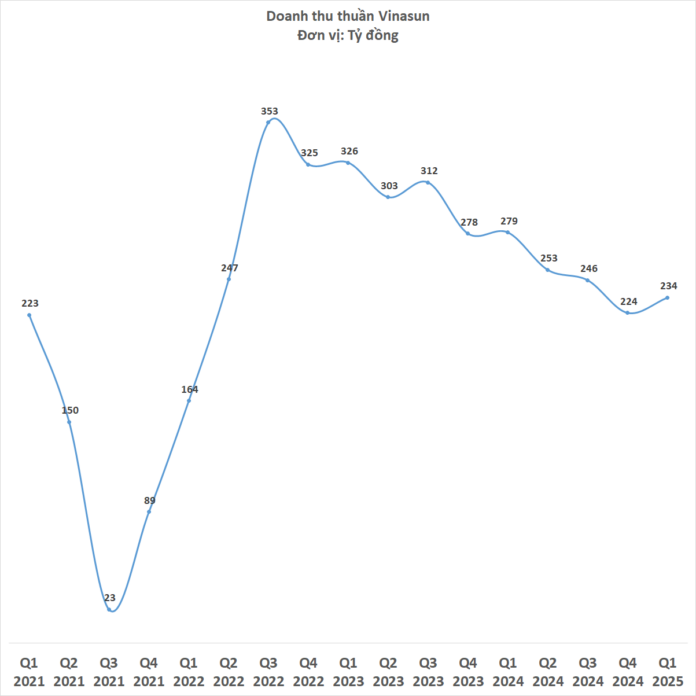

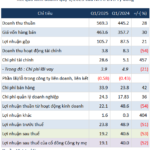

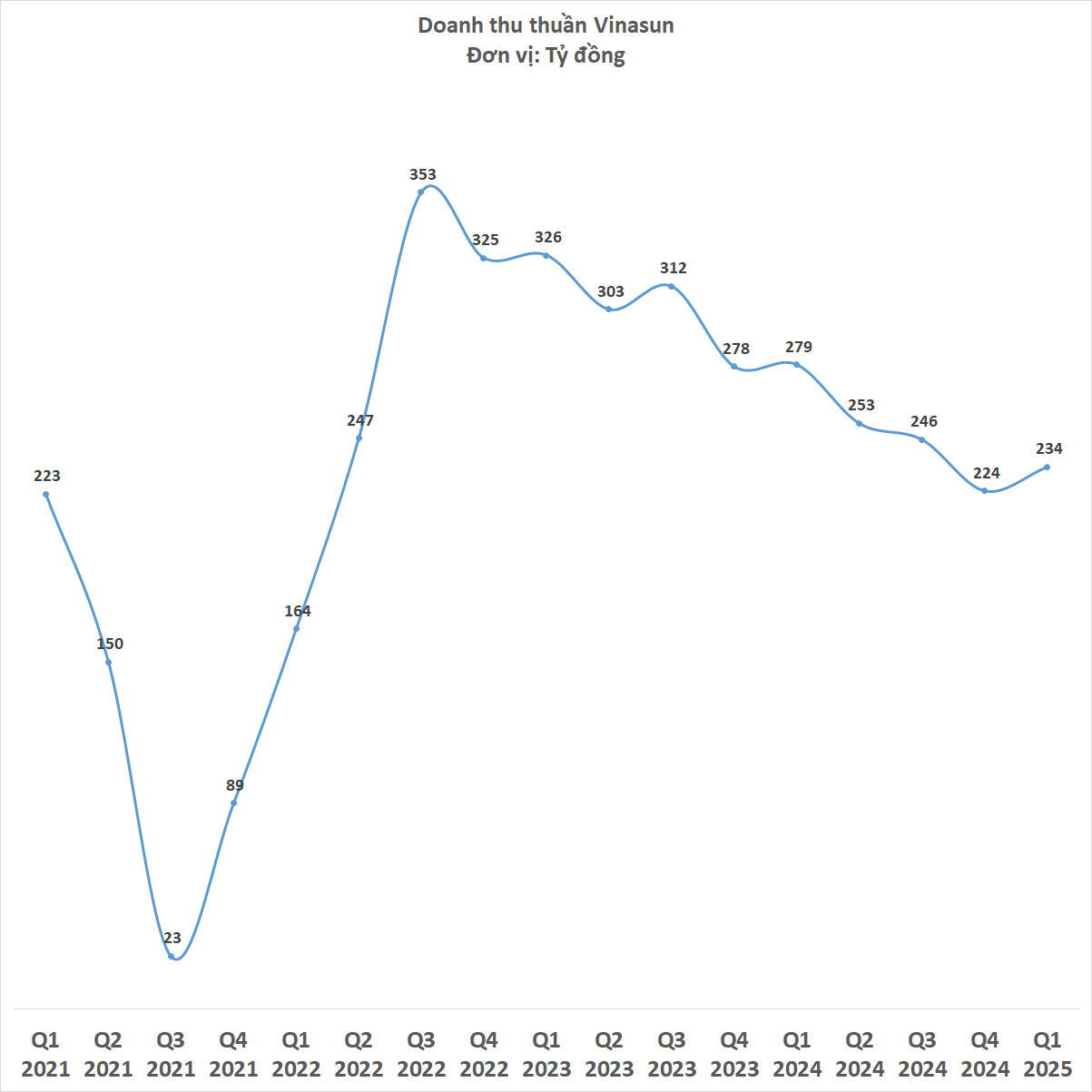

Vinasun JSC (HoSE: VNS) posted a 15.9% year-on-year decline in first-quarter revenue for 2025, amounting to VND 234.39 billion.

During this quarter, gross profit margin dipped as gross profit decreased by 4.6% to VND 52.2 billion. Financial income witnessed a sharp drop of 28.7%, settling at VND 3.21 billion. Conversely, financial expenses rose by 40.5% to VND 7.95 billion.

A 12% reduction in selling and administrative expenses (over VND 5 billion) was offset by decreases in gross profit, financial income, and elevated financial expenses. Other income and expenses for the period remained relatively stable.

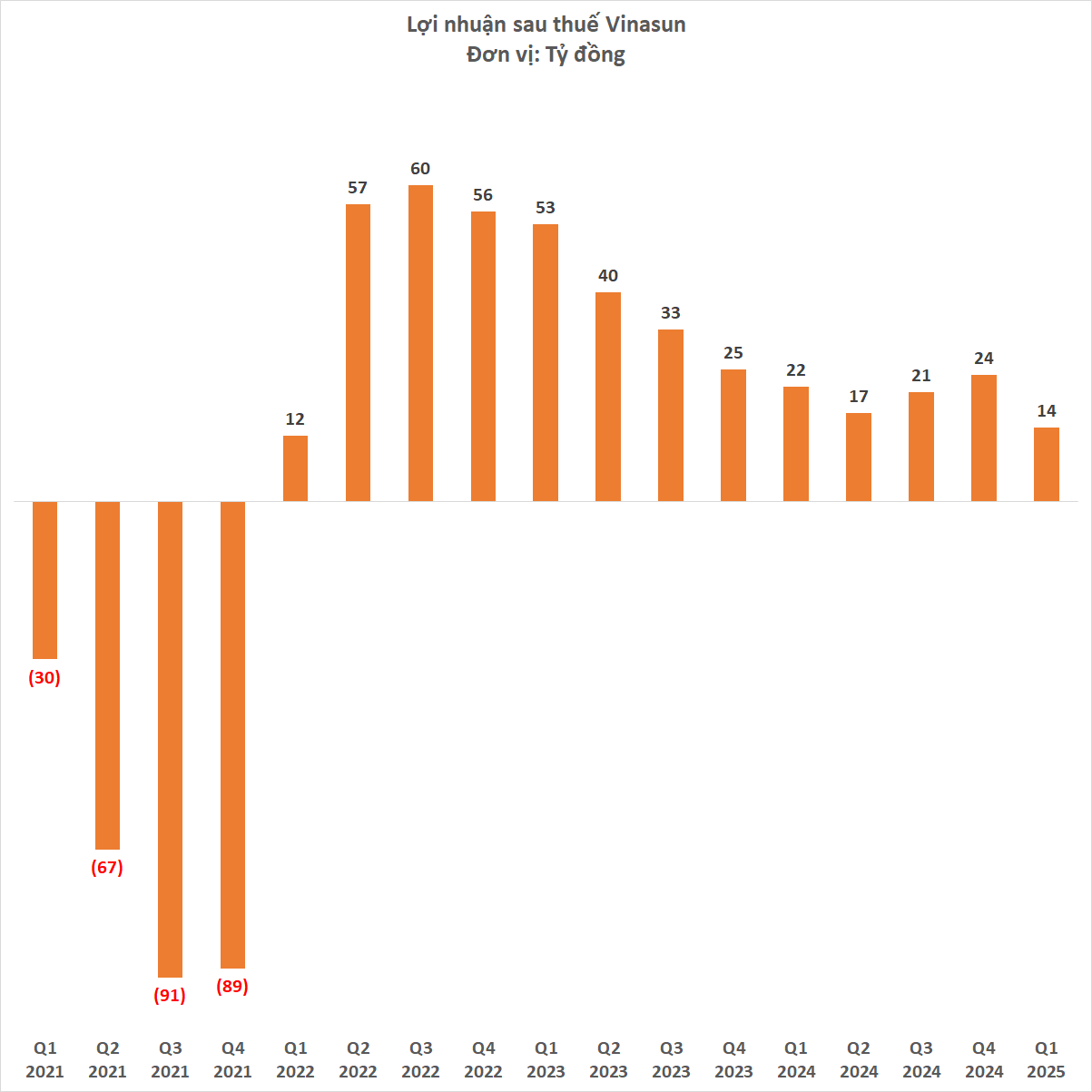

The company concluded the quarter with a net profit of VND 14.16 billion, the lowest since the second quarter of 2022.

At the recent annual general meeting, Vinasun approved the 2025 plan, targeting approximately VND 1,000 billion in revenue and over VND 53.63 billion in net profit. With the first-quarter results, the company has accomplished over 25% of its annual profit target.

The management also shared plans to invest in approximately 400 new vehicles this year, primarily Toyota Hybrid models. The projected total fleet size by year-end is 2,368 vehicles, a reduction of about 100 cars compared to the previous year. This initiative is part of a vehicle restructuring strategy to enhance service quality and operational efficiency.

However, the plan to invest in new vehicles has raised concerns among shareholders regarding cost pressures, especially given the lack of significant financial improvement.

In 2024, Vinasun’s revenue stood at VND 1,002 billion, marking a 17.78% decrease from 2023. More worryingly, profits from business operations plummeted by 83.52%, reaching only VND 17.69 billion. A Mordor Intelligence report attributes these figures to intense competitive pressure from tech rivals and the burden of operating costs.

Specifically, the report highlights how the emergence of ride-hailing platforms such as Grab and XanhSM has transformed the Vietnamese taxi landscape. With their convenient apps, flexible pricing, and cost-efficient electric fleets, these tech giants are dominating the market. According to the report, Vinasun currently holds just 2.36% of the taxi market share in Vietnam based on first-quarter 2025 revenue, paling in comparison to XanhSM’s 39.85% and Grab’s 35.57%.

On the stock exchange, VNS shares are trading at their lowest levels in years, prompting some shareholders to suggest a buyback program to support the stock price. However, the management stated they would only consider this if cash flow allows, noting that the free float is currently very low, at just 2-3%, as a significant portion is held by major shareholders.

Thúy Hạnh

The Cement Industry’s Performance in Q1 of 2025: A Comprehensive Overview.

In the first quarter of 2025, several cement companies witnessed an increase in revenue, yet they reported net losses amounting to billions of Dong.