Vietnam’s Mobile Phone and Component Exports: A Growing Industry

Preliminary statistics from Vietnam’s General Department of Customs reveal that mobile phone and component exports fetched an impressive $3.7 billion in April, albeit a 22% dip from the previous month. Cumulative exports for the first four months of the year reached nearly $18 billion, a slight decrease of 2% from the same period last year.

(Figure 1: Vietnam’s Mobile Phone and Component Exports)

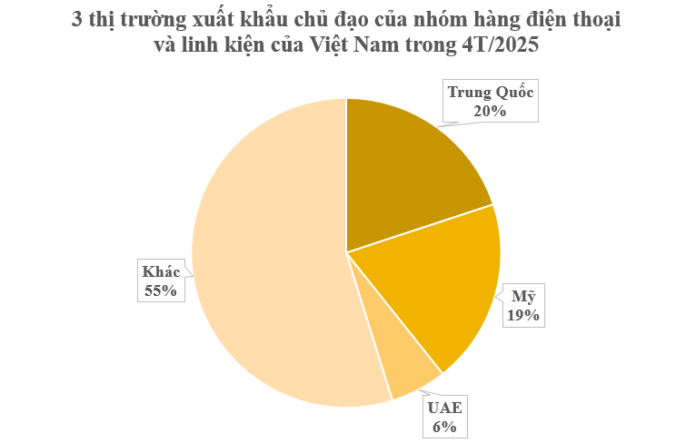

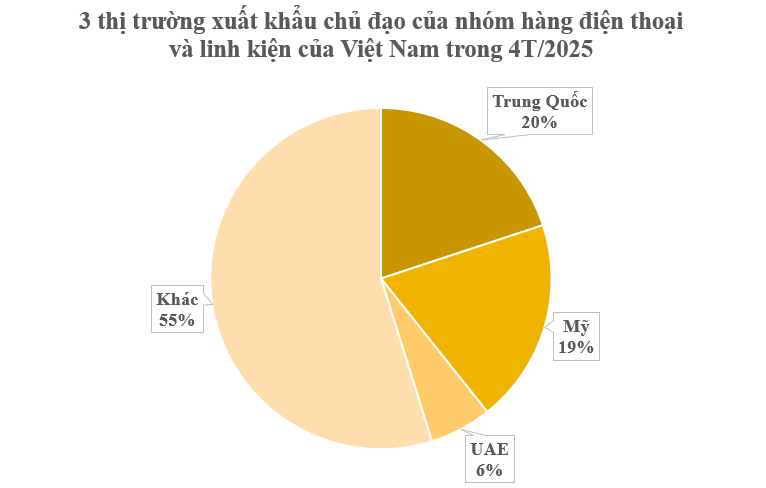

Diving into the market breakdown, China emerges as Vietnam’s largest importer, accounting for over $3.5 billion, a 2.2% increase from the previous year. The US follows closely with more than $3.4 billion, despite a 9% decline year-on-year. The UAE, Vietnam’s third-largest export market, contributed over $1.04 billion, an 8.5% drop compared to 2024.

In a significant development, the US Customs and Border Protection announced on April 11 that certain electronic and high-tech products imported into the US would be exempt from tariffs under the new trade policy unveiled by the Trump administration. This includes smartphones, desktop computers, electronic components, and advanced technology products such as semiconductor chips, solar panels, and memory cards. The exemption applies to goods imported into the US or removed from warehouses from April 5 onward.

This decision aims to mitigate the negative impact of tariff measures on the US technology sector, particularly companies reliant on global supply chains, including Apple, Nvidia, and electronics manufacturers. Vietnam currently ranks second globally in smartphone exports and fifth in component exports. In 2024, the country’s exports of mobile phones and components surpassed $53.89 billion, marking a 2.9% increase from 2023.

According to Vietnam’s Ministry of Industry and Trade, the electronics industry’s growth is largely attributed to substantial investments from South Korean and Japanese multinational corporations in the field of electronic component manufacturing. Leveraging their research and development advantages in Vietnam, these corporations produce a diverse range of electronic products in terms of types, colors, and designs, catering to both domestic demands and exports to major global markets.

Vietnam’s mobile phone market has emerged as a shining star, witnessing rapid development and boasting immense potential. Apple, in particular, has achieved remarkable success, with its three major partners—Foxconn, Luxshare, and GoerTek—continuously expanding their investments in electronics production. The primary export markets for the electronics industry include the US, Europe, China, and South Korea. Notably, exports of computers, electronic components, and phones to Europe and the Americas reached $56.9 billion in the previous year, accounting for nearly 45% of total export turnover.

Looking ahead to 2025, the electronics export turnover is projected to reach a remarkable $140-145 billion if the growth trajectory of 2024 is maintained. However, a significant challenge lies in the US market due to its volatile trade policies and new tariff measures. There is an increased risk of Vietnamese exports, including electronics, facing trade protectionism in the US market.

The UOB Expert: It’s Unlikely the US Will Return to Making Shoes or Assembling iPhones

The UOB Vietnam banking expert believes that the trend of global supply chain relocation is irreversible through tariff measures alone. The expectation that the US will bring production back home is “highly unlikely.”

The VN-Index Surges Past 1,200 Points: Experts Predict a Market Rebound

The stock market is expected to continue its recovery trend next week, with key indices remaining above the 1,200-point mark. Bank stocks, consumer staples, and retail sectors are expected to be in focus, with potential for strong gains. As investors eye these sectors, the market sentiment is likely to remain positive, building on the recent momentum.

The Shifting Economic Trends: Standard Chartered Adjusts USD/VND Exchange Rate Forecast

In its latest Vietnam Macroeconomic Report released on March 26, Standard Chartered Bank revised its USD/VND exchange rate forecast, reflecting shifts in the global and regional economic landscape.

“Don’t Put All Your Eggs in One Basket” for Exporters

In the face of escalating global trade tensions, it is imperative for relevant authorities and businesses to enhance their trade promotion efforts by diversifying export markets. The strategy of “not putting all your eggs in one basket” becomes crucial to mitigate risks and ensure sustainable growth.