According to UOB, the US dollar experienced a volatile April, with rumors of de-dollarization trends spreading in the market. The focus was on the speculations surrounding the ‘Mar-a-Lago Agreement’, believed to include trade tariffs and a weakening of the US dollar.

However, UOB suggests that the real reason for the dollar’s sell-off after President Trump’s “Liberation Day” may have been due to exporters offloading their stockpiled USD reserves from export proceeds.

“We maintain our view that the US dollar will continue to weaken against other major currencies. This will cause the USD Index (DXY) to fall to a new trading range below 100 and further down to 96.9 by Q1 2026,” said UOB’s expert.

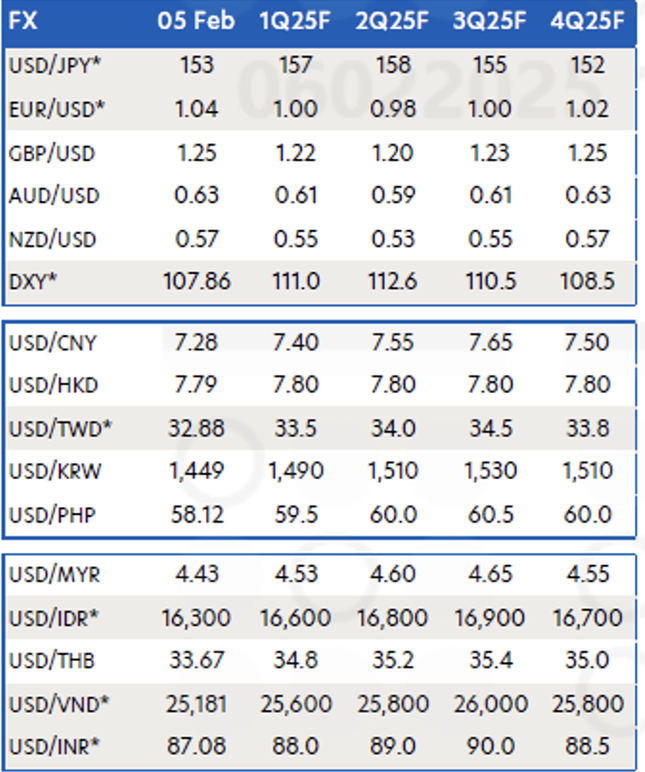

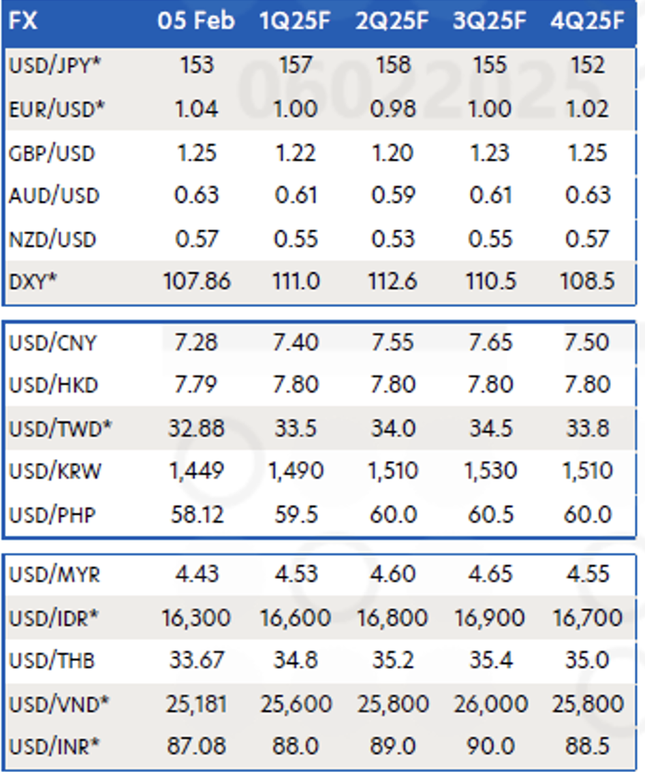

UOB’s forecast for USD exchange rates against other currencies.

UOB notes that the recent strong recovery of Asian currencies has been somewhat excessive but, compared to last month’s forecast, the bank has lowered the expected peaks for USD/Asia rates in Q3, reflecting the possibility that the most tense phase of the trade war is over.

UOB forecasts USD/CNY to be at 7.32 in Q3 2025, USD/SGD at 1.32, USD/MYR at 4.38, USD/THB at 33.5, USD/IDR at 16800, and USD/VND at 26300.

The Singapore-based bank considers the VND a special case in the region’s strong currency recovery in April, as it weakened by 1.6% to 25,990 VND/USD. The market may have reacted to the negative economic impact on Vietnam after the US announced tariffs of up to 46% on Vietnamese goods – the second-highest in the world, after China.

The manufacturing PMI also fell sharply to 45.6 – the lowest in two years, indicating manufacturers’ cautious sentiment amid concerns about Vietnamese goods losing their price competitiveness in the US, their largest export market.

UOB expects the VND to remain in a weak range against the USD.

Failing a trade deal with the US, UOB believes the VND will remain in a weak range against the USD. Their updated forecast for this quarter is 26,100 VND/USD, 26,300 in Q3, 26,000 in Q4, and 25,800 in Q1 2026.

Regarding interest rate prospects, UOB maintains its view that the US Federal Reserve (Fed) will continue to ease monetary policy. Although the timing of the Fed’s rate cut has been pushed back, UOB still predicts three 25-basis point cuts this year.

The anticipated timing of these cuts is during the FOMC meetings in September, October, and December, bringing the policy rate down to 3.75% by year-end.

As for the gold market, UOB predicts that safe-haven demand will persist, along with central banks consistently increasing their gold holdings, expectations of a weaker USD, and the potential return of funds to US gold ETFs. All these factors provide positive support for gold prices. Therefore, UOB maintains a positive outlook and raises its gold price forecast to $3,600 per ounce by Q1 2026.

“Reduced Interest Rates on the VND 120,000 Billion Package for Social Housing Purchases”

According to a report by the Ministry of Construction, the disbursement of the VND 120 trillion credit package for social housing reached VND 3.4 trillion, with over VND 550 billion disbursed in the first four months of this year. Lending rates have decreased by more than 2% over the past two years, falling to 6.1% per annum.

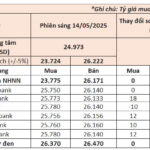

“May 14th: Central Bank Keeps USD Exchange Rate at Peak, Significant Differences in Gold Ring Prices Across Brands”

The USD exchange rates at banks witnessed a mixed trend as the SBV kept the daily reference rate unchanged at 24,973 VND/USD. Domestic gold bar prices witnessed a slight dip on Thursday morning, while gold ring prices showed a significant variation across brands.

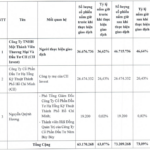

A Strategic Stake: CII Invest Acquires Over 10 Million Shares in NBB, Now Holding a Commanding 47% Stake

“In two sessions held between May 9 and May 12, 2025, CII Invest, a renowned private trading and investment company, successfully acquired over 10 million shares of NBB, a leading investment company listed on the HOSE, from My Steel Trading and Services Co., Ltd. This strategic move was executed without the need for a public offering, as per the resolution of the 2025 Annual General Meeting of Shareholders.”

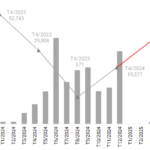

April 2025 Private Placement Memorandum: Back with a Bang, But So Are Defaults.

After a subdued start to the year, the private placement of corporate bonds picked up pace in April, with issuances totaling over VND 38,000 billion—a remarkable twofold increase compared to the same period last year.