The US and China agreed to significantly reduce tariffs on each other’s goods, initially for a period of 90 days, according to a joint statement released on May 12. Concurrently, the US will temporarily lower tariffs on Chinese goods from 145% to 30%, while China will cut import taxes on American goods from 125% to 10%.

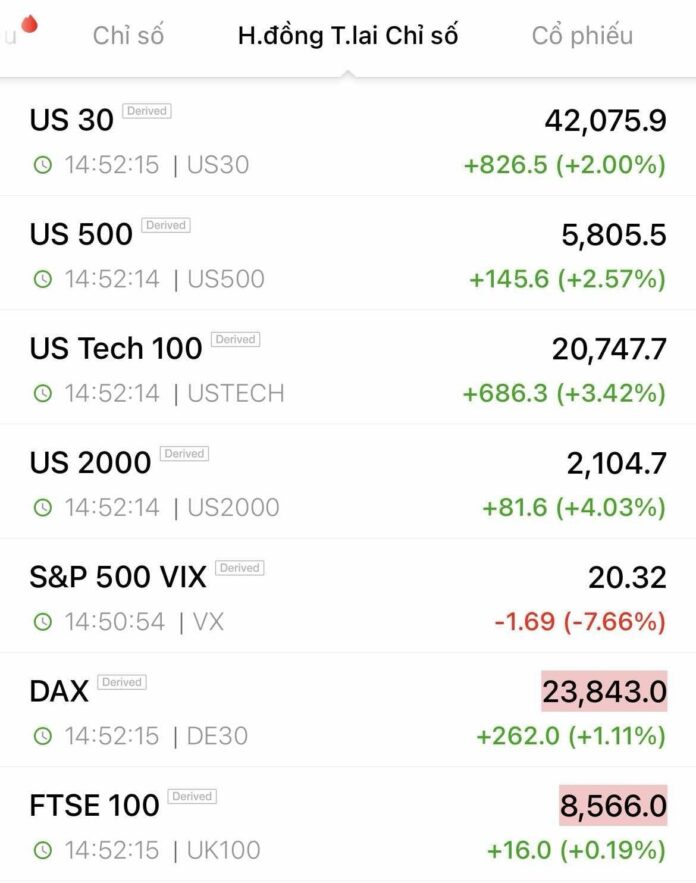

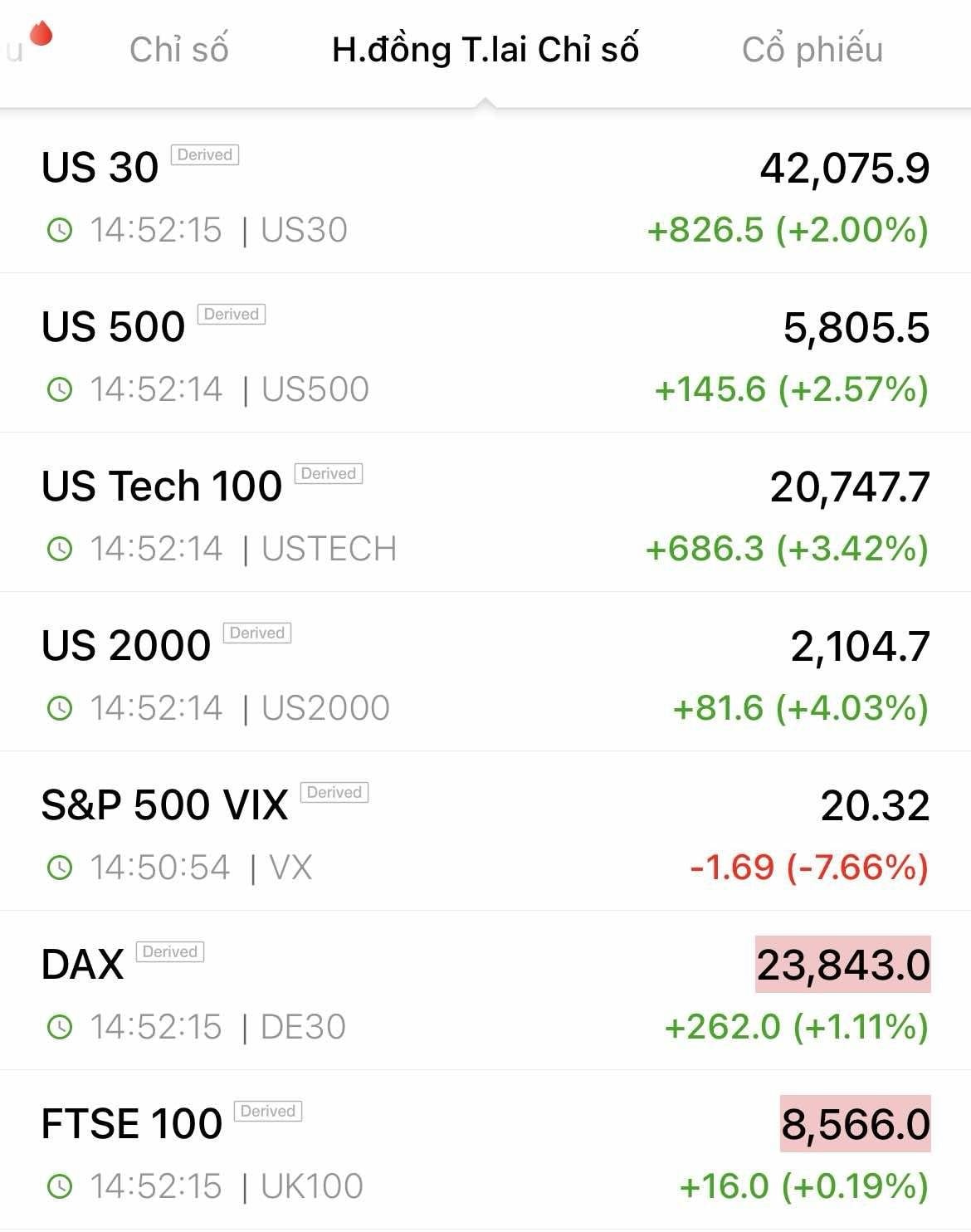

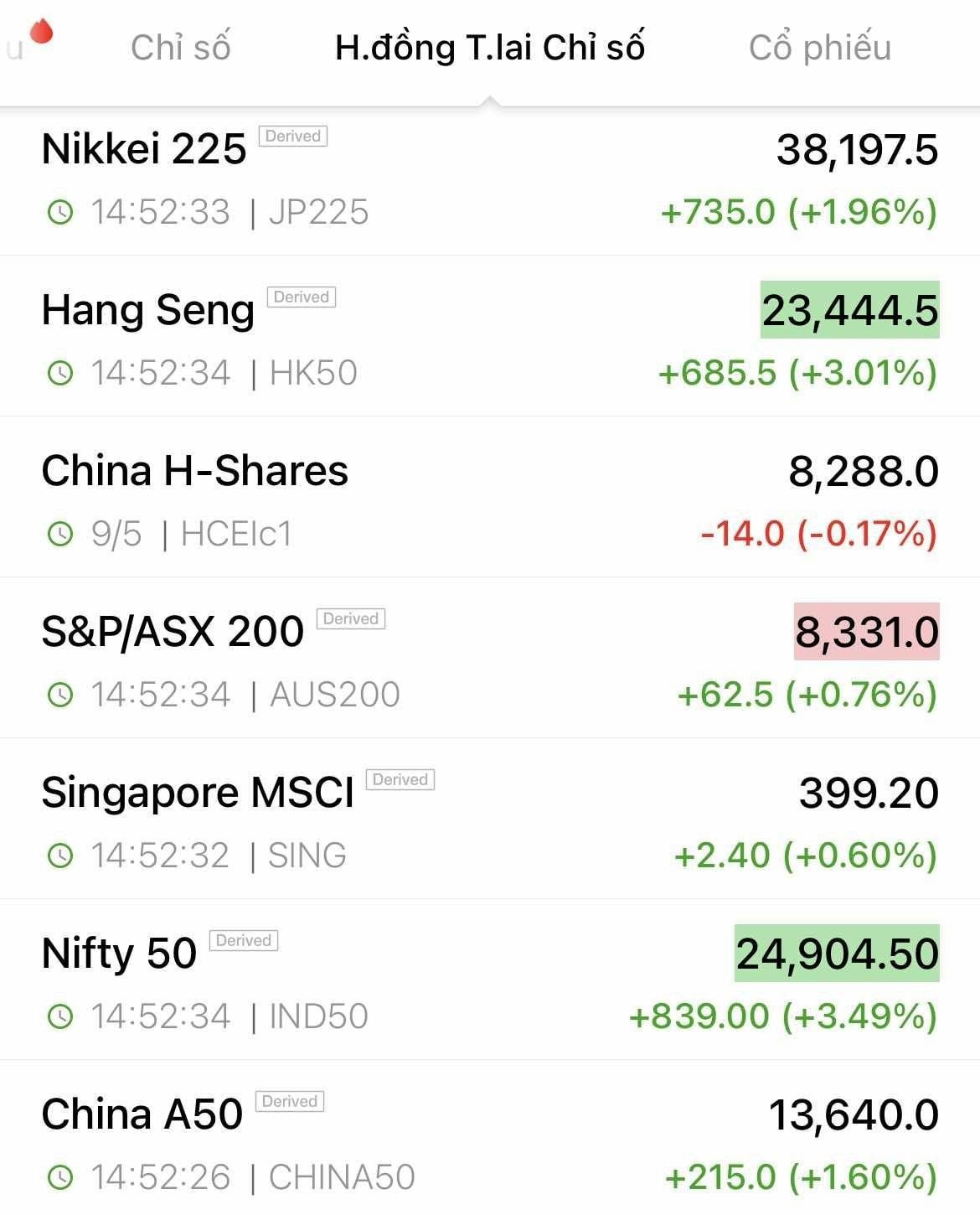

This news immediately had a positive impact on global stock markets. US stock index futures rose sharply, and Asian markets in Japan, China, India, and others followed suit with gains ranging from 2-3%. Vietnamese stocks joined this upward trend, experiencing a vibrant trading session.

In the recent May 12 session, the market witnessed a predominantly green session, driven by several pillar stocks such as TCB and VIC. The upward momentum extended towards the end of the session as buying pressure intensified. Banking, securities, and industrial zone sectors witnessed a boost, while steel and real estate remained relatively stagnant.

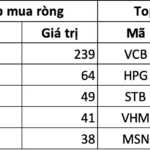

At the close of the May 12 session, the VN-Index climbed 15.96 points (+1.26%), settling at 1,283.26. Trading liquidity improved compared to the previous week, with matched orders reaching nearly VND 20,000 billion. However, foreign investors’ net selling of nearly VND 300 billion on the market remained a downside.

Recently, commenting on the US retaliatory tariffs, Petri Deryng, head of Pyn Elite Fund, stated that even before President Trump’s decision on tariffs, Vietnam had been boosting public spending and stimulating domestic private sector demand in various ways. With the new tax rates, domestic investment stimulation initiatives will undoubtedly intensify.

“Should the tariffs become reasonable, significant positive factors in the Vietnamese market may emerge to support the recovery of the country’s stock market. At the same time, investor capital may continue to shift from US tech and MAG7 stocks to other regions of the world, including Vietnam,” emphasized Petri Deryng.

Expert Insights: A Market Correction May Be Imminent, Exercise Caution With Margin Trading

“The market needs a breather to consolidate after a sharp rally last week to digest the influx of bargain buys,” said Mr. Hinh.

Vietnam Airlines Proposes a Capital Increase and a Narrow-Body Aircraft Project at an Extraordinary General Meeting

The meeting was convened to approve the proposal to issue shares and increase the charter capital, along with the investment in narrow-body aircraft.