Vietnam’s stock market kicked off the new week on a positive note, in line with the global market trend. The VN-Index remained in the green for most of the trading session, led by strong performances from several pillar stocks such as TCB and VIC.

The upward momentum intensified towards the end of the session as buying interest became more decisive. Sectors such as banking, securities, and industrial parks generally witnessed an upturn, while steel and real estate sectors experienced some fluctuations.

At the close of the session on May 12, the VN-Index rose by 15.96 points (+1.26%), climbing to 1,283.26. Trading liquidity improved compared to the previous week, with a matching value of nearly VND 20,000 billion. However, foreign transactions remained a downside, with a net sell-off of nearly VND 300 billion in the entire market.

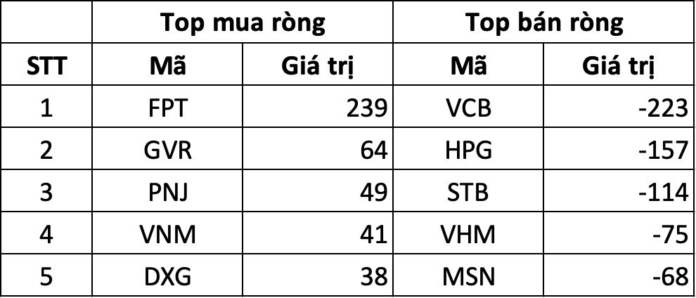

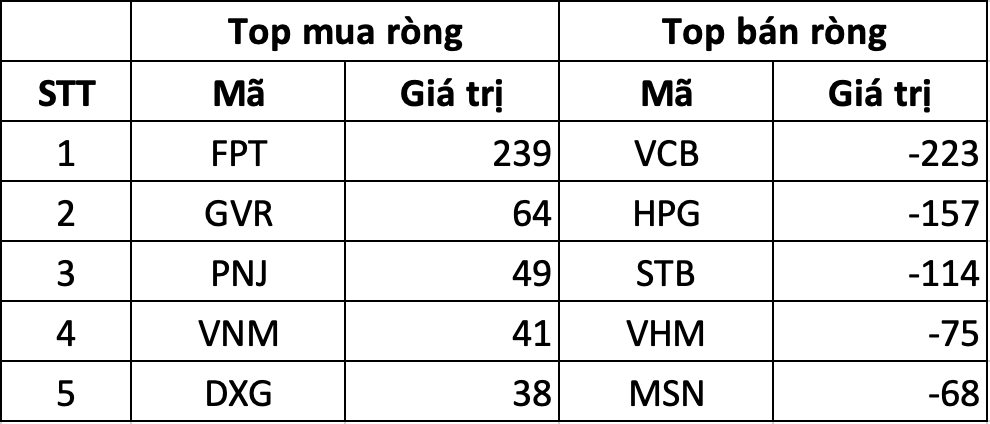

Foreigners net sold over VND 293 billion on HoSE

Selling pressure was spread across various blue chips, including VCB, HPG, STB, VHM, and MSN. VCB witnessed the strongest selling pressure, with a net sell-off value of VND 223 billion. The top three stocks with the highest net sell-off value all exceeded VND 100 billion.

On the opposite side, FPT continued to attract strong foreign buying, recording a net buy value of VND 239 billion, the highest on the exchange. Previously, this stock had experienced a prolonged period of net selling due to profit-taking pressures and concerns about cheap AI models.

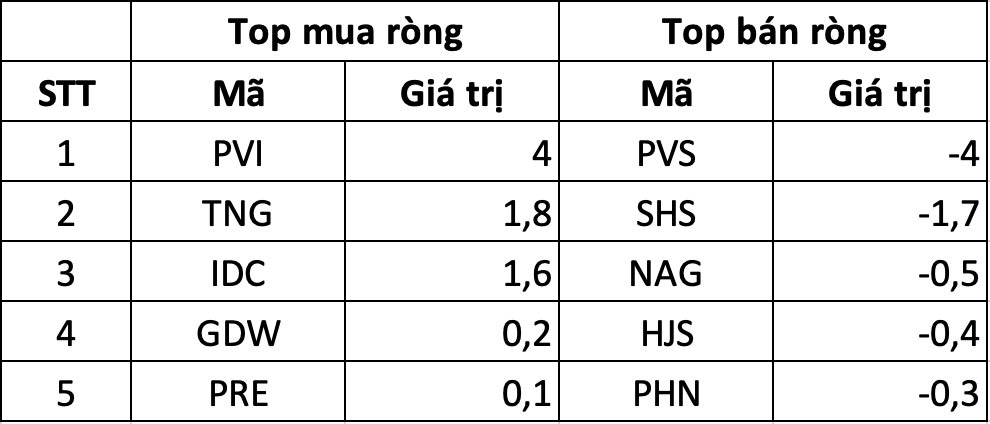

Foreigners net sold VND 0.4 billion on HNX

Foreign trading on HNX was relatively balanced. On the buying side, PVI witnessed the strongest accumulation, although the value was only VND 4 billion. TNG and IDC were the two stocks with net buying values exceeding VND 1 billion, while the rest had insignificant buying values.

Conversely, PVS experienced the strongest net selling pressure on HNX, with a net sell-off value of VND 4 billion. This was followed by SHS, NAG, HJS, and PHN, although their net selling values were not significant.

Foreigners net sold VND 3.5 billion on UPCoM

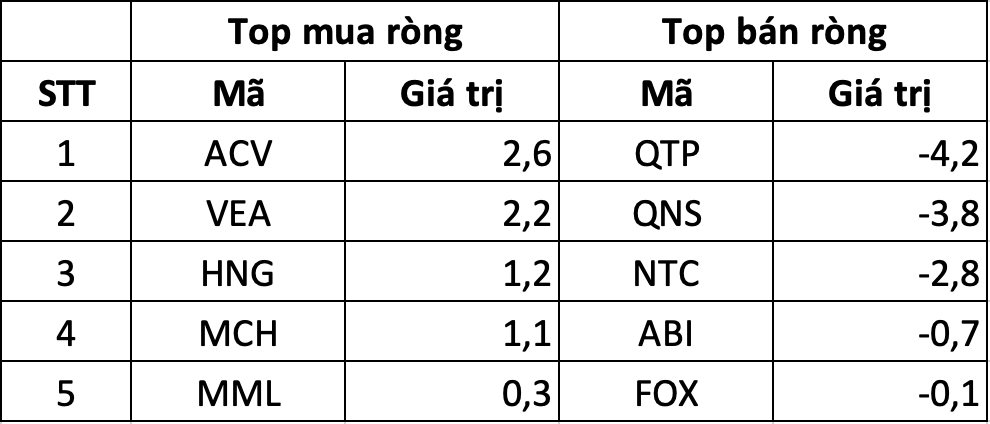

Selling pressure was mainly concentrated on stocks such as QNP, QNS, and NTC. Other stocks witnessed net selling values of less than VND 1 billion. On the buying side, ACV, VEA, HNG, and MCH were the most accumulated stocks on UPCoM, although their values were not significant compared to the scale of these stocks.

The Power of Private Enterprise: Unlocking Vietnam’s Economic Potential through Resolution 68-NQ/TW.

“The Resolution 68/NQ-TW emphasizes the role and significance of the private sector as a vital force in the national economy, as stated by Cao Thi Ngoc Quynh.”

The Novaland Stock Saga: A Market Focus

Today (May 12th), NVL stock halted its volatile movement as major shareholders simultaneously registered to sell their shares.

The Rise of Midcap Stocks: A Foreign Investment Frenzy

The liquidity dipped slightly this afternoon, but the market remained resilient and turned positive. The VN-Index closed 0.79% higher, outperforming the morning session and ending at the day’s high. This positive turn can be attributed to the price recovery of several large-cap stocks, indicating a strong and resilient market despite the slight dip in liquidity.