The spotlight was on Vinpearl’s VPL stock, which surged to its daily limit-up price during its debut on HoSE. At the closing bell, VPL reached VND 85,500 per share, but its impressive performance failed to boost the sentiment among other “Vin” family stocks. VIC inched up by 0.3%, while VHM and VRE ended in the red.

The VN30 group, comprising the market’s 30 largest caps, attracted strong cash flow, gaining over 10 points and contributing significantly to the overall market’s upward momentum.

Banking stocks painted the town green.

Banking stocks witnessed vibrant trading, with large caps such as CTG, MBB, BID, and VPB dominating the scene. CTG emerged as the biggest gainer, climbing 4.1% and serving as the primary catalyst for the index’s ascent. The remaining stocks in this sector posted gains ranging from 1% to 2%.

VPBank’s shares rose 2% ahead of its upcoming dividend payout. May 16th has been set as the record date for shareholders to receive a 5% cash dividend, which will be distributed on May 23rd. The bank has allocated nearly VND 3,967 billion for this purpose, marking the third consecutive year of cash dividend payments.

Aside from its financial performance, VPBank has also garnered attention for organizing an international music festival featuring renowned South Korean artists, including G-Dragon of Big Bang and CL, formerly of 2NE1.

As banking stocks took the lead in the market rally, sectors that had been performing well recently, such as real estate, showed signs of slowing down. High-liquidity stocks like NVL, GEX, CII, and PDR underwent adjustments.

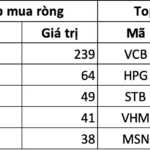

Notably, foreign investors recorded their strongest net buying session since the beginning of the year, with a net purchase value of over VND 986 billion. Their primary focus was on MBB (net buying of VND 348 billion), MWG (VND 314 billion), PNJ, and CTG, all with net purchases exceeding VND 200 billion each. This marked a sharp contrast to the persistent net selling trend observed over the last two years.

Analysts attribute the shift in foreign investors’ sentiment to various factors, including the narrowing interest rate differential between VND and USD and the significant capital outflows witnessed in the previous years. They predict that the net selling trend observed in 2024 may not be as intense in 2025.

Wrapping up the session, the VN-Index climbed 10.17 points (0.79%) to close at 1,283.26. The HNX-Index gained 1.89 points (0.87%) to reach 217.93, while the UPCoM-Index rose 0.96 points (1.03%) to end at 94.55. Trading liquidity improved, with the matched order value on HoSE surpassing VND 23,500 billion.

Foreign Block Buys a Record High of Over VND 1,100 Billion, Large-cap Stocks Lift VN-Index Past 1300 Points

The blue-chip stocks witnessed a surprising boost this morning, with foreign investors’ buying power accounting for nearly 21% of the total liquidity in the VN30 basket. Foreign capital drove a 25.5% surge in liquidity for blue-chip stocks, taking it to the highest level in 20 sessions, while trading on the HoSE floor dipped 7.5% compared to yesterday’s morning session.

The Novaland Stock Saga: A Market Focus

Today (May 12th), NVL stock halted its volatile movement as major shareholders simultaneously registered to sell their shares.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)