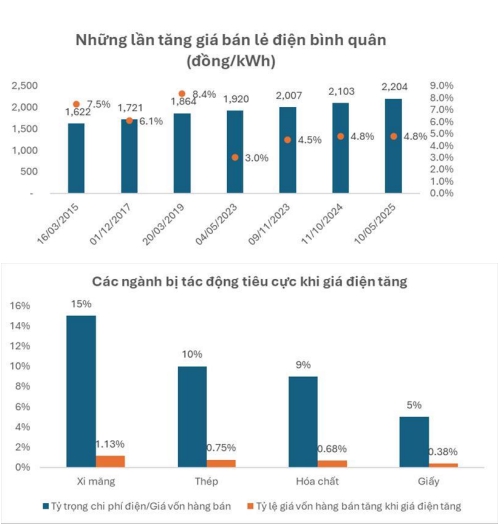

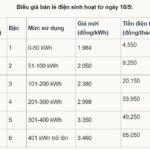

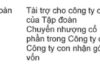

As of May 10, 2025, the Vietnam Electricity Group (EVN) has adjusted electricity retail prices, increasing the average rate by 4.8%. This is the second adjustment since 2023, bringing the total increase over the past three years to over 17%.

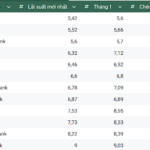

Yuanta Vietnam Securities Company analyzed that compared to the previous two-year interval between price hikes with a 6-8% increase, the frequency of electricity price adjustments has accelerated due to rising electricity production costs. Multiple factors influence the cost of electricity production, including electricity output, coal, oil, gas prices, and foreign exchange rates.

Despite a downward trend in oil, gas, and coal prices, the depreciation of the Vietnamese dong could be a factor in this price hike, along with a potential effort to alleviate EVN’s recent financial difficulties.

Some power generation enterprises will benefit from the price adjustment, mainly due to improved payment capabilities of EVN, which will support their cash flow and business performance. Additionally, electric installation companies may benefit as EVN’s improved financial situation could lead to better implementation of power source and grid projects.

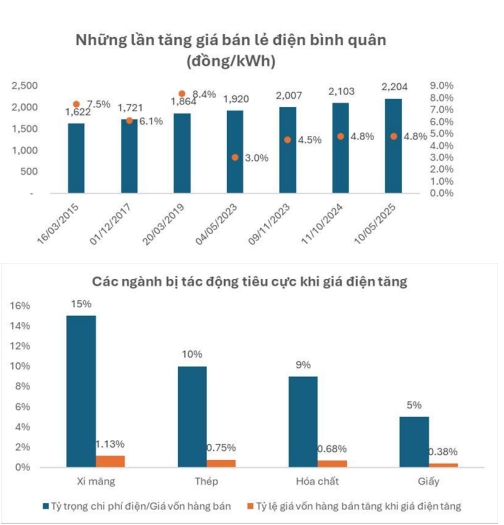

On the other hand, industries like cement, steel, chemicals, and paper will be negatively impacted as electricity costs account for a significant portion of their production expenses. A 4.8% increase in electricity prices will result in higher overall costs for these businesses.

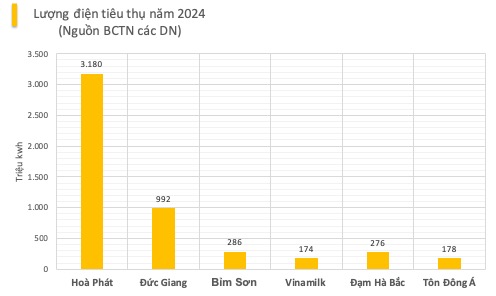

According to 2024 data, Hoa Phat Group’s two integrated steel production complexes in Hai Duong and Dung Quat achieved a total electricity output of 3.18 billion kWh, a 29% increase compared to the previous year. This enabled Hoa Phat to self-supply over 90% of their electricity needs for production.

Specifically, on February 5, 2025, the Hoa Phat Dung Quat Steel Company’s thermal power plant officially reached a cumulative electricity output of 10 billion kWh since its operation in April 2024, contributing to optimizing production costs.

Hoa Phat’s total self-generated electricity output at the Hai Duong and Dung Quat complexes is equivalent to that of a medium-sized thermal power plant. Based on 2024 electricity prices, the electricity output for that year was valued at approximately VND 5,400 billion.

With the recent price adjustment, Hoa Phat will only incur an additional VND 28-30 billion in electricity costs at these complexes.

Another major electricity consumer is the Duc Giang Chemical Group (DGC), which consumed 992 million kWh in 2024, a 7.5% increase compared to 2023.

As electricity prices rise, Duc Giang will face nearly VND 100 billion in additional electricity expenses. However, compared to their 2024 revenue of VND 9,864 billion and pre-tax profit of VND 3,400 billion, this increase is negligible.

Other large electricity consumers include Ton Dong A, Dab Ha Bac (DHB), and Vinamilk (VNM), with consumption ranging from 100 to 300 million kWh per year. These businesses will face additional electricity costs of VND 10 billion to VND 30 billion.

In summary, while the impact of the electricity price increase is noticeable, it is not significant due to the relatively small rise in electricity costs. Moreover, many businesses have mitigated the impact by investing in solar energy, CNG, and biomass.

However, for small and medium-sized enterprises, the rise in electricity prices adds a considerable burden to their operational costs.

Mr. Tran Van Linh, Chairman of the Board of Thuân Phuoc Seafood Trading and Processing Joint Stock Company, shared with Tien Phong newspaper that the seafood processing industry heavily relies on electricity, especially for maintaining cold storage facilities.

Currently, the company pays an average of VND 1.5-2 billion per month in electricity bills, depending on production volume and actual electricity consumption. With the recent increase in commercial electricity prices, they anticipate an additional expense of up to hundreds of millions of VND per month.

Similarly, Mr. Pham Van Viet, Director of Viet Thang Jean Company, shared with Vnbusiness that the textile industry, which relies on machinery and energy-intensive processes like weaving and dyeing, is struggling with rising input costs, including the recent electricity price hike. He added that the increased electricity prices contribute to higher production costs, reducing the competitiveness of Vietnamese goods in the international market.

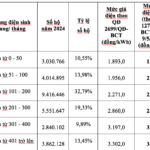

Small businesses and households are also concerned about the rising electricity prices, especially during the hot season when electricity demand and usage are at their peak.

“Vietnam’s Power Company Explains the Recent 4.8% Electricity Price Hike, Taking it Above 2,200 VND per kWh”

“According to EVN’s Vice President, Vo Quang Lam, the 4.8% electricity price hike is a carefully considered decision, taking into account the fluctuating input costs, including coal and gas prices for power generation, and the impact on households and businesses.”

The Rising Cost of Electricity: A Strain on Household Budgets

The rising electricity costs are negatively impacting not just the manufacturing industry, but also small businesses, restaurants, and households alike.