The market kicked off the new trading week on a positive note, with gains in scores, liquidity, and investor sentiment. The VN-Index rose nearly 16 points, a significant increase after a period of fluctuation around the 1,270-point level.

Liquidity across the market surged, surpassing 21,400 billion VND, indicating a potential shift in investor sentiment and a more robust recovery. This improvement was supported by large-cap stocks, diversifying beyond the real estate sector and spreading across various industries.

NVL, after a strong recovery streak with a 32% increase over the last month, closed at a reference price of 12,300 VND per share following the announcement of major shareholders’ plans to sell 18.7 million NVL shares.

NVL has experienced a notable rebound, surging over 32% in the past month.

According to disclosures, NovaGroup Joint Stock Company, Novaland’s largest shareholder, registered to sell 3.9 million NVL shares from May 16 to June 13, through matching and/or negotiated transactions. If this transaction is successful, NovaGroup’s ownership will decrease from 17.373% to 17.171% of the charter capital.

Another major shareholder, Diamond Properties, also registered to sell 3.2 million shares. Following this transaction, their ownership is expected to decrease to 8.483%, equivalent to nearly 165.4 million NVL shares.

Additionally, three individual shareholders belonging to the group of

internal shareholders

, namely Mr. Bui Cao Nhat Quan, Ms. Bui Cao Ngoc Quynh, and Ms. Cao Thi Ngoc Huong, registered to sell a total of 11.6 million shares for personal reasons. After the transaction, the ownership ratio of these three shareholders will decrease to 6.818%.

TCB emerged as a bright spot, closing near the ceiling price at 29,400 VND per share. A slew of banks, including TPB, VIC, VPB, and SHB, witnessed price increases. TPB, in particular, surged 5% ahead of the upcoming dividend payout with a 10% cash dividend ratio on May 14.

At the close of the trading session, the VN-Index climbed 15.96 points (1.26%) to 1,283.26. The HNX-Index rose 1.91 points (0.89%) to 216.04, while the UPCoM-Index gained 0.19 points (0.2%) to reach 93.59. The VN-Index’s breakthrough above the resistance level has raised hopes for a new upward trend. However, the behavior in the 1,285-1,300 range warrants careful observation to assess the sustainability of this momentum.

The Rise of Midcap Stocks: A Foreign Investment Frenzy

The liquidity dipped slightly this afternoon, but the market remained resilient and turned positive. The VN-Index closed 0.79% higher, outperforming the morning session and ending at the day’s high. This positive turn can be attributed to the price recovery of several large-cap stocks, indicating a strong and resilient market despite the slight dip in liquidity.

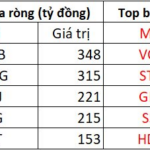

Market Beat: Foreigners Net Buy Nearly VND 1 Trillion

The VN-Index extended its rally throughout today’s session, with a brief period of consolidation in the latter half of the afternoon. Despite this, strong upward momentum from CTG propelled the Ho Chi Minh Stock Exchange’s benchmark index to close higher. The VN-Index gained over 10 points, finishing at 1,293.43.

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.