A trust contract between CSI and GFM was announced on August 1, 2024, with a term of 12 months, subject to extension depending on the net asset value NAV of the contract meeting the Company’s expected profit level at the closing date.

According to the contract, the selected securities portfolio consists of stocks (listed and traded) with medium and large capitalizations, leading in several representative industries… with potential, alongside listed bonds issued by large enterprises with healthy finances and reasonably-term bonds.

The contract also stipulates a stop-loss rule, with corresponding actions at loss levels of 30% and 40%, respectively. GFM also commits to completing the stop-loss process within three business days from the time of executing the stop-loss, simultaneously pledging to compensate for any damages caused by delays in handling divestment transactions due to GFM’s fault.

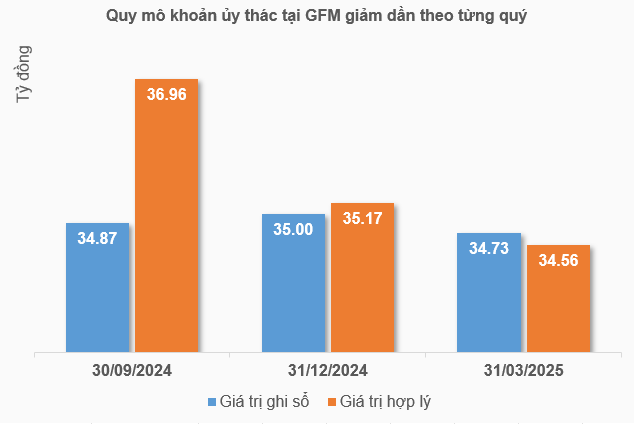

This entrustment began to appear in CSI’s Q3/2024 financial statements, with a book value of nearly VND 34.9 billion and a fair value of nearly VND 37 billion as of September 30, 2024. By December 31, 2024, the recorded values were VND 35 billion in book value and nearly VND 35.2 billion in fair value. By the end of Q1/2025, the investment scale decreased to over VND 34.7 billion in book value and nearly VND 34.6 billion in fair value.

Thus, the scale of the entrustment tends to narrow down. In the context of the stock market’s strong fluctuations since the beginning of Q2, many questions have been raised about the actual scale of the entrustment as of the present.

Source: VietstockFinance

|

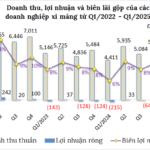

Regarding CSI’s overall business situation, in Q1/2025, the Company incurred a net loss of over VND 5.4 billion, higher than the loss of nearly VND 4.3 billion in the same period last year. During the quarter, the Company’s two main business segments, proprietary trading and brokerage, both suffered losses, while management expenses increased by 26%.

Overall, the Q1 profit results fall short of the Company’s target for 2025, which is set at VND 15 billion.

– 19:28 05/14/2025

The Cement Industry’s Performance in Q1 of 2025: A Comprehensive Overview.

In the first quarter of 2025, several cement companies witnessed an increase in revenue, yet they reported net losses amounting to billions of Dong.

The Ultimate Guide to Captivating Copy: “Unleashing the Power of Words: Digiworld’s Generous Dividend Payout for 2024”

Digiworld plans to spend nearly VND 110 billion on dividends for the fiscal year 2024, offering a 5% payout ratio. The record date for shareholders to be eligible for this dividend is May 26, 2025.