The recently issued Decree 69/2025/ND-CP, effective from May 19, 2025, adjusts the foreign ownership ratio in commercial banks that are mandated to acquire struggling financial institutions. Specifically, the total foreign ownership in these banks can exceed 30% but must not exceed 49% of their chartered capital, except for those in which the State holds more than 50% of the capital.

In its latest report, ACB Securities (ACBS) asserts that Decree 69/2025/ND-CP facilitates capital raising for these banks by allowing them to issue shares to foreign investors. This move could expedite the restructuring process if banks need to inject more capital into the weaker institutions they acquire. For instance, MBB plans to contribute up to VND 5,000 billion to MBV during the restructuring phase. Similar plans are expected from other banks as part of the restructuring proposal for distressed banks.

Moreover, capital raising strengthens the capital adequacy ratio (CAR), especially for banks that receive high credit growth limits of 20-30% annually upon taking over ailing banks. While HDB boasts a relatively high CAR (~14%), it relies heavily on Tier 2 capital bonds. Thus, the bank may consider increasing Tier 1 capital to reduce funding costs in the future. In contrast, VPB, with a similar CAR, has not utilized Tier 2 capital extensively and, therefore, may not require immediate capital raising. Meanwhile, MBB, with a lower CAR (~10%), has also not tapped into Tier 2 capital yet and may consider raising capital in the future.

However, ACBS highlights that state ownership could hinder capital raising as state-owned enterprises may resist dilution. It’s important to note that the relaxed foreign ownership limit is subject to the bank’s charter and only applies during the mandatory transfer plan’s implementation, expected to last between 5 and 10 years. Afterward, foreign investors cannot purchase additional shares until their total ownership falls below 30%, except when subscribing to shares offered to existing shareholders or transferring between foreign investors.

Which bank will take the lead?

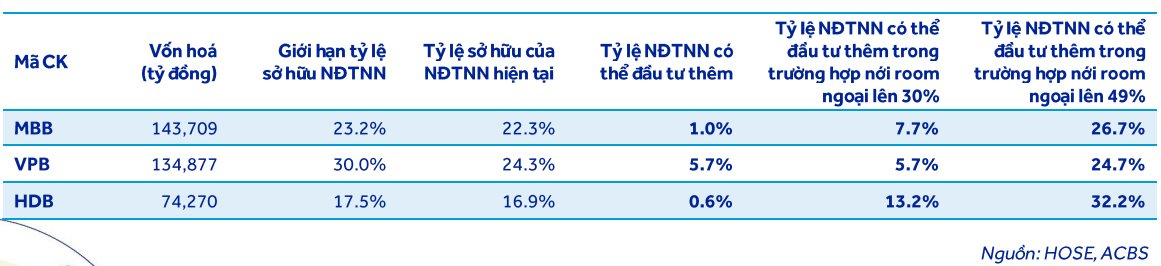

Among the banks eligible for this decree, excluding Vietcombank, where the State Bank of Vietnam holds 74%, the current foreign ownership ratios are as follows: MBB at 22.3%, VPB at 24.3%, and HDB at 16.9%. None of these banks have reached the previous foreign ownership limit. Therefore, ACBS suggests that raising the cap to 49% may not significantly impact their stock prices in the short term.

However, in the medium to long term, the 49% limit will enable these banks to attract foreign investment, particularly from strategic investors. MBB already has strong state-owned enterprise shareholders, including Viettel, which plays a crucial role in its business ecosystem. VPB has SMBC as its foreign strategic investor, holding 50% of FE Credit.

On the other hand, HDB, which is actively seeking foreign strategic partners, has not yet established such relationships. Therefore, ACBS believes that HDB is most likely to increase its foreign ownership limit due to its growing need for Tier 1 capital and the absence of foreign strategic investors. If HDB intends to bring on a strategic investor, typically acquiring a 15-20% stake, the bank will likely be among the first to implement strategies for opening room and raising capital. This move is expected to positively impact its stock price.

Positive Spillover Effects on the Banking Sector and the Stock Market

Beyond the positive impact on capital and stock prices for the aforementioned banks, ACBS suggests that this policy will allow for a controlled experiment to assess the effects of increased foreign ownership on financial capacity, governance, and the stability of the banking system. By limiting the pilot to three banks, potential risks to financial and monetary security from foreign capital flows are mitigated. The results from this experiment will provide valuable insights into attracting foreign capital, improving governance, and addressing distressed banks, informing future policy decisions.

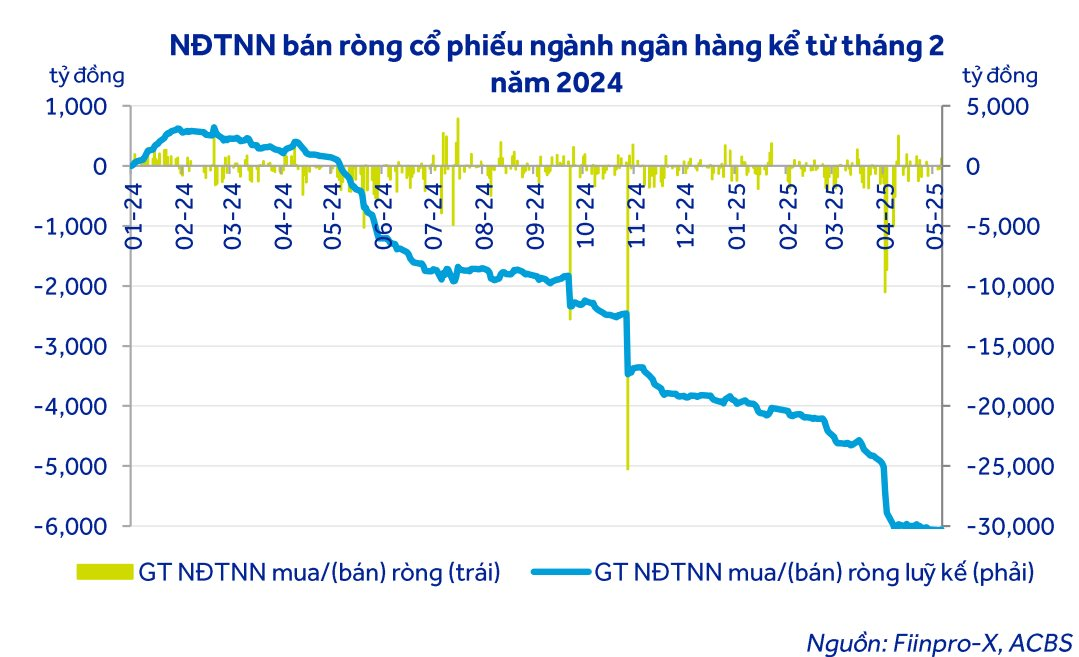

Given the net foreign selling of banking stocks exceeding VND 30,000 billion since the beginning of 2024, facilitating capital raising for banks mandated to acquire struggling institutions could help attract foreign capital to the Vietnamese banking sector and stock market in the future.

“5 Days to Go: Shares Soar for Producers of ‘Brother Overcoming Adversity’ as Anticipation Builds for Concert”

The concert Anh Trai Vượt Ngàn Chông Gai – Day 2 is set to wow audiences at Vinhomes Ocean Park 3 Hung Yen on December 14th.