I. MARKET ANALYSIS OF SECURITIES ON MAY 13, 2025

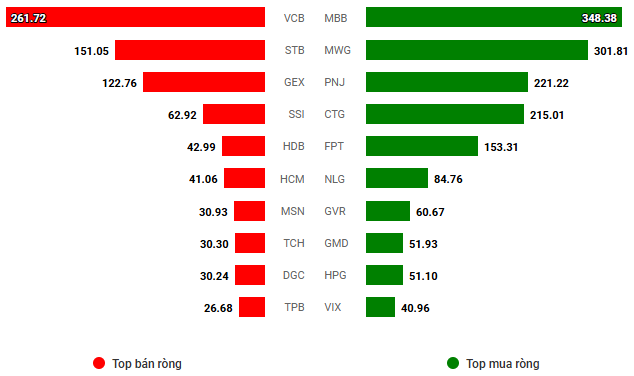

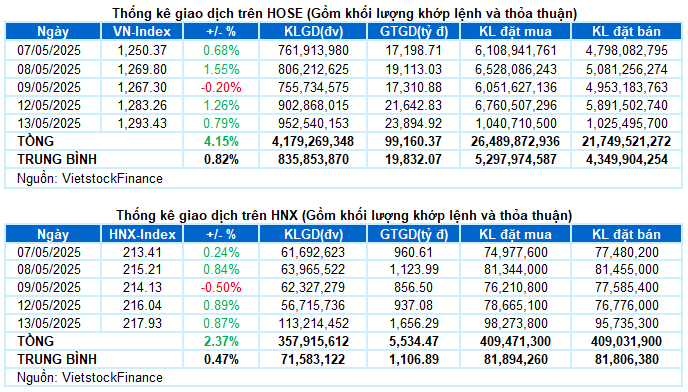

– The main indices continued to gain points during the trading session on May 13. VN-Index increased by 0.79%, reaching 1,293.43 points; HNX-Index reached 217.93 points, an increase of 0.87%.

– The trading volume on the HOSE increased by 6.2%, reaching nearly 884 million units. Meanwhile, the HNX floor recorded more than 73 million units, a strong increase of 30.4%.

– Foreign investors returned to net buying with a value of more than VND 940 billion on the HOSE and nearly VND 21 billion on the HNX.

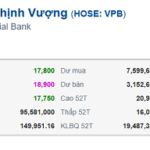

Trading value of foreign investors on HOSE, HNX and UPCOM by date. Unit: VND billion

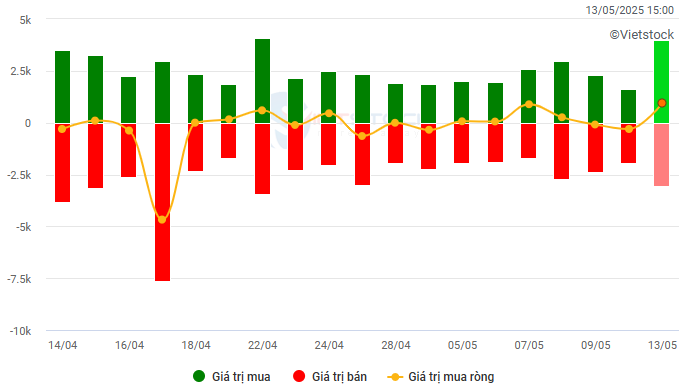

Net trading value by stock code. Unit: VND billion

– The Vietnamese stock market maintained its positive momentum in the context of the global financial market easing pressure after the news of a tariff reduction agreement between the US and China. The green color prevailed throughout the trading session with improved liquidity, indicating that money flow participated more confidently. In addition, the strong net buying by foreign investors further boosted enthusiasm and reinforced positive sentiment. At the end of the session, the VN-Index gained more than 10 points, closing at the level of 1,293.43 points.

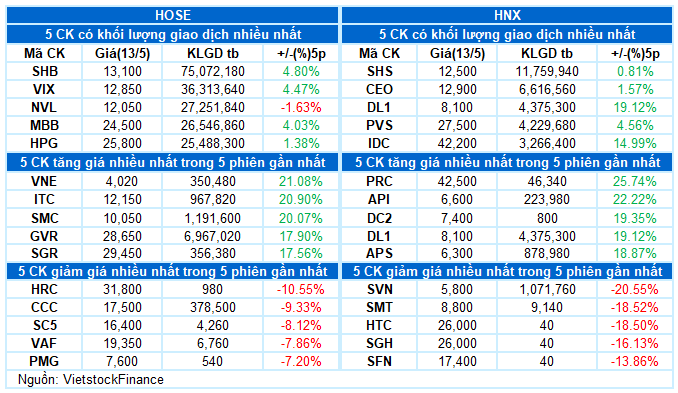

– In terms of impact, the “king stocks” made a significant contribution to the overall index, typically CTG, MBB, BID, VPB, and VCB, bringing in a total of nearly 5 points for the VN-Index. On the contrary, there was no code that had a significant negative impact.

– VN30-Index continued to break through with nearly 11 points, reaching 1,382.78 points. The green color still dominated with 20 rising codes, 9 falling codes, and 1 code keeping the price. Leading the board were MWG and CTG with an increase of more than 4%. Meanwhile, SSB and TPB were at the bottom when going against the general trend, losing more than 1%.

Most industry groups continued to gain positive points. The non-essential consumer group led the market with an outstanding increase of nearly 7% thanks to the great contribution from the “newbie” VPL newly listed on the stock exchange. This stock had a successful debut on the HOSE when it hit the daily limit right from the start of the session, while also surpassing MWG to become the stock with the largest market capitalization in the non-essential consumer group. In addition, many other stocks in the industry also recorded no less impressive increases, such as PNJ (+4.58%), MWG (+4.44%), GEE (+3.41%), FRT (+1.39%), TCM (+2.98%), DGW (+1.5%), TLG (+2.7%), and TNG (+1.64%).

The groups of materials, finance, information technology, and essential consumer goods also recorded an increase of more than 1%, with a series of codes attracting positive buying force such as HPG, GVR, NKG, CSV, VGC; CTG, MBB, VPB, VIX, FTS; FPT, CMG; VHC, MCH, HAG, and BAF.

On the contrary, the utilities group slightly adjusted after a series of previous positive increases, becoming the only group to close in the red. Typical stocks include POW (-1.16%), GAS (-0.48%), REE (-0.43%), GEG (-0.93%), PPC (-2.37%), TTA (-0.9%).

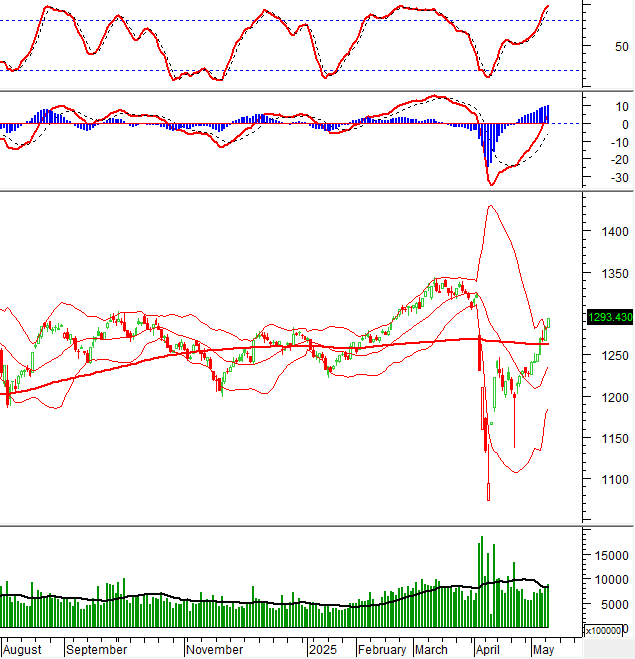

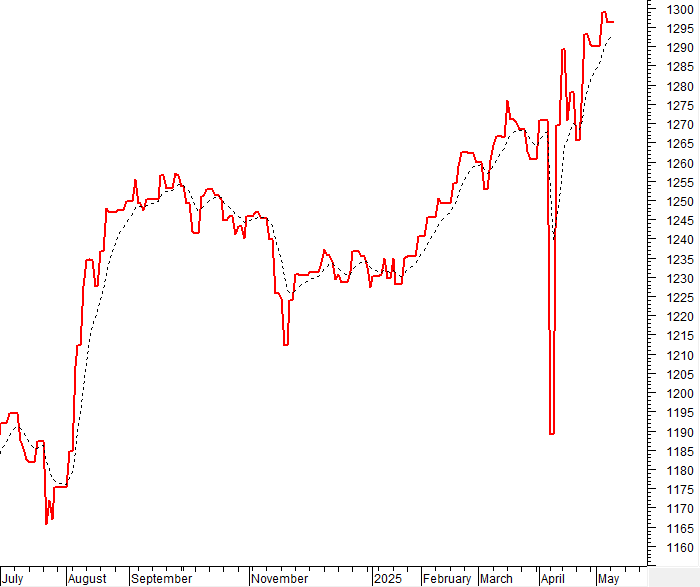

VN-Index continued to rise strongly while sticking close to the Upper Band of the Bollinger Bands. In addition, the trading volume exceeded the 20-day average, indicating that the money flow participating in the market is showing positive signs. If in the next sessions, the VN-Index continues to maintain its positive momentum, it is likely to have the opportunity to advance to the 1,300-point region. This is an important resistance level, and the result of testing this region will determine the index’s trend in the coming time. Currently, the MACD indicator is maintaining a buy signal and has just cut above the 0 threshold. This indicates that the short-term optimistic outlook is still ongoing.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Opportunity to advance to the 1,300-point region

VN-Index continued to rise strongly while sticking close to the Upper Band of the Bollinger Bands. In addition, the trading volume exceeded the 20-day average, indicating that the money flow participating in the market is showing positive signs. If the VN-Index continues to maintain its positive momentum in the next sessions, it is likely to have the opportunity to advance to the 1,300-point region. This is an important resistance level, and the result of testing this region will determine the index’s trend in the future.

Currently, the MACD indicator is maintaining a buy signal and has just cut above the 0 threshold. This indicates that the short-term optimistic outlook is still in play.

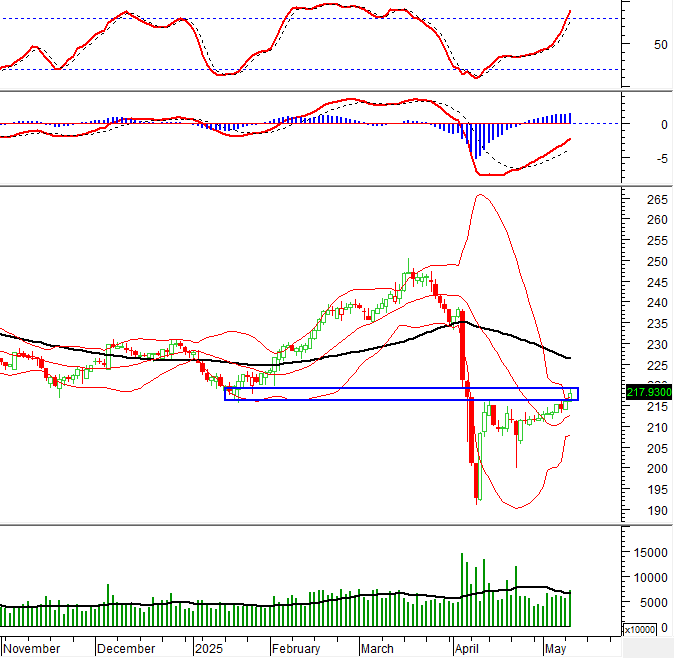

HNX-Index – Testing the old peak in January 2025

HNX-Index increased points, and the trading volume exceeded the 20-day average, indicating that investors are starting to trade more actively. Currently, the index is testing the old peak in January 2025 (equivalent to the region of 216-219 points).

At the moment, the MACD indicator continues to point up after giving a buy signal. If, in the future, this indicator surpasses the 0 threshold, the optimistic outlook will continue.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index cut above the EMA 20 days. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreign investors returned to net buying in the trading session on May 13, 2025. If foreign investors maintain this action in the next sessions, the situation will be even more optimistic.

III. MARKET STATISTICS ON MAY 13, 2025

Department of Economic and Market Strategy Analysis, Vietstock Consulting

– 17:15 May 13, 2025

Market Beat: Foreigners Ramp Up Buying, VN-Index Surges Past 1,300 Points

The trading session concluded with impressive gains, as the VN-Index surged by 16.3 points (+1.26%), closing at 1,309.73. Simultaneously, the HNX-Index displayed a notable increase of 0.95 points (+0.44%), finishing the day at 218.88. The market breadth tilted strongly in favor of advancers, with 426 tickers in the green and only 322 in the red. Within the VN30 basket, bullish momentum prevailed, evidenced by 22 gainers, 7 losers, and 1 unchanged stock.

Technical Analysis for May 13: The Green Wave is Spreading

The VN-Index and HNX-Index both surged, with a significant increase in trading liquidity in the morning session, indicating a continued improvement in investor sentiment.

The Stock Market Soars: VN-Index Holds Steady Amid Pressure from Blue Chips

Today, VPL made its debut on the HoSE stock exchange amidst a backdrop of declines for VIC, VHM, and VRE. The 20% surge in VPL, which is not yet factored into the VN-Index, was offset by pressure from other pillar stocks, resulting in a modest 0.45% gain for the index. Despite this, the market breadth showcased a dominant uptrend among stocks, particularly within the booming securities sector.