According to VietstockFinance statistics, out of 57 power companies that published their first-quarter 2025 financial statements, 38 reported higher profits than the same period last year. Only 15 companies experienced a decrease in profits, while 6 incurred losses.

Hydropower shines with favorable water conditions

Most hydropower businesses had a brilliant performance thanks to favorable water conditions. Some companies even witnessed a tenfold increase in profits due to the extremely low base in the same period last year, which was affected by the El Niño phenomenon.

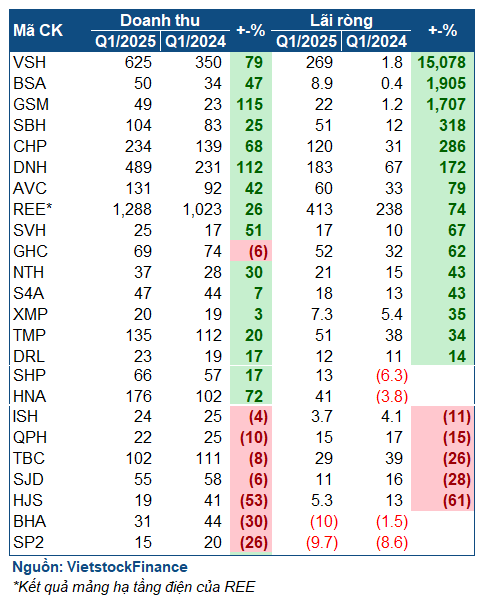

|

First-quarter 2025 business results of hydropower companies

|

Vinh Son – Song Hinh Hydropower JSC (HOSE: VSH) led the pack with a staggering 152-fold increase in net profit, amounting to VND 269 billion. This remarkable improvement was attributed to favorable water conditions in the Central – Highlands region, with prolonged rainfall increasing water flow into the reservoir. Additionally, a higher average electricity selling price compared to the previous year also contributed to the surge in profits.

| Business situation of VSH |

Buon Don Hydropower JSC (UPCoM: BSA) impressed with a 1,900% surge in net profit, reaching VND 8.9 billion, attributed to a nearly 50% increase in electricity output and a significant reduction in financial expenses. GSM (Huong Son Hydropower) also achieved impressive growth, with a net profit of VND 22 billion, 18 times higher than the previous year. This remarkable performance was due to the application of the avoided cost pricing mechanism for Huong Son 1 and 2 power plants since November 2024, resulting in more than double the revenue compared to the previous year.

Favorable water conditions also enabled other hydropower companies to record several folds of growth in profits during the first quarter. SBH (Song Ba Ha Hydropower) witnessed a fourfold increase in net profit, amounting to VND 51 billion. Although no specific reason was mentioned, the significant rise in revenue coupled with a decrease in cost of goods sold indicated an increase in electricity output. CHP (Mien Trung Hydropower) explicitly attributed its VND 120 billion profit, nearly four times higher, to favorable water conditions. Similarly, DNH (Da Nhim – Ham Thuan – Da Mi Hydropower) benefited from the positive water conditions, resulting in a net profit of over VND 183 billion, more than 2.7 times higher than the previous year.

Several other companies also reported substantial profit increases, such as AVC with a 79% rise, amounting to VND 60 billion; GHC with a 62% hike, reaching VND 52 billion; and SHP and HNA, which turned losses into profits. REE Corporation’s power segment, which includes subsidiaries like VSH and CHP, also delivered positive results with a 74% increase in profit, totaling VND 413 billion.

| REE attains profit growth, partly attributed to the power segment |

However, some companies were adversely affected by weather conditions. HJS (Nam Mu Hydropower) experienced a 61% drop in profit, amounting to VND 5.3 billion, due to prolonged dry weather and the application of temporary electricity selling prices, resulting in reduced revenue. BHA (Bac Ha Hydropower) incurred heavier losses of VND 10 billion due to decreased water inflow into the reservoir. SP2 (Su Pan 2 Hydropower) continued to operate below production costs, with a loss of VND 9.7 billion, slightly higher than the VND 8.6 billion loss in the same period last year.

Thermal power shines brightly

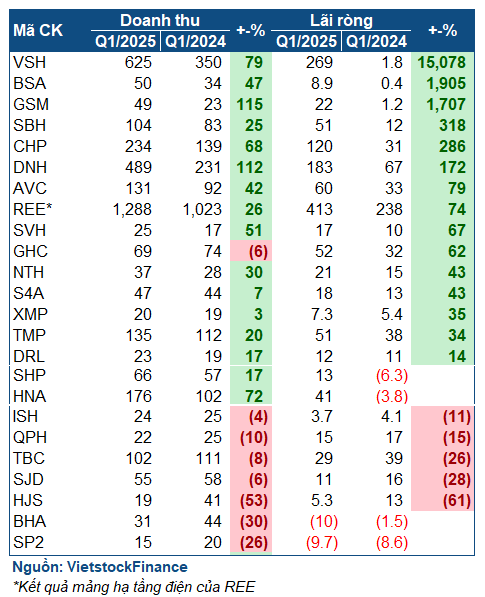

|

First-quarter 2025 business results of thermal power companies

|

The first quarter of 2025 also witnessed positive developments for thermal power companies due to various reasons.

The most notable performer was POW, which achieved a leading profit of VND 445 billion, a 60% increase compared to the previous year. The company’s revenue for the period rose by 31% to nearly VND 8.2 trillion, while the cost of goods sold increased at a slower rate. Additionally, POW benefited from a doubling of financial revenue compared to the previous year (surpassing VND 208 billion) due to increased interest income and dividends from associated companies.

| Business situation of POW |

NBP (Ninh Binh Thermal Power) recorded a modest profit of VND 5 billion, but this represented an impressive 148% increase compared to the previous year – the highest growth rate among thermal power companies. In reality, NBP experienced a significant revenue decline of 87%, amounting to only VND 46 billion, due to reduced electricity output. However, the company benefited from a higher fixed electricity selling price to EVN in the first quarter of 2025, as per the amended and supplemented contract signed on March 26, 2025, resulting in improved profits.

NT2 (Nhon Trach 2 Thermal Power) and PGV (EVNGENCO3) successfully turned losses into profits. NT2 achieved a profit of VND 37 billion, compared to a loss of VND 158 billion in the previous year, thanks to a nearly fourfold increase in electricity output, leading to a fivefold surge in electricity production revenue. On the other hand, PGV recorded a profit of VND 96 billion, marking a significant turnaround from a hefty loss of VND 655 billion in the previous year. This improvement was partly due to higher electricity sales but mainly attributed to a substantial reduction in foreign exchange losses.

The two declining performers in the thermal power group were QTP and PPC. PPC experienced a 24% decrease in net profit compared to the previous year, despite selling a similar volume of electricity, due to a reduction in the average electricity selling price. Meanwhile, PPC witnessed a 67% plunge in net profit, amounting to VND 52 billion, as it did not receive dividends from its associated companies.

Renewable energy shines brightly

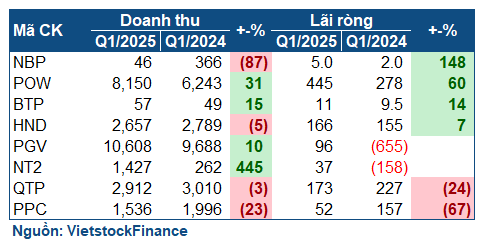

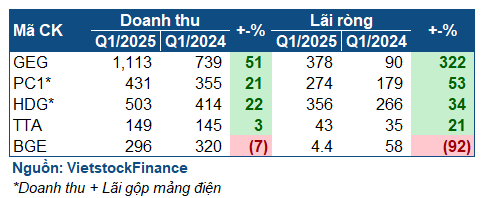

|

First-quarter 2025 business results of renewable energy companies

|

Renewable energy companies also experienced a buoyant first quarter. Leading the pack was GEG, which achieved a remarkable 51% increase in revenue and a fourfold surge in profit, totaling VND 378 billion. The company benefited from successfully signing a power purchase agreement (PPA) supplement for the Tan Phu Dong 1 wind farm project.

It is worth noting that since its commercial operation date (May 31, 2023), the electricity selling price at Tan Phu Dong 1 has been calculated based on a temporary price set by the Ministry of Industry and Trade (50% of the ceiling price). However, on March 26, 2025, GEG officially signed the PPA supplement, applying a transitional price mechanism with a new rate of 1,813 VND/kWh (7.8 cents), equivalent to 99.8% of the ceiling price. Following the signing, the company was able to retrospectively adjust its revenue for the project, resulting in a significant boost.

| The retrospective profit for the Tan Phu Dong 1 project propelled GEG‘s quarterly profit to new heights |

Although PC1 reported a decline in consolidated net profit for the first quarter, its electricity segment witnessed robust growth in both revenue and gross profit, increasing by 21% and 53%, respectively. The company attributed this improvement to favorable weather conditions for its wind power projects, along with project settlement, which reduced depreciation expenses and improved profit margins. It is important to note that PC1 also operates several hydropower projects, a sector that generally performed well during the first quarter.

Similarly, the electricity segment of HDG recorded a significant increase in revenue, despite a decline in the company’s overall profit due to the absence of real estate revenue. In the first quarter, the energy segment contributed VND 503 billion in revenue, a 22% increase, and VND 356 billion in operating profit, a 34% hike.

In contrast, BGE – the energy company of BCG – experienced a 92% plunge in profit. This was mainly due to unfavorable weather conditions, which reduced electricity output, along with decreased profit from joint venture projects and increased provisions for investments in subsidiaries due to foreign exchange losses.

A new chapter for the power industry

Looking ahead, the recently approved adjusted Power Development Plan 8 (PDP8) is expected to usher in a new era for renewable energy. With a target of 10% average GDP growth from 2026-2030, the total power capacity target has been raised by 16%-49% compared to the previous plan.

The power industry is on the cusp of a new chapter. Illustration: Jobya

The power industry is on the cusp of a new chapter. Illustration: Jobya

LNG-based power is expected to play a crucial role as the primary energy source for the entire system. Additionally, the government has included nuclear power in the plan, aiming to operate 4-6.4 GW by 2030-2035, and shifted the timeline for offshore wind power to 2030-2035, targeting 6-17 GW.

The capacity targets for hydropower, coal-fired power, and gas-fired power remain unchanged. Meanwhile, renewable energy has been prioritized, with the 2030 target raised by 50%-130% compared to the previous PDP8 and 3.4-5.2 times higher than the capacity in 2024.

The capacity target for solar power has been adjusted to increase by 2.3-3.6 times compared to the previous PDP8, possibly due to its advantage of easy installation within a short period. Meanwhile, the capacity target for wind power has been adjusted to increase by 1.2-1.7 times. According to VNDIRECT, the potential for a new investment cycle in renewable energy has emerged after a long period of stagnation due to the lack of clear mechanisms and policies.

However, capital requirements could pose a challenge. Vietnam will need to mobilize significant capital for power source investments, estimated at approximately $136 billion for the 2026-2030 period and around $114 billion for the 2031-2035 period, according to VNDIRECT.

– 12:00 14/05/2025

The Sun-Powered Revolution: Unveiling the CoCo Solar Platform for Easy Access to Solar Power Installation and Financing.

On May 9, 2025, CoCo Solar, the pioneering platform for solar roof installation and financing, proudly debuted with a stellar lineup of strategic partners in attendance. The event marked a significant step forward in Vietnam’s renewable energy landscape, with the presence of leading financial and solar industry giants: VietinBank, BIDV, TPBank, MSB, VPBank, Sacombank, and renowned solar brands such as Sungrow, JA Solar, Trina Solar, Jinko Solar, Huawei, Deye, Solis, and Astronergy.

“EVN Invests Over 3.9 Trillion VND in Tri An Hydropower Plant Expansion”

The Vietnam Electricity Group (EVN) announces an expansion project for the Tri An Hydropower Plant, a significant investment of over VND 3,900 billion. This expansion includes the installation of two new generators with a combined capacity of 200MW, expected to be completed and operational by the end of 2027.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.