Liquidity eased slightly this afternoon, but the market didn’t falter and instead turned positive. The VN-Index closed 0.79% higher, an improvement from the morning session, and ended at the day’s high. This change came from the price recovery of several large-cap stocks.

The HoSE breadth at the end of the session was similar to the morning with 201 gainers and 106 losers, but the VN-Index climbed higher, adding 10.17 points compared to 5.77 points earlier. The VN30-Index also strengthened, rising 0.78% against the previous 0.44%.

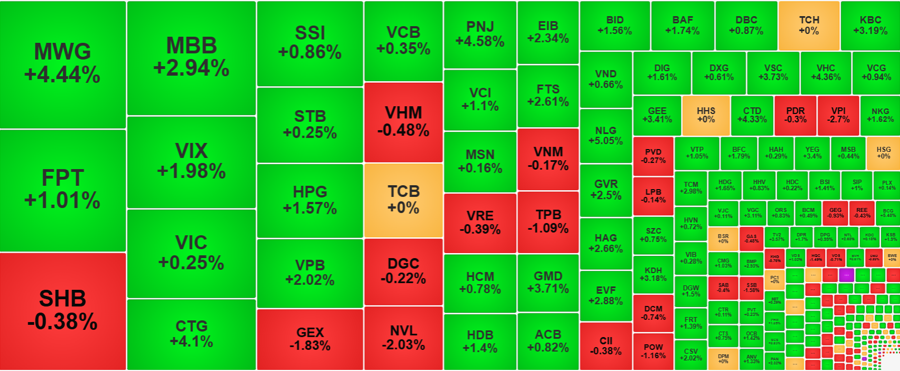

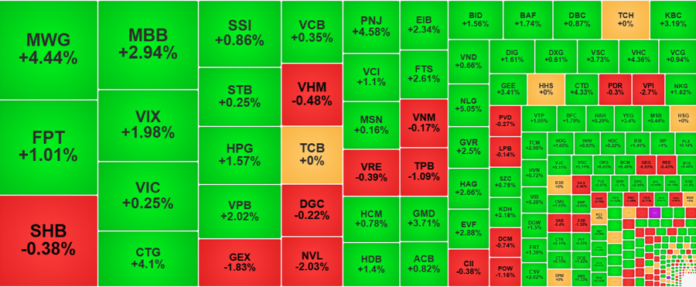

The index’s strength came from VIC, which saw a price surge during the ATC session, turning around to gain 0.25% against the reference price, while it was still down 1.39% at the morning close. VHM also showed resilience, recovering 0.81% from the morning session, narrowing its loss to 0.48% against the reference price. CTG, the market’s fifth-largest cap stock, had a booming afternoon. CTG was among the most actively traded stocks this afternoon, with a volume of VND 403.3 billion, and the whole session saw a volume of over VND 610.1 billion. CTG surged 2.47% from the morning and closed up 4.1%. BID added another 1.13%, surpassing the reference price by 1.56% at the end of the session.

The VN30 basket saw 13 stocks rise in the afternoon against the morning session, but there were also 13 falling codes. On the positive side, the declining group wasn’t too weak and didn’t face significant large-cap pressure. VCB was also among this group, but it only eased slightly by 0.18% and still managed to gain 0.35% against the reference price. FPT also slipped marginally by 0.17%, yet it still climbed 1.01%. The two weakest stocks in the basket were TPB, down 1.09%, and SSB, down 1.32%, with relatively small market caps, thus limiting their impact.

Mid-cap and small-cap stocks saw more active trading in the afternoon, with many codes rising sharply. The HoSE floor ended the session with 64 stocks rising over 2%, while the VN30 basket contributed only five. SMC and VNE hit the ceiling, and the group rising over 4% included CRC, BCG, TDH, CSM, NLG, PNJ, ASM, VHC, CTD, and TCD, with decent liquidity. Overall, the VN30 basket’s liquidity decreased by 4.5% from the previous session, while Midcap and Smallcap increased by 37.8% and 12%, respectively.

Among the HoSE indices, Midcap and Smallcap have not yet returned to pre-tax counterparty news levels. Statistics show that out of 70 Midcap codes, only 13 have surpassed the price of April 2nd, and out of 184 Smallcap codes, only 65 have done so, while the VN30 basket has 10 out of 30. The strong stocks have largely surpassed the April 2nd price and are showing signs of profit-taking. Therefore, funds are seeking other opportunities, and codes that have not recovered much may be an option.

However, looking at the capital allocation perspective, the VN30 blue-chips still hold the highest proportion. The liquidity increase in Midcap and Smallcap cannot compensate. Today, the VN30 basket accounted for 58.4% of the total matched orders on the HoSE floor, despite a decrease in trading volume. Among the top 10 stocks in market liquidity – accounting for 36.2% of total trading – only VIX is not in the VN30 basket. Among the 18 codes trading over VND 300 billion, we also have GEX, DGC, NVL, and PNJ. The two leading stocks in liquidity were MWG with VND 1,070.4 billion, with a price increase of 4.44%, and FPT with VND 1,024.9 billion, with a price increase of 1.01%.

Foreign capital this afternoon was also a bright spot after the unexpected net buying in the morning. This capital poured an additional VND 2,311.3 billion into the HoSE, an increase of 25%. The net buying value reached VND 667.7 billion, while the morning session only saw net buying of VND 309 billion. Thus, this was the second session with net buying of stocks exceeding VND 900 billion within five sessions, following May 7th with VND 906 billion.

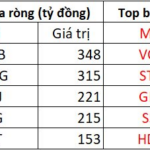

The bought stocks were MBB, MWG, and PNJ, which were bought this afternoon at the same high level as the morning: MBB +VND 348.2 billion, MWG +VND 314.7 billion, and PNJ +VND 221 billion. FPT also saw good additional net buying, with a net value of VND 153.2 billion for the whole session. Notably, CTG saw strong net buying in the afternoon with VND 214 billion. Notable sold codes included VCB -VND 261.9 billion, STB -VND 151.2 billion, GEX -VND 122.7 billion, SSI -VND 62.9 billion, HDB -VND 43 billion, HCM -VND 41 billion, MSN -VND 31 billion, and TCH -VND 30.4 billion.

The Big Buy: Foreign Investors Snap Up Nearly a Trillion Dong, Targeting Blue-Chip Stocks

In the afternoon trading session, MBB stock witnessed a significant surge in buying activity, making it the most actively bought stock across the market. The value of the net buying reached an impressive peak of VND 348 billion.

Market Beat: Foreigners Net Buy Nearly VND 1 Trillion

The VN-Index extended its rally throughout today’s session, with a brief period of consolidation in the latter half of the afternoon. Despite this, strong upward momentum from CTG propelled the Ho Chi Minh Stock Exchange’s benchmark index to close higher. The VN-Index gained over 10 points, finishing at 1,293.43.

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

Mirae Asset: VN-Index to Extend its Recovery in May

In their latest strategic report, Mirae Asset Vietnam Securities predicts a continued recovery for the VN-Index in May. With countries entering trade negotiations, the market sentiment is expected to turn more positive as this could reduce the frequency of unpredictable news from the US, leading to a more stable environment.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)