According to the Vietnam Bond Market Association, as of April 30, 2025, there were a total of 21 corporate bond issuances worth over VND 34 trillion in April 2025.

Specifically, the issuances comprised 19 private placements worth more than VND 30 trillion and two public offerings valued at VND 4 trillion.

The growth momentum in the corporate bond market in April 2025 continued to be driven by banks, with significant transactions such as Techcombank (a total of four issuances worth VND 8.7 trillion), VietinBank (VND 3 trillion), and MSB (three issuances worth VND 4 trillion).

However, a notable new development is the return of real estate enterprises to the market. In April 2025, there were three private placements of corporate bonds by real estate companies, totaling VND 10 trillion. This included two private issuances by Vingroup totaling VND 7 trillion and one issuance by TCO Real Estate Consulting and Trading Joint Stock Company worth VND 3 trillion. Vingroup’s private bonds offer the most attractive interest rates in the market at 12% per annum.

Corporate bonds in the real estate sector make a comeback.

Mr. Nguyen Tung Anh, Head of Credit Risk and Sustainable Finance Research at FiinRatings, stated that real estate enterprises would likely increase their corporate bond issuance plans this year as the business environment improves.

According to analysts, while transaction volumes in the real estate market have decreased by 30% from their peak, soaring property prices have offset this decline. The market has reached a new equilibrium, where higher selling prices maintain project feasibility. FiinRatings analysts forecast that demand and pressure for refinancing and restructuring capital will increase in capital-intensive industries such as real estate, construction, and materials in the coming quarters.

Dr. Can Van Luc, an economist, assured that bond pressure in 2025 is not a significant concern, and default risks are minimal. He observed that the real estate market is showing positive recovery signs. Enterprises with robust financial strategies could easily recover their capital and sell products by reducing prices by about 10%, instead of the previous deep discounts of 40-50%.

Many large enterprises with strong financial strategies have started to adapt to the new situation. They are implementing debt restructuring, price reduction, and expansion into real estate segments that match market demands to improve liquidity and avoid default risks.

While new issuances are more active, redemption pressure on bonds remains high, especially for real estate enterprises, according to Mr. Nguyen Ba Khuong from VNDIRECT Securities Corporation. As of April 15, 2025, more than 90 enterprises were listed as delinquent in their bond interest or principal payment obligations. The estimated total debt of corporate bonds from these issuers exceeds VND 200 trillion, accounting for about 16.5% of the total outstanding private corporate bonds. Most of these delinquent issuers are from the real estate sector.

April 2025 Private Placement Memorandum: Back with a Bang, But So Are Defaults.

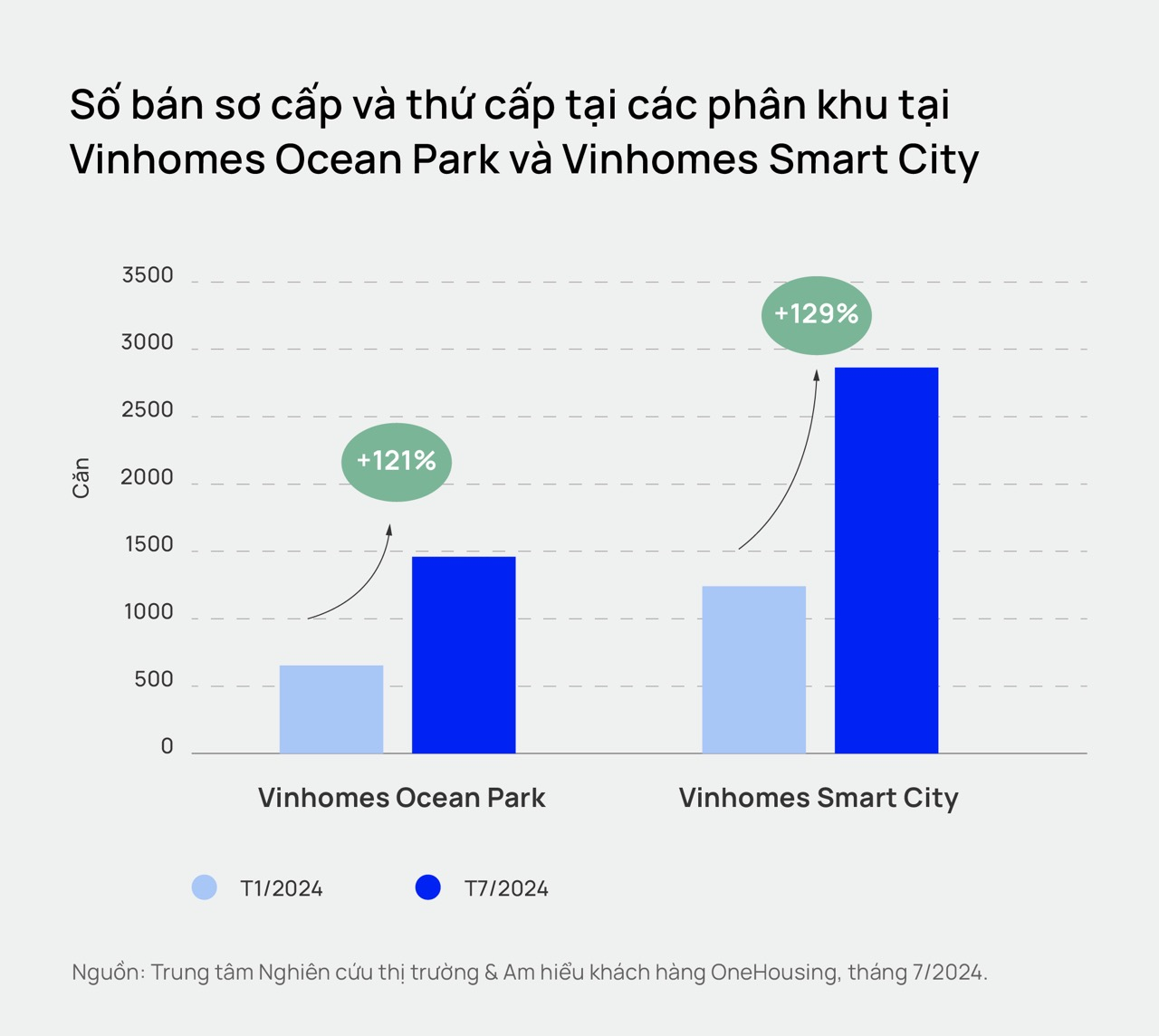

After a subdued start to the year, the private placement of corporate bonds picked up pace in April, with issuances totaling over VND 38,000 billion—a remarkable twofold increase compared to the same period last year.

Financial Investment Litigation: Navigating the Complex Landscape

“The head of the National Assembly’s Committee for Petitions and Supervision noted that the situation regarding complaints related to corporate bonds and financial investments has remained complex and continues to evolve.”