In its May strategic report, An Binh Securities (ABS) predicts that the next 2-3 months will be a pivotal period for Vietnam’s economy, with significant macro developments on the horizon, particularly regarding the Vietnam-US trade agreement.

Vietnam has proactively implemented measures to support balanced trade, such as reducing import taxes on US goods to 0%, increasing purchases of US goods to reduce the trade deficit (LNG, aircraft, high-tech goods), and tightening control over the origin of exported goods to prevent trade fraud. However, ABS forecasts that negotiations will be challenging and prolonged, as Vietnam is among the countries with the highest trade surplus with the US.

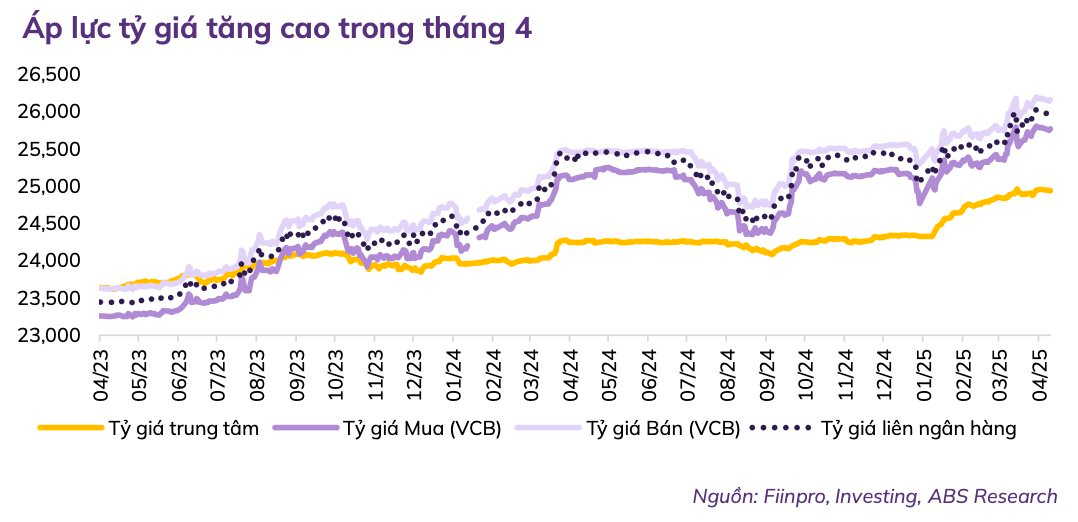

ABS also points out some disadvantages for inflows into the stock market. The rise in US Treasury bond yields following the news of retaliatory tariffs complicates the management of the VND/USD exchange rate, as US interest rates surpass those in Vietnam, influencing the outflow of international capital from Vietnam back to the US.

Additionally, Vietnam’s need to increase USD purchases to meet future import demands from the US to improve trade balance puts further pressure on the exchange rate. Gold prices have also surged due to both global price increases and the appreciation of the VND/USD exchange rate.

On a positive note, the Fed recently conducted a direct auction to purchase $14 billion of 10-year US Treasury bonds, leading to market expectations of an early end to Quantitative Tightening (QT). If this action persists over the next 3-6 months, it could mark a policy turning point for the Fed.

Moreover, the Fed is expected to continue cutting interest rates in the upcoming June or July meetings (followed by two more cuts in October and December 2025), easing pressure on exchange rates and global currencies.

Against this backdrop, Vietnam has implemented various policies to mobilize and strengthen its internal resources, including public investment, credit easing, institutional reforms, a focus on science and technology development (Resolution 57), private sector growth (Resolution 68), business support (taxes, fees), consumption boosts (VAT reduction), and expanded social security.

In terms of valuation, with the recovery in April and early May, the VN-Index’s P/E ratio for the last four quarters increased from 10.86x on April 9, 2025, to 12.12x on May 9, 2025, still below the three-year average of 13.13x.

Large-cap stocks in the VN30 have a P/E ratio of 10.89x, significantly lower than mid-cap stocks in the VNMID (15.06x) and small-cap stocks in the VNSML (13.41x). These P/E levels are all below their three-year averages, indicating attractive valuation levels. The VN30 index’s P/E is only slightly higher than one standard deviation below its three-year average of 10.51x.

Based on these arguments, ABS believes that this period may present significant opportunities in the stock market, which often anticipates economic news. Investors can prioritize leading stocks in industries and niches, with clear business advantages, maintaining a better trend and momentum than the overall market.

In May, ABS suggests focusing on export-oriented sectors and stocks, including TCM, GMD, MBB, CTG, TCB, BFC, DCM, DDV, MWG, DGW, MSN, TCH, HDC, PVB, FPT, CMG, ELC, and MSR.

The Bank Stock Boom: Foreign Capital Sweeps In

“The market was stunned this afternoon by the sheer volume of foreign investor purchases. HoSE alone saw an additional 3.4 trillion VND injected, with a net buy of nearly 1,153 billion VND on top of the already substantial 1,112 billion VND net buy in the morning. This marks the highest net buying session since November 29, 2022. Notably, the VN30 basket of stocks witnessed an additional net buy of approximately 531 billion VND…”

The Exchange Rate in Vietnam: An Unusual Development

The US Dollar Index, a measure of the greenback’s strength against a basket of foreign currencies, fell nearly 9% in the first four months of the year on global markets. However, in Vietnam, the story is different, with the USD exchange rate appreciating. Since the beginning of the year, the USD has gained around 2.2% at commercial banks in the country.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)