The market’s positive psychology extended into today’s session, largely due to a strong rebound in global stocks after the US and China temporarily ceased their trade war. Domestic and foreign capital competed in buying, pushing liquidity higher towards the end of the session, with the index gaining over 10 points to reach 1,293, approaching the 1,300 mark.

The breadth wasn’t exceptionally strong, with 205 gainers and 106 losers, indicating some degree of rotation and differentiation among sectors. Real estate took a back seat today as small and mid-cap stocks took the lead. Notable growth was observed in sectors such as Securities, Materials, Distribution, Retail, and Consumer Services.

Notably, VPL, the Vinpearl stock, debuted today and closed at the upper limit with a two-million-share surplus. Materials stocks witnessed a robust performance, particularly in rubber and steel companies such as GVR, HPG, TVN, and VGC. Securities firms maintained their upward momentum, albeit less vigorously compared to the previous session, with tickers like VND, SSI, VCI, VIX, BSI, and MBS.

The retail sector benefited from substantial foreign capital inflows, resulting in substantial gains for tickers like MWG, PNJ, FRT, and DGW. Among large-cap stocks, banks continued their leading role, with CTG, BID, VPB, MBB, and VCB posting gains, although the sector’s consensus weakened as SSB, LPB, SHB, and TPB closed with losses ranging from 0.14% to 1.58%. Conversely, real estate stocks witnessed a setback, with VHM, VRE, NVL, VPI, PDR, and KSF trending downward.

Today’s liquidity across the three exchanges increased compared to the previous session, reaching VND26,600 billion, with net foreign buying of VND985.9 billion. Specifically, in terms of matched orders, foreign investors were net buyers to the tune of VND951.5 billion, focusing on the Retail and Personal & Household Goods sectors.

The top stocks bought by foreign investors via matched orders included MBB, MWG, PNJ, CTG, FPT, NLG, GVR, GMD, HPG, and VIX. On the selling side, they offloaded Industrial Goods & Services stocks, with the top sells via matched orders being VCB, STB, GEX, SSI, HDB, MSN, TCH, DGC, and TPB.

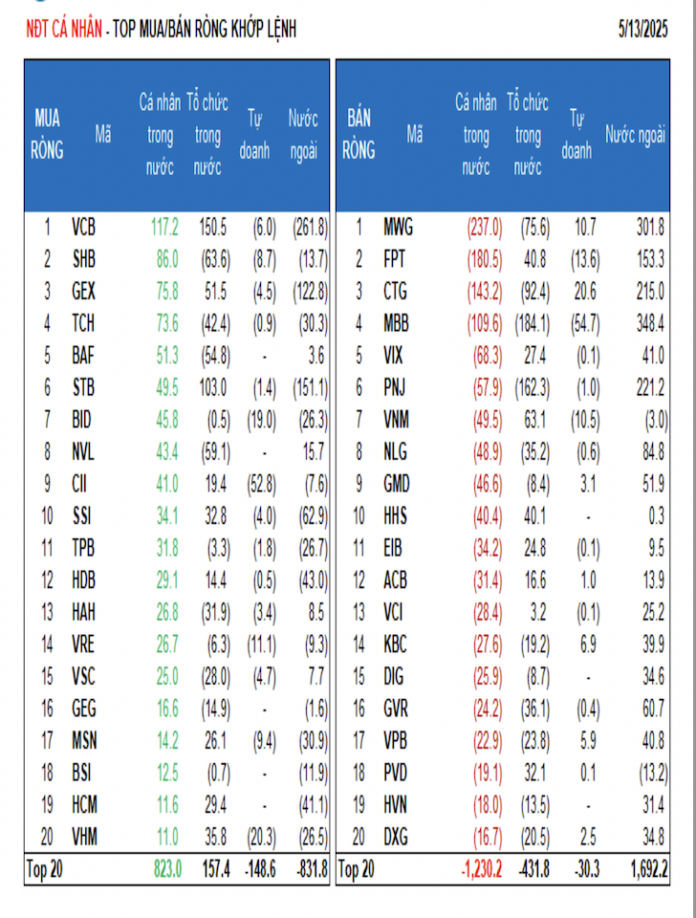

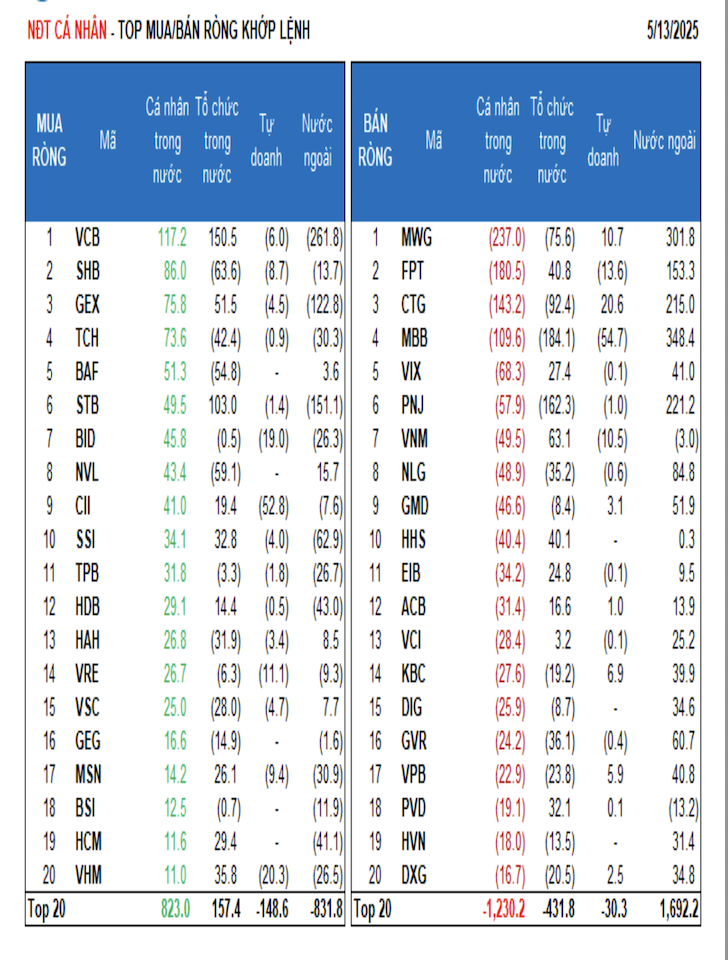

Individual investors sold a net VND755.7 billion, of which VND561.6 billion was via matched orders. In terms of matched orders, they bought 5 out of 18 sectors, primarily focusing on Industrial Goods & Services. Their top buys via matched orders included VCB, SHB, GEX, TCH, BAF, STB, BID, NVL, ClI, and SSI.

On the selling side via matched orders, they offloaded 13 out of 18 sectors, mainly Retail and Information Technology stocks. Their top sells via matched orders included MWG, FPT, CTG, MBB, VIX, PNJ, NLG, GMD, and HHS.

Proprietary trading accounts sold a net VND303.1 billion, of which VND272.7 billion was via matched orders. In terms of matched orders, they bought 2 out of 18 sectors, with Retail and Healthcare being the most purchased. Their top buys via matched orders included CTG, MWG, FUEVFVND, KBC, NAF, VPB, HHV, SZC, VGC, and GMD.

On the selling side via matched orders, banks were the most offloaded sector. The top sells via matched orders included MBB, CII, VIC, VHM, TCB, BID, DGC, FPT, VRE, and LPB.

Local institutional investors bought a net VND81.4 billion, although they sold a net VND117.2 billion via matched orders. In terms of matched orders, institutions sold 7 out of 18 sectors, primarily Personal & Household Goods. Their top sells via matched orders included MBB, PNJ, CTG, MWG, SHB, NVL, BAF, TCH, GVR, and NLG. On the buying side via matched orders, they focused on Financial Services. Their top buys via matched orders included VCB, STB, VIC, VNM, GEX, DGC, FPT, HHS, VHM, and SSI.

Today’s negotiated trading value reached nearly VND3,700 billion, up 23.2% from the previous session, contributing 13.6% to the total trading value. Negotiated trading was particularly active among local institutions, focusing on TCB, VHM, SJS, and FPT.

In terms of capital allocation, there was an increase in Real Estate, Securities, Chemicals, Aquaculture & Seafood, Retail, Electrical Equipment, and Personal & Household Goods. Notably, Retail and Personal & Household Goods witnessed improved liquidity due to active institutional trading, while the upward momentum in these sectors was supported by strong foreign demand.

Specifically, in terms of matched orders, there was an increase in capital allocation towards mid-cap (VNMID) and small-cap (VNSML) stocks, while large-cap (VN30) stocks witnessed a decrease.

The Magic of Words: Transforming Titles with Artistry and Precision

“German Chemicals Giant Infuses $20 Million into its Real Estate Venture”

“With a substantial investment of 5000 billion VND, Duc Giang Chemicals plans to boost the charter capital of Duc Giang Real Estate to an impressive 1000 billion VND in the second quarter of 2025. This significant capital increase from 500 billion VND will undoubtedly propel the company’s growth and expansion in the real estate industry.”

Stock Market Insights: Capital Flows Gain Further Momentum

Today marked the debut of VPL on the HSX exchange, while VIC and VHM experienced brief moments of instability. Despite this, the supporting forces at these pillars remained relatively robust, and the decline was not significant. The closing session of VIC even witnessed a boost beyond the reference level. The stable index backdrop encouraged more active trading in mid-to-small-cap stocks.

The Ultimate Downtown Development: Unveiling the $7 Billion, Four-Facade Project

This investor became a shareholder of Saigon Glory last year after acquiring a stake from the Bitexco Group.