|

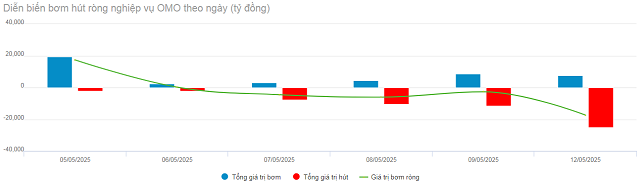

OMO Net Pumping Developments over the Past Week (05-12/05/2025). Unit: VND billion

Source: VietstockFinance

|

Specifically, the SBV issued VND45,646 billion in new bills through its term deposit channel at an interest rate of 4%/year, while total matured bills amounted to VND58,673 billion. As a result, the SBV net withdrew VND13,027 billion from the open market operations (OMO) channel, marking the third consecutive week of net withdrawal. As of May 12, the total outstanding amount in the term deposit channel stood at VND72,693 billion.

|

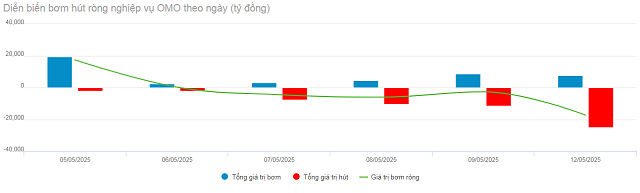

Developments in Overnight Interbank Interest Rates since the Beginning of 2025. Unit: %/year

Source: VietstockFinance

|

After hitting a one-year low, the overnight interbank interest rate rose to 4.09% on May 9, an increase of approximately 155 basis points compared to the end of April. The average daily trading volume climbed to nearly VND469 trillion, up from VND443 trillion recorded in the last week of April.

|

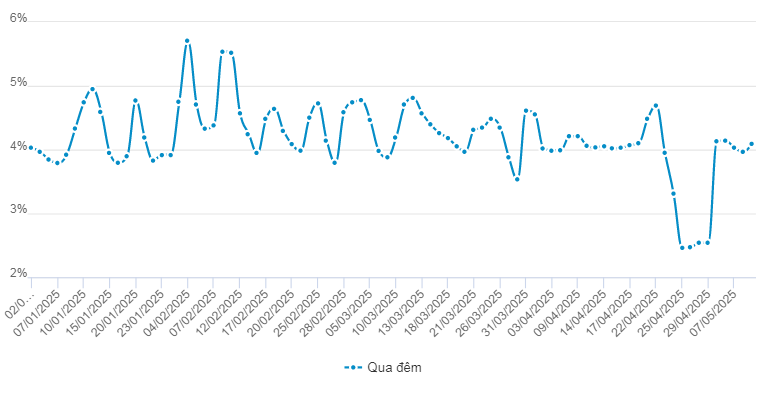

DXY Developments over the Past 3 Years

Source: marketwatch

|

In the international market, the USD-Index (DXY) rose by 0.38 points week-on-week to 100.42 during the week of May 5-9, marking its third consecutive weekly gain and reaching a four-week high.

The USD continued to strengthen due to two main supportive factors: the Federal Reserve’s decision to maintain interest rates and the trade agreement between the US and the UK, which eased concerns about global trade tensions.

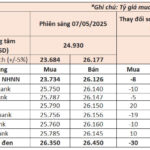

At Vietcombank, the USD/VND exchange rate closed at 25,750-26,140 (buying-selling) on May 9, down VND40 on both sides compared to the previous week.

– 13:23 13/05/2025

The Fed Turns Net Inflow

Between April 21 and 28, 2025, the State Bank of Vietnam (SBV) reversed course and net withdrew from the open market after four consecutive weeks of net injections. This move was primarily driven by substantial maturities in the term-purchase channel.

Why is the US Dollar Weakening Globally Yet Appreciating Against the VND?

According to MBS, the increase in foreign currency purchases by the State Treasury, coupled with heightened foreign currency demands from businesses amid global trade uncertainties and a significant negative shift in VND-USD interest rate differentials, contributed to the appreciation of the USD/VND exchange rate in April, despite the greenback’s weakness in the international market.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)