After nearly two weeks of accumulation, The Gioi Di Dong (MWG) stock suddenly surged to 63,500 VND per share, the highest since the beginning of 2025. Compared to the yearly low confirmed in early April, MWG’s market price has increased by more than 37%. Market capitalization also rose to approximately 94 trillion VND.

MWG stock, along with other retail and consumer goods stocks (FRT, DGW, MCH, etc.), witnessed a significant surge following news related to VAT. Specifically, the government proposed extending the 2% VAT reduction for goods and services serving production, business, tourism, and consumption until the end of 2026. This move is expected to stimulate consumer demand.

Regarding MWG, foreign investors have recently shown renewed interest in this stock. Notably, the Pyn Elite Fund has been actively acquiring MWG shares, making it one of the top four investments in their portfolio, with a weight of 7.2% as of April. Previously, this stock had experienced a period of strong sell-offs.

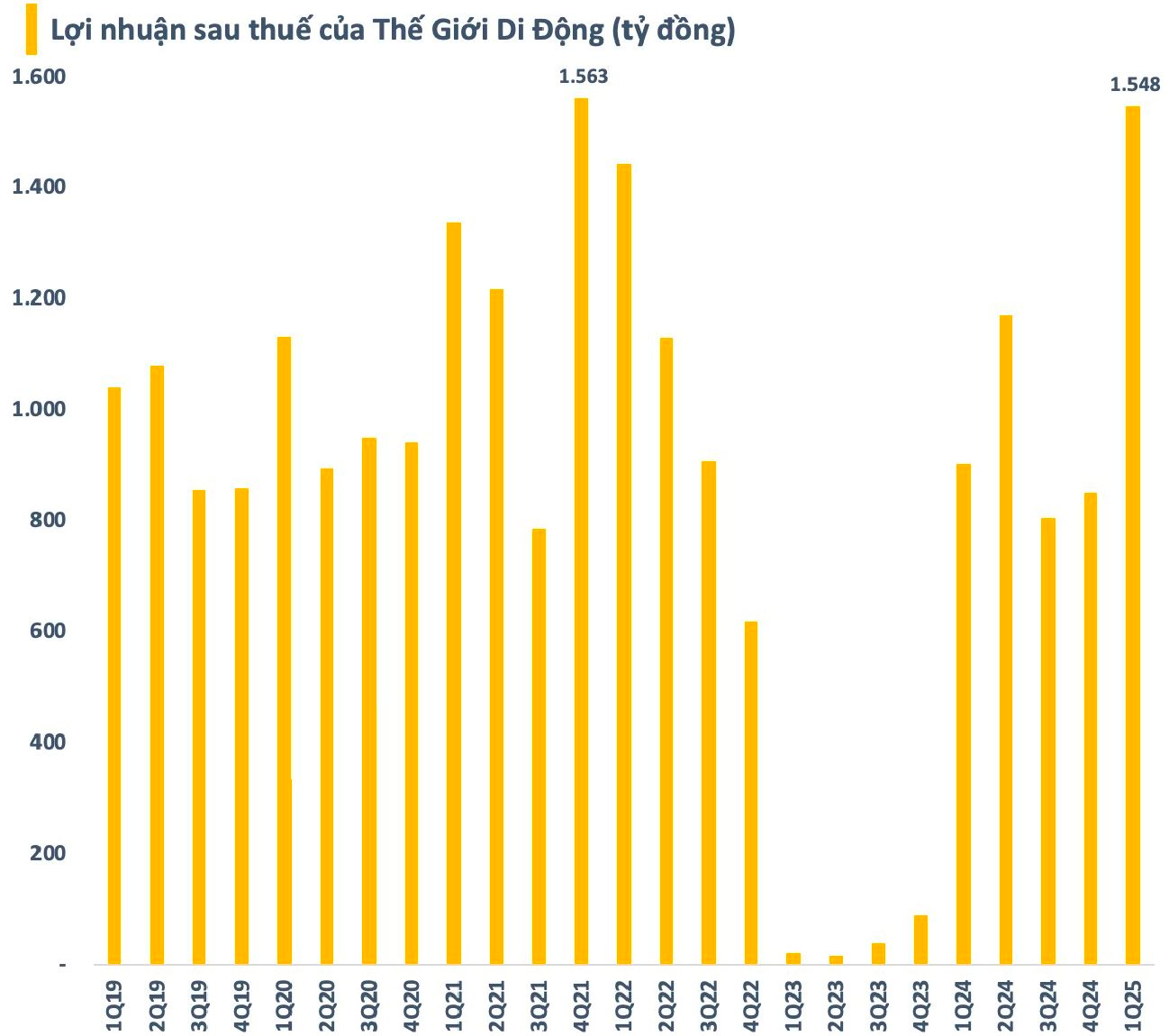

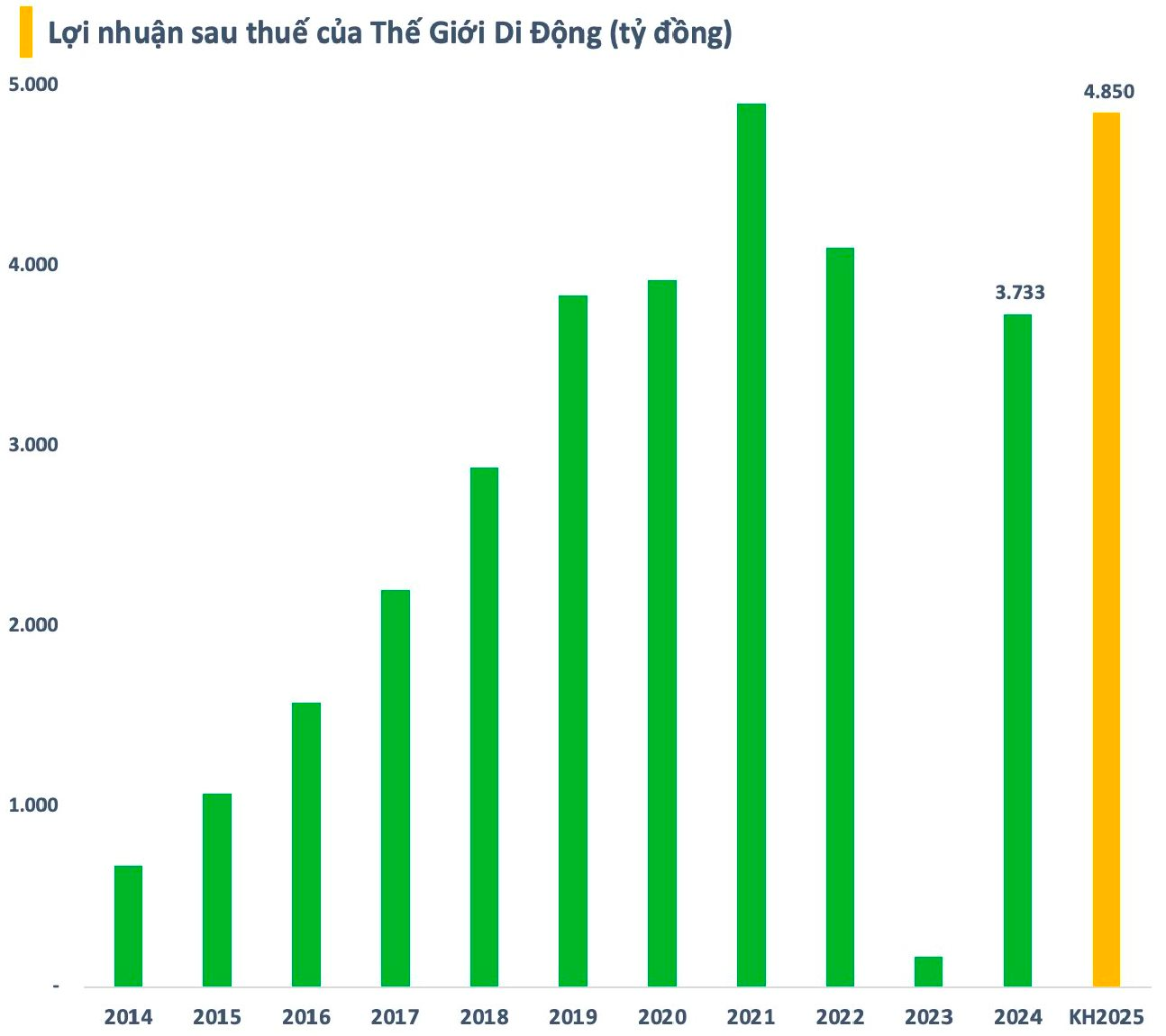

In the first quarter, The Gioi Di Dong recorded a net revenue of 36,135 billion VND, an increase of nearly 15% compared to the same period in 2024. After-tax profit reached 1,548 billion VND, a surge of over 71% year-on-year. This quarterly profit is the second highest in the history of this retail enterprise, slightly lower than the peak achieved in Q4/2021.

In addition to the increase in net revenue, the factors driving the surge in The Gioi Di Dong’s profit in the first quarter include: (1) an over 18% rise in financial revenue to nearly 700 billion VND; (2) effective cost control, with a slight decrease in total financial, sales, and management expenses compared to the previous year; and (3) profit from joint ventures (EraBlue).

For 2025, The Gioi Di Dong sets a target of 150 trillion VND in net revenue and 4,850 billion VND in after-tax profit, representing a 12% and 30% increase, respectively, compared to 2024. With the results achieved in the first quarter, the company has accomplished 24% of the revenue plan and 32% of the profit target for the year.

In a recent report, SSI Research assessed that the improved profitability of Bach Hoa Xanh (BHX) will be the main growth driver from 2026 onwards, while the profit growth of the technology and appliance chain is expected to return to normal after a strong recovery in 2024-2025. The analysis estimates an annual net profit growth rate (CAGR) of between 15% and 20% for The Gioi Di Dong during 2026-2028.

This year, The Gioi Di Dong plans to repurchase up to 10 million treasury shares to reduce charter capital and increase benefits for shareholders. The funding source for this repurchase will come from undistributed post-tax profits as of the latest audited financial statements. The timing of the repurchase will be after obtaining approval from the State Securities Commission.

Furthermore, The Gioi Di Dong’s shareholders have approved a 10% cash dividend (1,000 VND per share). With 1.46 billion circulating shares, the company is expected to spend nearly 1,500 billion VND on dividends.

Additionally, The Gioi Di Dong has an ESOP plan that depends on the ratio of profit plan completion and the correlation between the growth rate of MWG share price and VN-Index. In the event that the profit plan is achieved or exceeded, the ESOP ratio will be a minimum of 0.5% and a maximum of 1%.

Technical Analysis for May 13: The Green Wave is Spreading

The VN-Index and HNX-Index both surged, with a significant increase in trading liquidity in the morning session, indicating a continued improvement in investor sentiment.

The Elite PYN Elite Fund is No Longer a Major Shareholder of TPB

As of September 30, 2024, the Fund increased its holdings to over 104 million shares, representing a 4.7% stake in TPB.