Hanoi Machinery and Mineral Joint Stock Company (code: HGM) has just announced that May 27 will be the ex-dividend date for the third dividend payment of 2024 in cash at a rate of 88% (corresponding to receiving VND 8,800 per share). The expected payment date is June 27, 2025.

With 12.6 million shares outstanding, the total amount HGM is expected to pay out is nearly VND 111 billion.

Previously, Hanoi Minerals had paid two dividend advances with a total rate of 50%. Including this payment, the total cash dividend payout for 2024 reached 138% (VND 13,800/share), the highest in the company’s operating history.

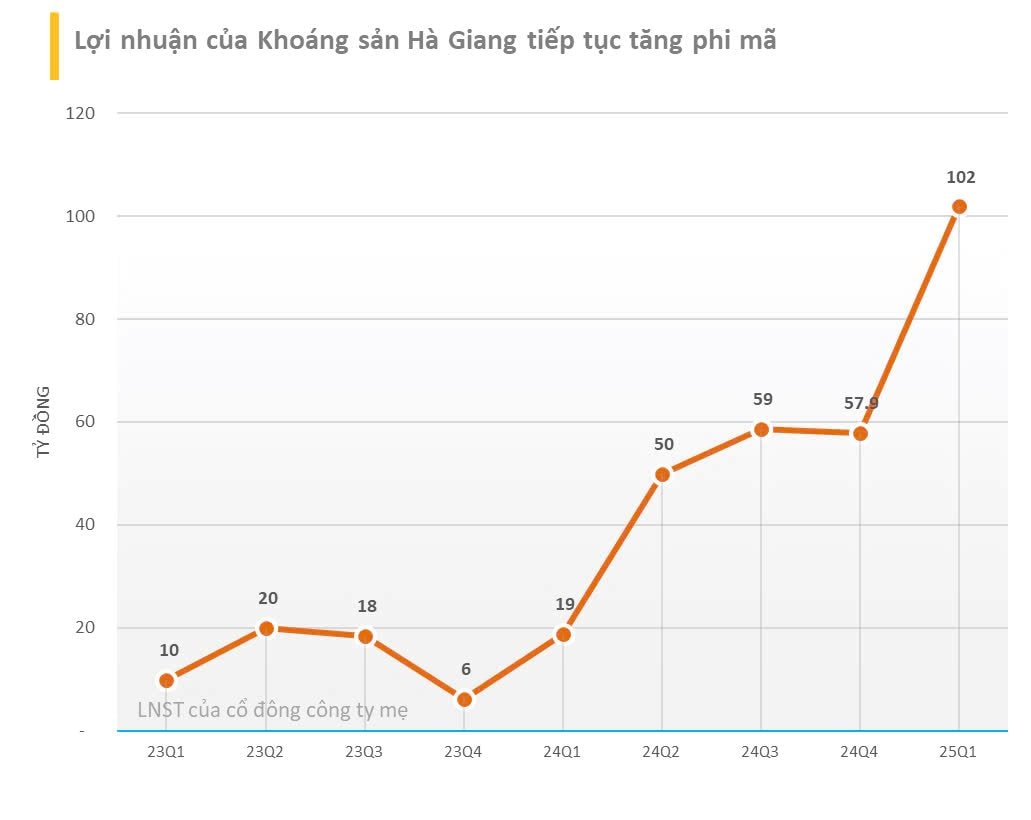

The mineral enterprise generously rewarded shareholders after recording record revenue and profits in 2024. Specifically, the company reported revenue of over VND 370 billion and pre-tax profit of VND 233 billion, up 111% and 232% year-on-year, respectively. The pre-tax profit margin reached 63%, meaning the company made a profit of VND 2 for every VND 3 in revenue.

In the first quarter of 2025, the company’s business results continued to improve, with net revenue reaching VND 154 billion, up 194% over the same period last year. This was driven by a 249.5% surge in exports of Antimon metal compared to the previous year. The cost of Antimon also decreased by approximately VND 5 billion, or 17.93%, from the previous period.

After deducting expenses, HGM earned VND 127 billion in pre-tax profit and nearly VND 102 billion in after-tax profit, increases of 444% and 441%, respectively, from the same period last year.

Holding a Mineral Sought After by the World

Antimon is a critical mineral sought after by Canada, the United States, the European Union, the United Kingdom, and other countries worldwide. It is a strategic metal used in military applications such as ammunition and missiles, as well as lead-acid storage batteries used in automobiles and brake pads due to its heat resistance.

This important resource is also widely applied in high-tech industries, serving as a key component in semiconductors, circuit boards, electrical switches, fluorescent lighting, high-quality transparent glass, and lithium-ion batteries. Familiar products such as smartphones, high-definition TVs, modern kitchen appliances, and even automobiles that use digital circuits rely on Antimon.

With the increasing demand from vital industries, Western countries are facing intense competition for Antimon. Currently, China accounts for approximately 50% of Antimon mining and 80% of global production. This has made Western countries, particularly the United States, dependent on Chinese supplies.

HGM is the only unit in Vietnam capable of producing Antimon on an industrial scale. China’s restrictions on Antimon exports are expected to give the company an advantage in terms of selling prices.

Currently, the company has the right to exploit the Antimon Mau Due mine in Ha Giang province, which consists of three ore bodies. They are currently mining ore body II, which has a reserve of approximately 372,000 tons of ore with an Antimon grade of nearly 10%. In addition, with the estimated reserves of ore bodies I and III being similar to ore body II, the company expects to have an abundant source of ore to meet future production expansion needs.

In the market, HGM’s closing price on May 13 was VND 313,000 per share, making it one of the stocks with the highest market price on the stock exchange. HGM has seen a price increase of nearly 40% since the beginning of the year.

“NHA to Pay Dividends After 5 Years”

Introducing the Urban and Southern Hanoi Housing Development and Investment Corporation (HOSE: NHA), a powerhouse in the real estate industry, as they announce their latest dividend offering. Shareholders, take note: May 27th is the crucial date for entitlement, as the company gears up to distribute its 2024 dividend entirely in shares.

The Long Thanh Airport Investor Considers Record Dividend Payout

The Vietnam Airports Corporation (UPCoM: ACV) is seeking shareholder approval for a generous dividend plan. The company has proposed a dividend payout ratio of 64.58% – the highest in its history – in the form of stock dividends. This bold move underscores ACV’s commitment to rewarding its shareholders and fostering long-term growth. Stay tuned as we bring you more updates on this exciting development.

“Cash Dividend Delights: Top Pick with a Whopping 60% Payout for Investors”

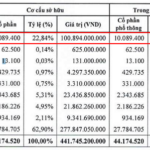

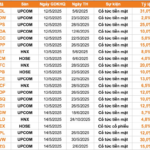

Introducing the top-performing stocks that shine with their generous cash dividends! A whopping 46 businesses shower their investors with cash dividends, with rates ranging from a substantial 61% to a modest yet meaningful 2%. These figures speak for themselves, showcasing the confidence these companies have in their success and their willingness to share the rewards with their valued shareholders.