Lending contributes significantly to profits

According to data from VietstockFinance, in Q1/2025, securities companies’ profits exceeded VND 6.2 trillion. This result is an increase of over 20% compared to the previous quarter but a slight decrease of 2% compared to the same period last year.

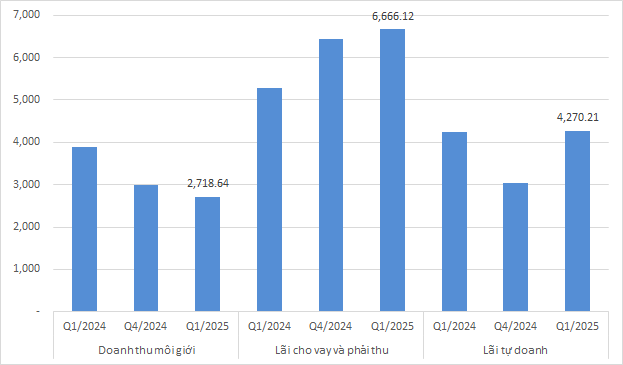

The main contributor to the business results is the lending segment. Lending revenue in Q1/2025 reached more than VND 6.6 trillion. This source of revenue has been on an upward trend recently. Compared to the same period last year, it increased by 26% and 3% compared to the previous quarter.

Proprietary trading also makes an important contribution to the business results of securities companies. Proprietary trading profit this quarter reached nearly VND 4.3 trillion. While the proprietary trading segment generated equivalent profits to the same period last year, it recorded a positive result compared to the previous quarter with a 40% increase.

There is a noticeable decline in the brokerage segment. Brokerage revenue in Q1/2025 reached only VND 2.7 trillion, down 30% compared to the same period last year and nearly 10% compared to the previous quarter.

|

Revenue from the main business segments of securities companies in Q1/2025

Unit: VND billion

Source: VietstockFinance

|

The stock market witnessed an upward trend in Q1. The VN-Index increased by more than 3% and returned to the 1,300-point region. However, the market liquidity was not very positive. The average trading value on the HOSE and HNX floors reached VND 17.3 trillion/session, a decrease of 13.5% compared to the 2024 average. The poor liquidity has significantly impacted brokerage activities. In addition, the downward trend in transaction fees has narrowed this revenue stream.

In contrast, the scale of securities companies’ lending activities has continuously expanded in the past time. By the end of Q1, the outstanding loan balance was pushed to nearly VND 282 trillion, up 13% from the beginning of the year. Considering a longer cycle, the total market lending balance has been on an upward trend for nine consecutive quarters, starting from Q1/2023.

The top 3 companies hold half of the profits

|

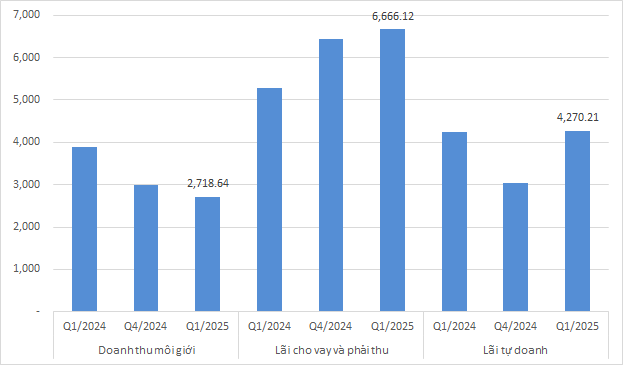

Top 20 most profitable securities companies in Q1/2025

Unit: VND billion

Source: VietstockFinance

|

In terms of scale, the profits of securities companies are concentrated in the hands of a few large companies. Techcom Securities (TCBS) leads the group in profit with after-tax profit of over VND 1 trillion. SSI Securities (SSI) ranked second, with after-tax profit of nearly VND 820 billion. In the top 3, VPS Securities (VPS) recorded a profit of VND 730 billion. The total profit of the above three companies reached over VND 2.5 trillion, accounting for more than 40% of the group’s total profit.

The profit of the top 3 is far ahead of the rest. In fourth place, VNDIRECT Securities (VND) had a profit of nearly VND 380 billion, only half of VPS‘s.

Meanwhile, in terms of growth, the group with strong profit growth includes securities companies in the same ecosystem as banks. Notably, KAFI Securities (KAFI), OCBS Securities, Asean Securities (Aseansc), VPBank Securities (VPBankS), and An Binh Securities (ABW)…

|

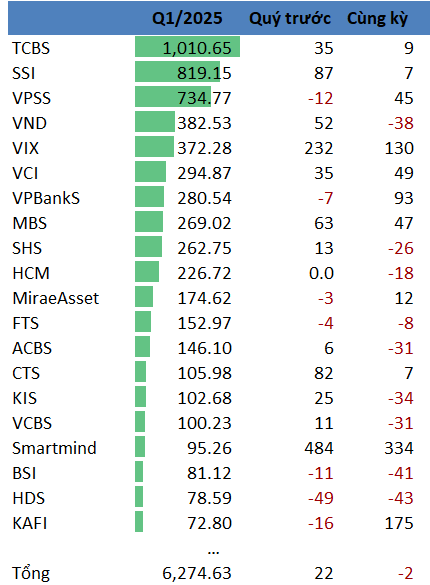

Top 20 securities companies with the highest profit growth compared to the same period

Unit: VND billion

Source: VietstockFinance

|

KAFI recorded a profit of nearly VND 73 billion in Q1, up 175% over the same period last year. OCBS’s profit reached VND 4.4 billion, up 156%. The company is transforming after OCB officially promoted the restructuring of the securities company.

VPBankS also achieved a 93% increase compared to the same period, earning VND 280.5 billion.

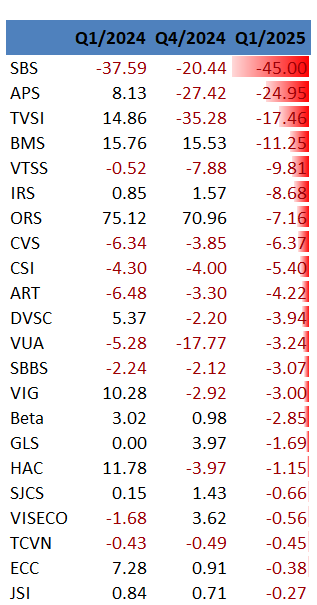

In Q1, quite a few companies reported losses. The number of loss-making companies in Q1 was 22, a slight improvement from 24 in the previous quarter but higher than 15 in the same period last year. Among them, the largest loss belonged to SBS. Ranked second was APEC Securities (APS).

|

Securities companies reporting losses in Q1/2025

Unit: VND billion

Source: VietstockFinance

|

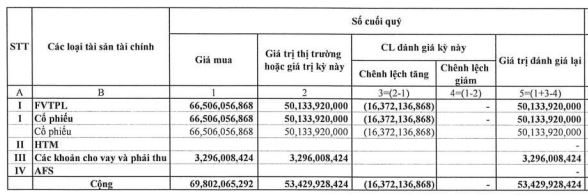

Specifically, SBS reported a net loss of nearly VND 45 billion, a significant increase compared to VND 38 billion in the same period last year. According to the explanation, due to the unpredictable fluctuations in the market, the company’s revenue decreased compared to the same period last year. At the same time, operating expenses from proprietary trading activities increased, leading to unsatisfactory results.

According to the financial statements, in Q1, the company cut losses on nearly 4.4 million shares of BGE (BCG Energy) at a selling price of 5,218 VND/share. This cut-loss phase caused SBS to lose more than VND 31.4 billion. In 2024, SBS‘s proprietary trading also cut losses on 5.4 million shares of BCR (BCG Land) at a selling price of 4,615 VND/share, incurring a loss of nearly VND 19.6 billion.

Meanwhile, the company pocketed nearly VND 500 million from EIB shares, VND 220 million from VND shares, and VND 179 million from SSI shares.

|

SBS‘s profit/loss from the sale of financial assets in Q1/2025

|

Source: SBS‘s Financial Statements

|

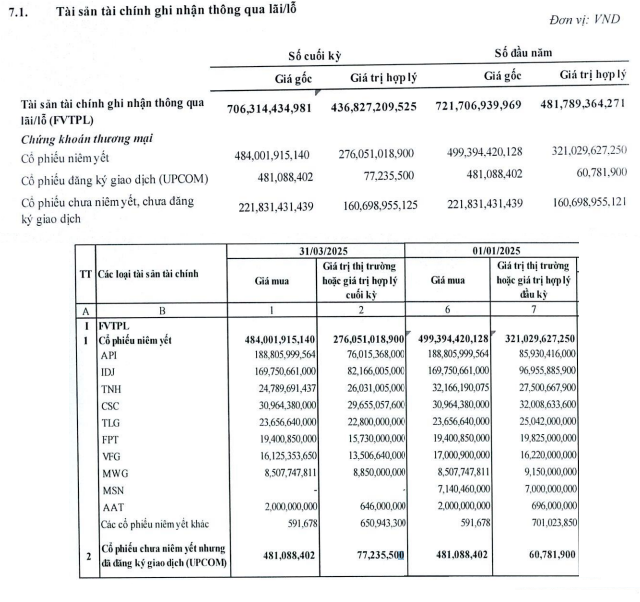

In the case of APS, the company lost nearly VND 25 billion, mainly due to the decline in the value of listed securities in its portfolio in Q1. The main stocks in the portfolio, such as API, IDJ, FPT, and VFG, all decreased compared to the beginning of the quarter.

|

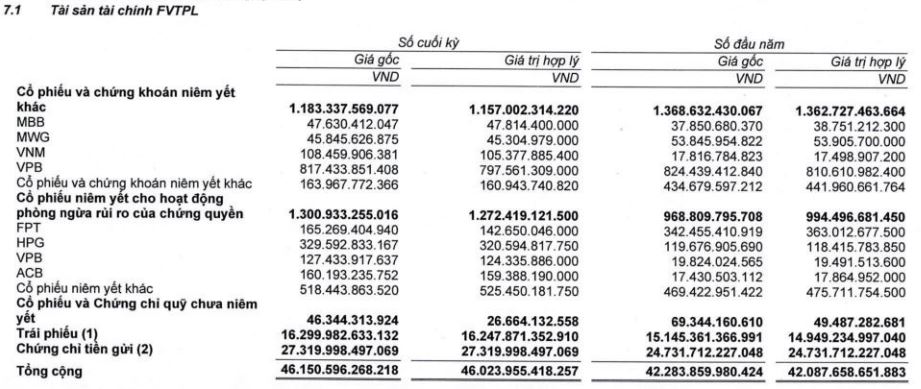

APS‘s portfolio of financial assets at fair value through profit or loss

Source: APS‘s Financial Statements

|

– 10:17 13/05/2025

The Bank Stock Boom: Foreign Capital Sweeps In

“The market was stunned this afternoon by the sheer volume of foreign investor purchases. HoSE alone saw an additional 3.4 trillion VND injected, with a net buy of nearly 1,153 billion VND on top of the already substantial 1,112 billion VND net buy in the morning. This marks the highest net buying session since November 29, 2022. Notably, the VN30 basket of stocks witnessed an additional net buy of approximately 531 billion VND…”