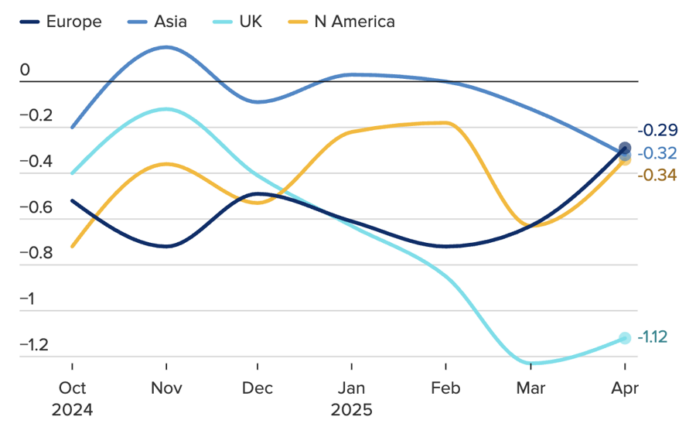

The Global Supply Chain Volatility Index by GEP reveals a sharp decline in purchasing activity in April, following a period of panic buying.

“The deferral of most punitive tariffs is a huge relief for manufacturers in both the US and China,” said John Piatek, Vice President of Consulting at GEP, in an interview with CNBC. “Our Global Supply Chain Volatility Index shows that production demand in China has dropped significantly, while US manufacturers have been stockpiling critical inputs to hedge against the impact of tariffs.”

According to Piatek, the new agreement between the US and China will not soon alleviate the concerns of US manufacturers about how to reduce long-term risks associated with China. “As US manufacturing companies cope with reducing risks and dependencies on China, the rapidly changing landscape and uncertainty are clouding their outlook, challenging their capital investments, and supply chains,” he said.

GEP’s Global Supply Chain Volatility Index tracks factors such as demand conditions, goods scarcity, shipping costs, inventory levels, and order backlogs based on a monthly survey of approximately 27,000 businesses.

“The first negative impacts of tariffs on manufacturers globally are being felt,” Piatek stated. GEP’s supply chain volatility data should be viewed as a warning of what could happen if tariff reductions are not extended beyond the 90-day truce period and the trade war escalates again.

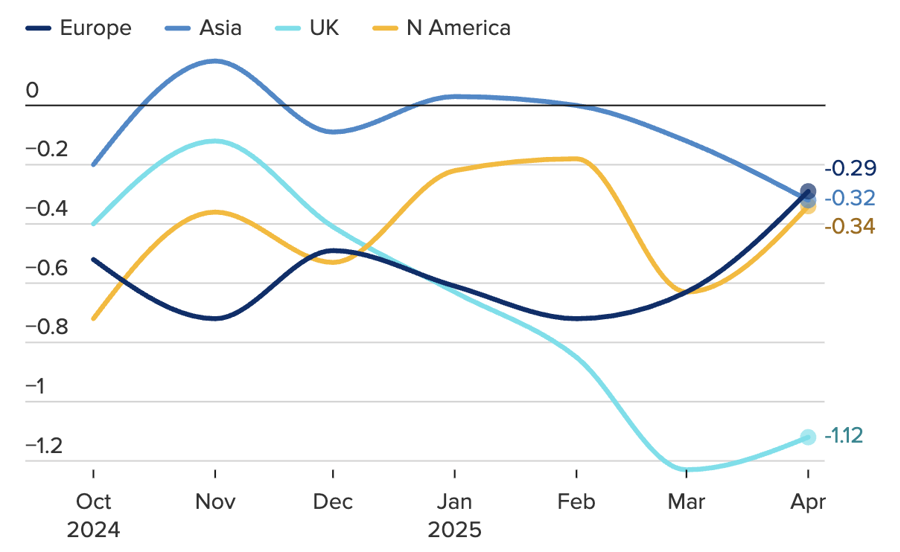

Piatek described the rate at which North American companies stockpiled goods in April as “worrying.” Additionally, “the first signs of manufacturers expecting declining demand and increasing scarcity of supply are also rising,” as reflected by Asian manufacturers’ purchasing activity falling to its lowest level since December 2023.

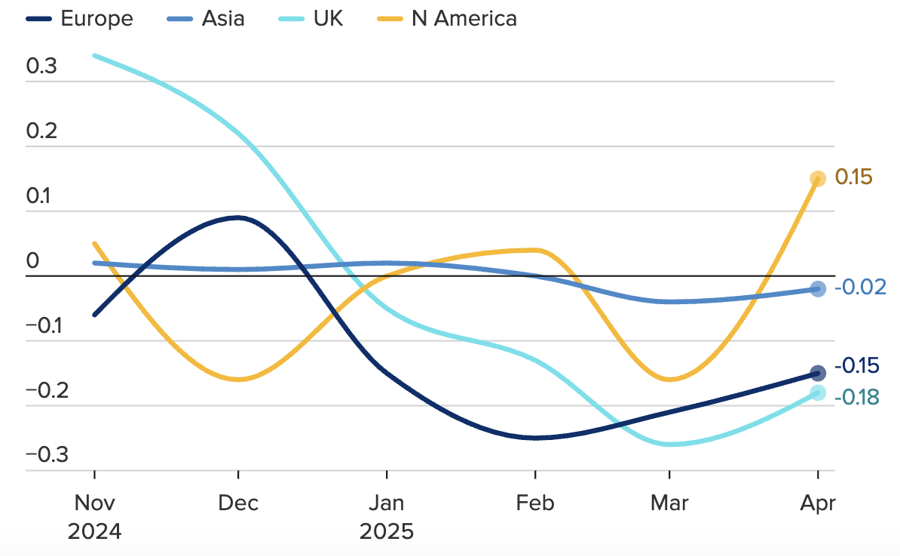

A bright spot offsetting the decline in production in Asia and Asia was Europe, where the period of recession in industrial production has come to an end.

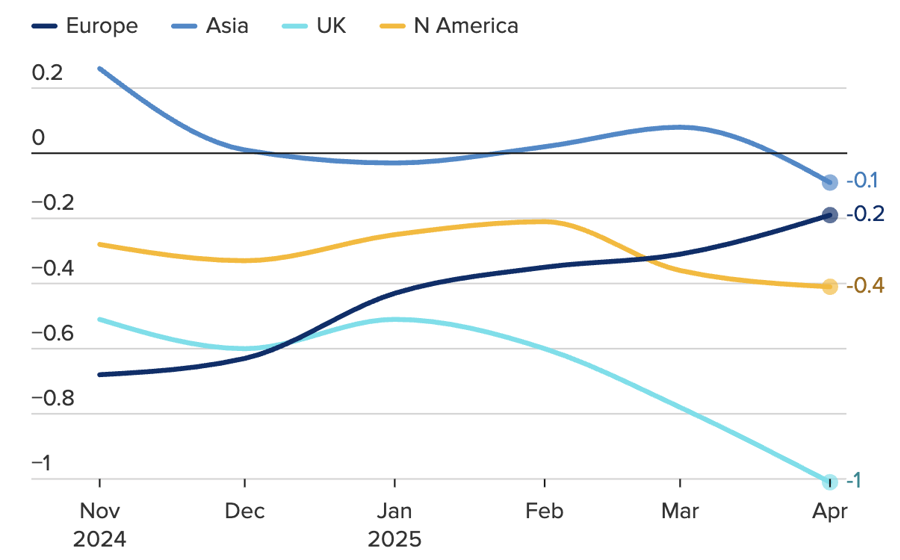

In the UK – the first country to reach a preliminary trade agreement with the US – manufacturing activity weakened significantly, with supplier activity falling to near-record low levels according to data from the past two decades. However, the underutilized supply chain capacity in Germany and France over the past year has started to show growth. Piatek cautiously stated that this growth could reverse if global trading conditions deteriorate.

GEP’s data also showed an increase in excess capacity in Asian supply chains in April, especially in China, Taiwan, and South Korea.

In a recent interview with CNBC, Stephen Edwards, CEO of the Port of Virginia, USA, stated that if the future of the global supply chain involves reducing dependence on China and increasing reliance on Southeast Asia, South Asia, and Europe, this port is well-positioned to serve that growth.

“Our fastest growth in the past four years has come from the Indian subcontinent, followed by Vietnam and Europe,” said Edwards. In contrast, goods from China arriving at the Port of Virginia have not grown in the past four years.

“China remains a significant trading partner for the US. But if the supply chain continues to shift away from China over time, regardless of the new trading environment, that’s an opportunity for us. Not many trade deals have been signed yet, but I think US trade with China will decrease, and with Southeast Asia and Europe will increase. We believe we are in a relatively favorable position,” Edwards added.

Winmart: Meat and Vegetable Sales Soar, With a 300% Increase in Foot Traffic

As news of Super Typhoon Yagi’s impending landfall from the evening of September 7 spread, a frenzied rush to stock up on supplies engulfed the community.