The recently issued Decree 69/2025/ND-CP, effective from May 19, 2025, adjusts the foreign ownership ratio in commercial banks that are mandated to acquire struggling financial institutions. Specifically, the total foreign ownership in these banks can exceed 30% but must not surpass 49% of their chartered capital, except for those where the state holds more than 50% of the capital.

According to ACB Securities (ACBS), Decree 69 facilitates capital raising for these banks by allowing them to issue shares to foreign investors. This becomes particularly relevant if banks need to inject more capital into the acquired weak banks, thus expediting the restructuring process. For instance, MBB plans to contribute up to VND 5,000 billion to MBV during the restructuring phase. Similar strategies will likely be adopted by other banks as part of the weak bank restructuring plan.

Additionally, the capital increase strengthens the capital adequacy ratio (CAR), especially for banks that are granted high credit growth limits of 20-30% annually due to the acquisition of struggling institutions. While HDB boasts a healthy CAR of ~14%, it relies significantly on Tier 2 capital bonds. As a result, they may consider raising Tier 1 capital to reduce funding costs in the future. On the other hand, VPB, with a similar CAR of ~14%, has not extensively utilized Tier 2 capital bonds, so their immediate need for capital increase is less urgent. MBB, with a lower CAR of ~10% and no reliance on Tier 2 capital, may also contemplate a capital increase down the line.

However, the presence of state ownership could hinder capital raising efforts, as state-owned enterprises might resist dilution. It’s worth noting that the relaxation of foreign ownership limits is subject to the bank’s charter and is only applicable during the mandated transfer period, expected to last between 5 and 10 years. Post this period, foreign investors cannot purchase additional shares until their total ownership falls below 30%, except when subscribing to shares offered to existing shareholders or through transfers between foreign investors.

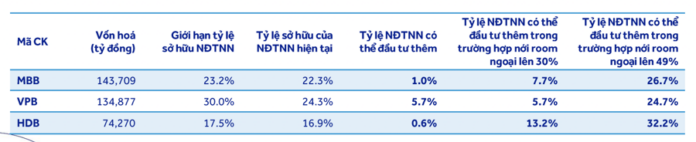

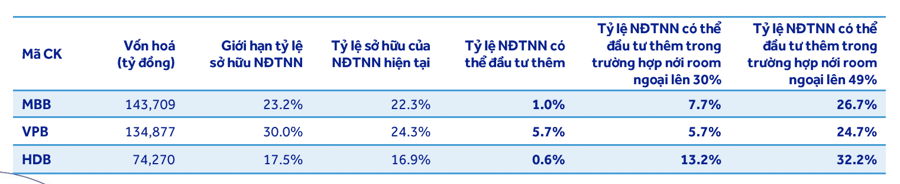

Currently, all three banks are below the foreign ownership limit, both in terms of the self-imposed limit set by the banks below 30% and the legal limit of 30%. The foreign ownership ratios of MBB, VPB, and HDB stand at 22.3%, 24.3%, and 16.9%, respectively. Hence, ACBS believes that raising the limit to 49% may not significantly impact their stock prices in the short term.

Nevertheless, in the medium to long term, the 49% cap enables these banks to attract foreign investment, particularly from strategic investors. MBB has strong state-owned enterprise shareholders, including Viettel, which plays a crucial role in its business ecosystem. VPB has SMBC as a strategic foreign investor, holding 50% of FE Credit. Meanwhile, HDB, which lacks a foreign strategic investor, is actively seeking one. Thus, ACBS assesses that HDB is most likely to pursue foreign ownership liberalization due to its growing need for Tier 1 capital and the absence of a foreign strategic partner. Should HDB aim for a typical strategic investor ownership of 15-20%, it is highly probable that they will be proactive in implementing these strategies, which are expected to positively influence their stock price.

Moreover, beyond the positive impact on capital and stock prices for these banks, ACBS suggests that this policy will enable a controlled experiment in foreign ownership liberalization, assessing its effects on financial capacity, governance, and the stability of the banking system. By limiting the pilot to these three banks, potential risks to financial and monetary security from foreign capital flows are mitigated. The outcomes from this pilot will provide valuable insights into attracting foreign capital, improving governance, and addressing weak banks, thereby informing future policy expansions.

Given the net foreign selling of over VND 30,000 billion in banking stocks since the beginning of 2024, facilitating foreign investment into banks mandated to acquire struggling institutions could support the inflow of foreign capital into Vietnam’s banking sector and stock market in the future.

The Permitted Foreign Ownership Limit Increase to 49%: Who Will Pull the Trigger First?

According to ACBS, Decree 69/2025 allows banks to issue additional shares to foreign shareholders, enabling them to increase their capital. This move is designed to facilitate capital injections into undercapitalized banks, providing them with the necessary funds to strengthen their financial positions.

“SCB Bank Restructuring Enters a Crucial Phase”

The State Bank is refining the restructuring plan for SCB and will submit it to the appropriate authorities for approval.

How to Prevent Bad Debt from Becoming an Economic Hindrance?

The rising tide of non-performing loans is a significant challenge for Vietnam’s banking system. It is not merely about managing bad debt but also about building a foundation for businesses to thrive and grow in an ever-changing world, ensuring that non-performing loans do not hinder the development of the financial system.