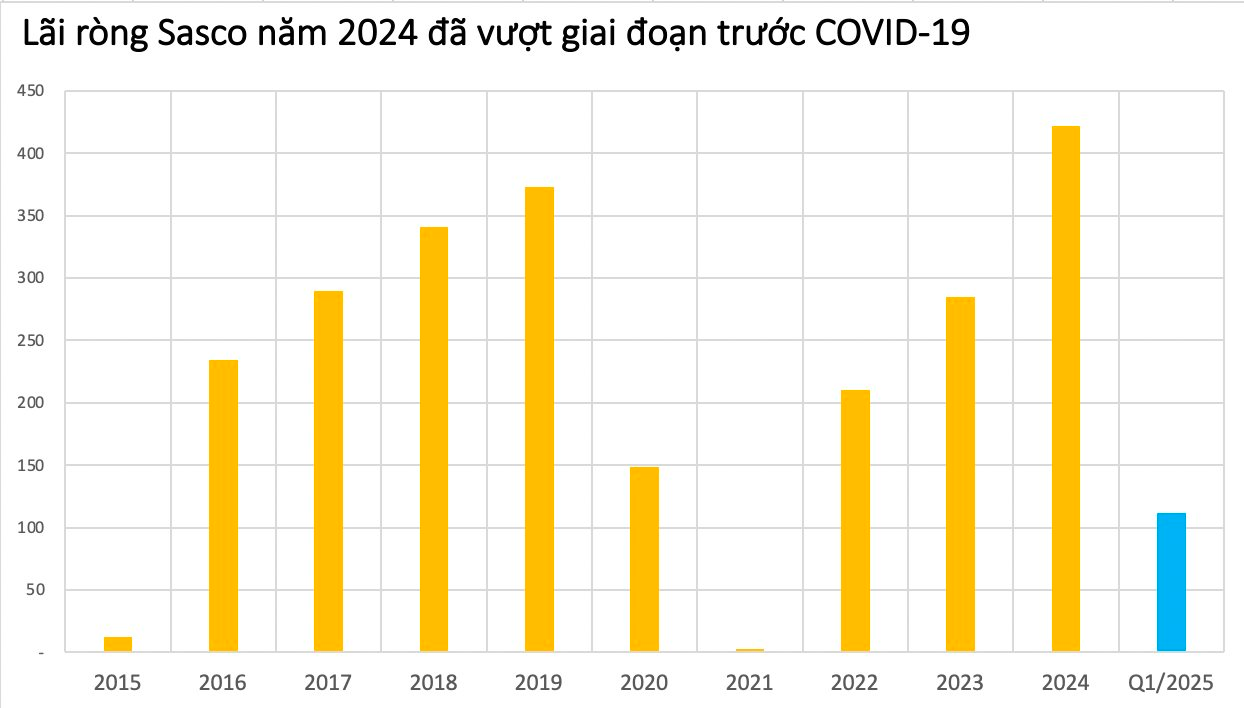

Since then, Sasco has been likened to a “cash cow” for this entrepreneur, with profits ranging from VND 290-450 billion per year (excluding years affected by Covid-19).

Sasco has just announced its Q1/2025 financial statements, recording a revenue of VND 764 billion, up 12% over the same period last year.

In the revenue structure, the business lounge segment surpassed the duty-free business segment to become the largest revenue contributor with nearly VND 229 billion, up 29% over the same period. The cost of goods sold for this segment was only about VND 43 billion, equivalent to a gross profit margin of up to 82% (4 VND profit for every VND of capital invested).

Meanwhile, despite a slight decrease, duty-free store revenue still reached VND 223 billion. It is known that SAS’s business activities are concentrated at Tan Son Nhat International Airport – the largest aviation hub in the country.

After deducting expenses, the company’s after-tax profit was VND 113 billion, nearly 2.5 times higher than in Q1/2024. According to SAS, profit growth was driven by the recovery of the aviation industry. Especially, the Chinese market saw a 78% increase in the number of passengers.

As of March 31, 2025, Sasco had total assets of VND 2,499 billion. Notably, Sasco owns a real estate investment portfolio with 6 land lots in Phu Quoc, with a total area of nearly 3.2 hectares and an original value of VND 37 billion. The company has a healthy capital structure with owners’ equity of VND 1,752 billion, retained earnings of VND 413 billion, and no bank loans.

The Luxury King’s Company: Unveiling the Sale of Sasco Shares by Hạnh Nguyễn

“Johnathan Hạnh Nguyễn, a prominent figure in the Vietnamese business landscape, is making waves with two of his affiliated companies: Âu Châu Fashion and Cosmetics Ltd. and Duy Anh Trading Joint Stock Company. The companies have jointly registered to sell over 1.3 million shares of Sasco, a move that is sure to capture the attention of the market. With a strategic vision and a deep understanding of the industry, this decision showcases the companies’ and Nguyễn’s confidence in their respective ventures.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)