The VN-Index has once again surpassed the 1,300-point mark. The index rose steadily, closing the session with a strong gain, doubling its morning session, and heading towards the 1,309.73 mark, a gain of 16.30 points or 1.26%.

Domestic and foreign investors competed to buy. In the morning session, foreign investors bought a net of more than VND 1,000 billion, marking the most impressive session in terms of the trend of reversing the net buying trend of this group after two consecutive years of leaving the Vietnamese stock market. Entering the afternoon session, this group increased their net buying value to nearly VND 2,300 billion, while domestic money also poured in, with nearly 1 billion shares changing hands on the three exchanges today, with a matching value of nearly VND 29,000 billion.

However, the breadth was not as strong as yesterday, with 189 gainers and 122 losers. Banks and Securities took the lead in today’s session. Notably, VPB hit the daily limit, while many other bank stocks also saw strong gains, such as VCB, BID, LPB, CTG, and HDB. The momentum for this stock group came from Decree 69 of the Government, which allows banks to increase foreign ownership limits to 49%. Some banks that still have room for foreign investment, such as VPB, MBB, and HDB, are expected to benefit. The banking group alone contributed 9 points to the market.

In addition, VPL, HPG, and FPT also performed well. Securities stocks did better today, with VCI up 2.31% and SSI up 2.14%, while many other stocks in the sector gained 1-2%, including HCM, MBS, BSI, SHS, FTS, and VDS. Telecommunications and information technology stocks surged thanks to foreign investors’ net buying of FPT, while retail stocks also gained with MWG and PNJ.

On the other hand, real estate stocks weakened, with VIC, VHM, and VRE losing ground after a period of supporting the market, while BCM, KBC, PDR, DIG, and NVL still posted gains.

Foreign investors bought a net of VND 2,274.1 billion, and their net buying on the matching value was VND 2,417.0 billion. Their net buying on the matching value focused on the Banking and Information Technology sectors. The top net bought stocks by foreign investors on the matching value were FPT, VPB, MWG, HPG, PNJ, CTG, BID, MBB, HSG, and NLG.

On the selling side, foreign investors net sold food and beverage stocks on the matching value. The top net sold stocks by foreign investors on the matching value were VHM, VRE, VNM, VSC, CTD, BAF, DBC, PLX, and HAG.

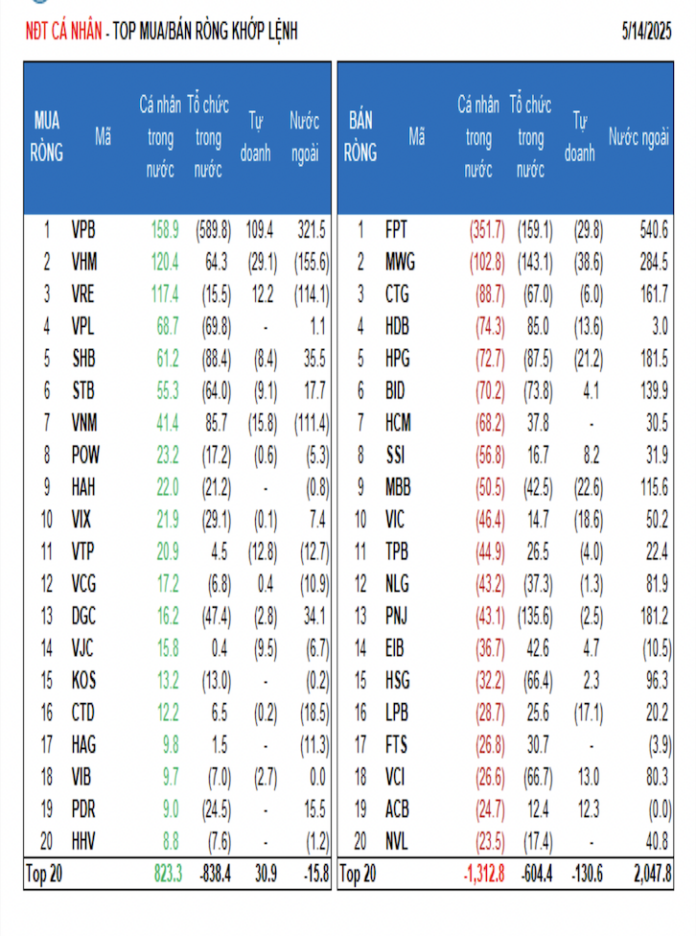

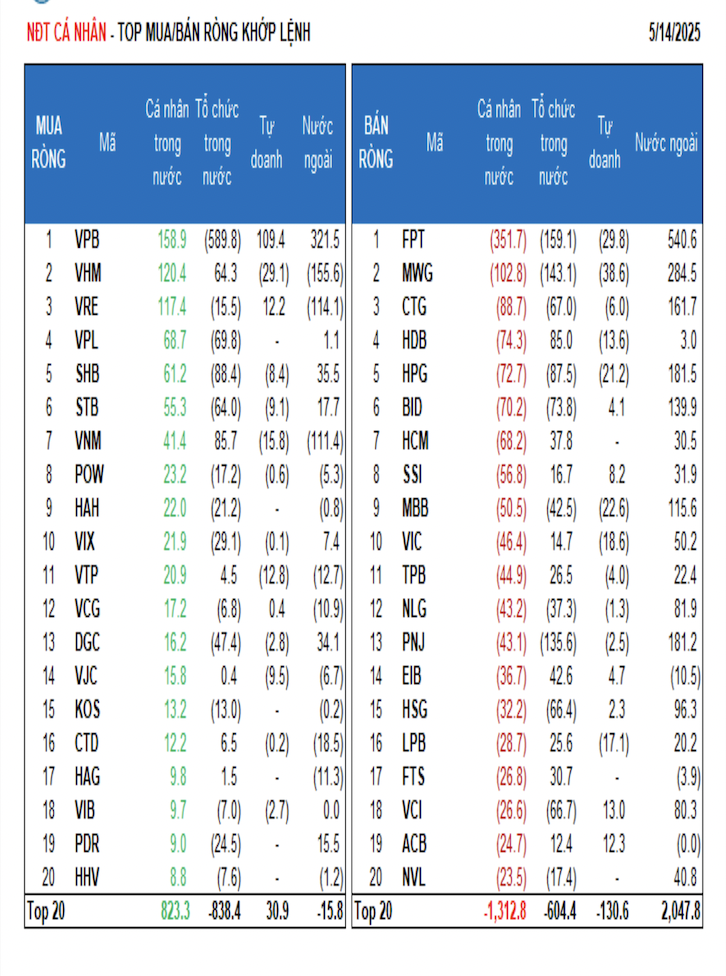

Individual investors net sold VND 1,276.9 billion, of which VND 839.1 billion was net sold on the matching value. On the matching value, they net bought 6/18 sectors, mainly in Tourism and Entertainment. The top net bought stocks by individual investors were VPB, VHM, VRE, VPL, SHB, STB, VNM, POW, HAH, and VIX.

On the net selling side of the matching value, they net sold 12/18 sectors, mainly in Information Technology and Financial Services. The top net sold stocks were FPT, MWG, CTG, HDB, HPG, BID, SSI, MBB, VIC.

Proprietary trading bought a net of VND 180.8 billion, and their net selling on the matching value was VND 264.9 billion. On the matching value, proprietary trading net bought 1/18 sectors, with the strongest net buying in Financial Services, Automobiles, and Auto Parts. The top net bought stocks by proprietary trading today were VPB, VCI, ACB, VRE, E1VFVN30, SSI, EIB, FUEVFVND, BID, and FUEKIV30. The top net sold sector was Retail. The top net sold stocks were TCB, MWG, FPT, VHM, MBB, PLX, HPG, VIC, LPB, and DGW.

Domestic institutional investors net sold VND 1,177.2 billion, and their net selling on the matching value was VND 1,312.9 billion. On the matching value, domestic institutions net sold 11/18 sectors, with the largest net selling in the Banking sector. The top net sold stocks were VPB, FPT, MWG, PNJ, SHB, HPG, BID, VPL, CTG, and VCI. The top net bought sector on the matching value was Food and Beverage. The top net bought stocks were VNM, HDB, TCB, VHM, VSC, EIB, HCM, DBC, FTS, and BAF.

The value of negotiated transactions today reached VND 4,844.2 billion, up 30.1% from the previous session and contributing 16.3% of the total trading value.

Today, there was a notable negotiated transaction in MSN stock, with more than 14.7 million units, equivalent to VND 867.8 billion, changing hands between foreign institutions. In addition, negotiated transactions were also active among domestic institutions, focusing on VHM, SHB, STB, FPT, and MWG.

The allocation of money flow increased in Banking, Securities, Steel, Food, Software, and Electricity Production & Distribution, while it decreased in Real Estate, Chemicals, Agriculture & Seafood, Retail, Electrical Equipment, and Personal Items. In terms of matching value, the allocation of money flow increased in the large-cap VN30 group while decreasing in the mid-cap VNMID and small-cap VNSML groups.

The Foreigners’ Net Buying Surge: A Record High Since the Year’s Start

The domestic stock market continued its upward trajectory today (May 13th), with the VN-Index inching towards the 1,300-point mark. Bank stocks painted the town green, providing a significant boost to the overall market. Foreign investors recorded their strongest net buying session since the start of the year.

Expert Insights: A Market Correction May Be Imminent, Exercise Caution With Margin Trading

“The market needs a breather to consolidate after a sharp rally last week to digest the influx of bargain buys,” said Mr. Hinh.

Foreign Block Buys a Record High of Over VND 1,100 Billion, Large-cap Stocks Lift VN-Index Past 1300 Points

The blue-chip stocks witnessed a surprising boost this morning, with foreign investors’ buying power accounting for nearly 21% of the total liquidity in the VN30 basket. Foreign capital drove a 25.5% surge in liquidity for blue-chip stocks, taking it to the highest level in 20 sessions, while trading on the HoSE floor dipped 7.5% compared to yesterday’s morning session.