VPL made its debut on the HoSE today amid a backdrop of declines for VIC, VHM, and VRE. Despite VPL’s 20% surge, which hasn’t been factored into the VN-Index yet, the index only managed a modest 0.45% gain due to pressure from other heavyweights. The overall market breadth, however, painted a different picture, with a dominant uptrend across stocks, especially in the securities sector.

VPL witnessed a mere three trades during the morning session, involving 4,800 shares, while buy orders for nearly 1.44 million shares at the ceiling price remained unfulfilled. With a market capitalization of over VND 153.3 trillion, VPL ranks 9th on the HoSE and is poised to become a new pillar for the VN-Index in upcoming sessions.

In stark contrast to VPL’s exuberant performance, the ‘Vin’ group painted a gloomy picture, with VIC, VHM, and VRE shedding 1.39%, 1.28%, and 1.96%, respectively. VIC has now closed in the red for two-thirds of the recent sessions after a remarkable 36% surge over just 10 sessions. Despite the downturn, VIC maintained its position among the top 10 most liquid stocks, with a trading value of more than VND 389 billion.

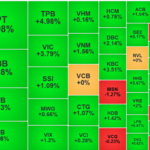

The index’s ascent was curtailed by the drag exerted by VIC and VHM, the second and third largest stocks by market cap in the VN-Index, respectively. A slight weakening was observed among the index’s largest stocks, with only CTG, FPT, and HPG posting notable gains. The VN30 basket concluded the morning session with 17 gainers and 11 losers, resulting in a modest 0.44% uptick. Notably, the top performers in this blue-chip basket were not the largest stocks: MWG soared 3.62%, MBB climbed 2.1%, and HDB advanced 1.86%.

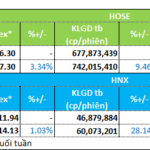

Although the VN-Index rose a mere 5.77 points, equivalent to 0.45%, the market was abuzz with activity. The overall market breadth on the HoSE was impressive, with 202 gainers and 105 losers, including 114 stocks climbing by more than 1%. Moreover, the exchange’s liquidity surged by 29.3% compared to the previous morning session, reaching nearly VND 11,425 billion—the highest in the last 18 sessions. This surge in liquidity was driven by existing stocks, as VPL’s trading volume was relatively minuscule.

Securities stocks stood out among the gainers, with several small-cap stocks surging beyond the 3% mark, including APS hitting the ceiling price, HAC climbing 7.61%, CSI surging 5.51%, VFS up 4.9%, ABW rising 4.11%, and FTS gaining 4.05%. Among the blue chips, SSI advanced 1.29%, VCI 1.78%, HCM 1.56%, VND 1.66%, and SHS 2.42%. The securities sector boasted 16 stocks climbing over 2% and 13 others rising between 1% and 2%. Only DSE and IVS were in the red, while VIG, HBS, and AAS remained unchanged. In terms of liquidity, VIX led the group with a trading value of VND 535.2 billion (up 3.57%), followed by SSI with VND 415.7 billion and HCM with VND 206.1 billion. These three stocks were among the top 15 most traded stocks on the market.

Money flow data revealed a slight increase of nearly 7% in the VN30 basket, but this group accounted for less than 15% of the additional liquidity on the HoSE. Numerous mid-cap and small-cap stocks witnessed a resurgence after the previous session. PNJ soared 4.33% with a matching value of VND 215.1 billion, VCI climbed 1.78% with VND 195.9 billion, FTS surged 4.05% with VND 160.3 billion, EIB rose 2.08% with VND 157.7 billion, EVF gained 2.88% with VND 136.8 billion, BAF climbed 2.33% with VND 136.2 billion, and GMD advanced 3.71% with VND 129.1 billion.

Among the decliners, the ‘Vin’ group remained prominent, posting substantial losses and high liquidity. Out of the 105 VN-Index stocks in the red, 48 dropped by more than 1%, but only seven recorded matching values exceeding VND 10 billion. Aside from the blue chips, notable losers included NVL, which fell 2.03% with a matching value of VND 223.2 billion, VPI, which declined 2.5% with VND 58.5 billion, and DBD, which slipped 1.19% with VND 11.2 billion. The total trading value of the group experiencing the sharpest declines (excluding VIC, VHM, and VRE) accounted for approximately 4.1% of the HoSE’s total.

Despite the lackluster performance of the VN-Index, the robust market breadth and high liquidity indicate a healthy market. The potential risk of a correction in VIC and VHM has been anticipated by the market, especially with the official listing of VPL. While VPL’s substantial market capitalization may provide some support to the index in the coming days, its impact is expected to be far more limited compared to the aforementioned two heavyweights.

Foreign investors returned as net buyers on the HoSE, recording a net purchase of approximately VND 309 billion. This turnaround was fueled by a staggering 190% surge in investment value compared to the previous morning session, reaching VND 1,849.5 billion. Notable stocks that attracted strong foreign investment included MWG (+VND 162.1 billion), PNJ (+VND 151.3 billion), MBB (+VND 140.2 billion), and FPT (+VND 128.9 billion). All of these stocks witnessed robust gains. On the selling side, STB (-VND 102.1 billion), VCB (-VND 101 billion), VIC (-VND 64.9 billion), GEX (-VND 56.9 billion), SSI (-VND 47.6 billion), HCM (-VND 33.7 billion), and VHM (-VND 32.1 billion) witnessed notable foreign net selling.

“Vingroup’s Total Value Surges to Nearly $43 Billion as Tycoon Pham Nhat Vuong Drops His 5th Billion-Dollar ‘Blockbuster’ IPO”

With a staggering valuation of $5 billion, Vinpearl has cemented its place among Vietnam’s most valuable companies, securing a spot in the top 15 on the stock exchange. This achievement places them just behind VPBank and ahead of notable non-banking giants such as Vinamilk, GVR, and Masan.

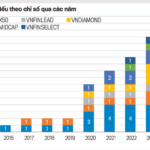

The Evolution of HOSE: Crafting a Robust Index System for the Stock Market

The evolution of the stock index system at HOSE over the past 25 years has been a remarkable journey. What started as a solitary VN-Index has now blossomed into a comprehensive ecosystem of indices. These indices have become the market’s guiding compass, providing direction and facilitating the development of a diverse range of financial products. They have played a pivotal role in enhancing investment tools and risk management strategies, shaping the financial landscape in Vietnam.

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.