Global Brent oil prices in Q1 2025 generally trended downward. According to MBS Research, oil prices rose from $75 per barrel at the beginning of the year to around $82 per barrel in mid-January, then continuously dropped to the $70-72 range as demand did not significantly improve and inventories remained high.

| Oil prices showed a downward trend in Q1 2025… |

|

Source: VietstockFinance

|

| …while prices increased in Q1 2024 |

|

Source: VietstockFinance

|

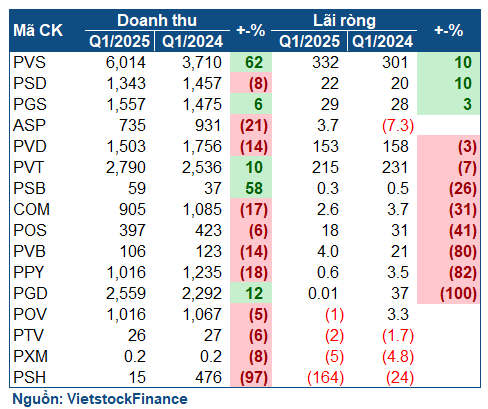

MBS also noted that the sharp drop in oil prices negatively impacted the performance of several businesses in the industry, particularly in the downstream sector. This assessment proved accurate, as evidenced by the financial statements of 19 companies in this group that were published in VietstockFinance. Only four companies reported higher profits, mostly related to gas trading. Conversely, 15 companies experienced significant profit declines, with four incurring losses.

Oil price decline hits industry leaders

|

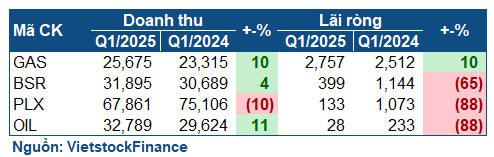

Q1 2025 financial results of leading gasoline, oil, and gas companies

|

Three out of the four leading companies in the gasoline, oil, and gas industry suffered negative results in Q1. Petrolimex (HOSE: PLX) experienced an 88% drop in net profit, reaching only VND 133 billion. This was attributed to the decline in oil prices influenced by tax policies, OPEC+ decisions, and geopolitical tensions. Additionally, the company had to increase provisions for inventory devaluation according to regulations. By the end of Q1, the provision for inventory devaluation stood at VND 334 billion, 4.5 times higher than at the beginning of the year.

| PLX witnessed an 88% profit decline compared to the previous year in Q1 2025 |

Similarly, PVOIL (UPCoM: OIL) reported a profit of only VND 28 billion, an 88% decrease compared to the previous year, due to falling oil prices and increasing foreign exchange losses.

BSR (Binh Son Refinery) also experienced a 65% profit drop, amounting to VND 399 billion, as a result of lower oil prices and crack spreads compared to the previous year. However, this outcome marked an improvement over the previous two quarters of losses, as crack spreads showed signs of recovery.

PV GAS (HOSE: GAS) was the only bright spot among the four industry leaders, with a 10% increase in profit, reaching nearly VND 2,760 billion. GAS attributed this growth to a 9% increase in LPG (liquefied petroleum gas) consumption and a 53% surge in LNG (liquefied natural gas) prices, which boosted revenue.

Bleak performance

|

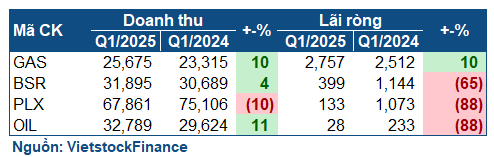

Q1 2025 financial results of gasoline, oil, and gas companies

|

Unlike recent quarters, Q1 2025 did not exhibit a clear differentiation between upstream, midstream, and downstream segments, as all three segments experienced negative results.

In the upstream segment, PVD reported a slight decline in profit of nearly 3%, amounting to VND 153 billion, despite a significant 14% drop in revenue to over VND 1,500 billion. The company explained that the self-elevating drilling rig in Q1 2025 had lower utilization (only 76% compared to 100% in the previous year) due to major maintenance and repair work. In reality, if it weren’t for the recognition of revenue from the disposal of onshore drilling rigs, PVD’s results would have been even lower, as their net profit was 36% lower than the previous year.

Another upstream company, PVB – the pipe-coating provider for PVN – saw its profit drop more than fivefold compared to the previous year, reaching only VND 4 billion. This was due to lower-margin contracts during the period.

On a positive note, PVS reported a 10% increase in net profit, amounting to VND 332 billion. Notably, their revenue surged by 62%, exceeding VND 6,000 billion, mainly driven by mechanical services, new construction, and installation (accounting for over VND 4,000 billion, double the previous year), indicating that PVS has secured new contracts.

In the midstream segment, PVT’s profit decreased by 7%, amounting to VND 215 billion, despite higher revenue, primarily due to a more significant increase in cost of goods sold compared to revenue growth.

The downstream segment was the most severely impacted, with many companies witnessing sharp profit declines, except for those engaged in gas trading, such as PGS, which reported a slight 3% profit increase, amounting to VND 29 billion, and ASP, which turned around from a loss of over VND 7 billion to a profit of nearly VND 4 billion.

However, PGD’s profit plummeted by almost 100%, leaving only about VND 13 million. The company explained that despite higher gas output, their key downstream customers in the industrial and real estate sectors continued to face challenges. Additionally, the impact of rising oil prices on the cost of goods sold led to a significant profit decline.

Retail gasoline and oil companies also presented a gloomy picture. Comeco (HOSE: COM) reported a 31% drop in profit, reaching VND 2.6 billion. At the 2025 Annual General Meeting of Shareholders, CEO Le Tan Thuong remarked that Q1 2025 was a challenging period for the entire gasoline and oil industry due to global factors, particularly the consequences of Donald Trump’s presidency in the US. Oil price margins fluctuated significantly, sometimes by 3-4% per day and continuously, resulting in relatively weak Q1 performance.

PSH, on the other hand, incurred a substantial loss of VND 164 billion (compared to a loss of VND 24 billion in the previous year). However, PSH’s case is somewhat unique, as the primary reason for this loss is the company’s inability to resolve a tax debt of over VND 1,000 billion from the end of 2023, leading to the seizure of invoices and disruption of business operations.

– 14:25 13/05/2025

“KIS Securities Fined Over $52,000 for Misfiling Taxes”

The Vietnam Securities Joint Stock Company (KIS Vietnam) has been ordered by the Tax Authority to take remedial action on three counts. This includes a tax levy of over 491 million VND, late payment fees of over 458 million VND, and an adjustment to their deductions, reducing them by 301 million VND.

The Calm Before the Storm: Blue Dominates the Global Commodity Market Ahead of Tariff Talks

The Vietnam Commodity Exchange (MXV) reported that before the US and China – the world’s leading economies – entered into tariff negotiations, the commodity market showed relatively positive developments. In the past trading week, overwhelming buying power pushed the MXV-Index up by more than 1%, reaching 2,193 points.

“VIB Bank Reports a Slight 3% Dip in Q1 Pre-Tax Profits, CASA Up by 17%”

The consolidated financial statements for Q1 2025 revealed that Vietnam International Commercial Joint Stock Bank (HOSE: VIB) posted a pre-tax profit of nearly VND 2,421 billion, a slight decrease of 3% compared to the same period last year.

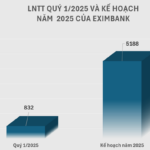

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.