On May 13th, over 1.79 billion VPL shares of Vinpearl Joint Stock Company officially began trading on the HoSE stock exchange, with a reference price of 71,300 VND per share on its first day. The stock immediately soared to the maximum allowed daily limit (+/-20%) to 85,500 VND per share, with a buying queue of more than 1 million units at the ceiling price.

Vinpearl’s market capitalization surged to over VND 150 trillion (approximately USD 6 billion) as a result. This figure could propel the tourism, resort, and entertainment enterprise of billionaire Pham Nhat Vuong into the top 10 most valuable companies on the stock exchange. This listing is the biggest IPO on the Vietnamese stock market since 2018.

With Vinpearl’s listing, the ecosystem of billionaire Pham Nhat Vuong now boasts five USD billion-dollar entities: Vingroup, Vinhomes, Vincom Retail, and VEFAC. The total market capitalization of the “Vingroup” family on the stock exchange is approximately VND 1,000 trillion, accounting for 13% of the entire stock market.

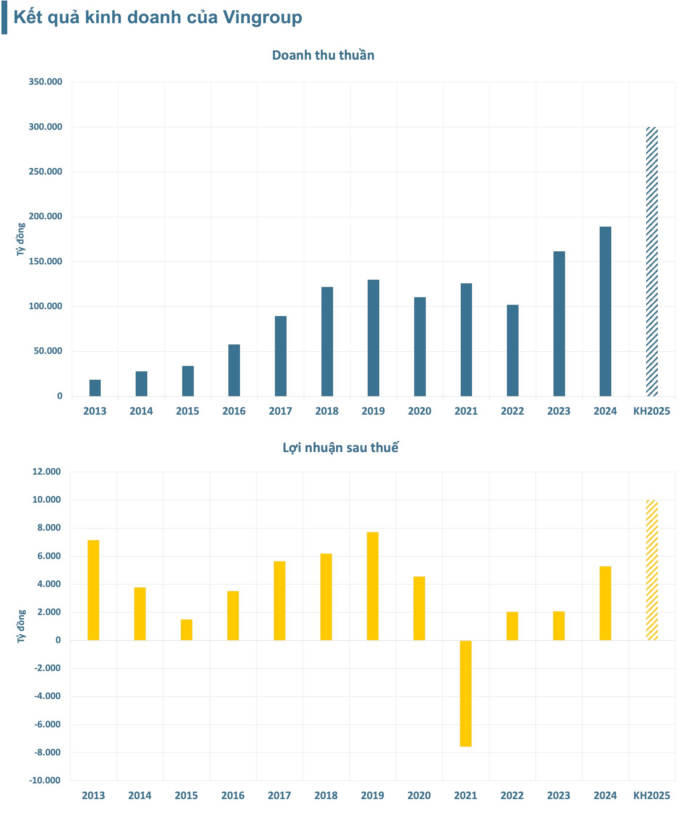

In terms of first-quarter financial results, Vingroup recorded a consolidated net revenue of 84,053 billion VND, a remarkable 287% increase compared to the same period in 2024. This impressive growth is attributed to the positive performance of its industrial production, real estate development, and business sectors. The company achieved a record-breaking quarterly revenue, with a net profit of 2,243 billion VND, a 68% surge compared to 2024’s first quarter.

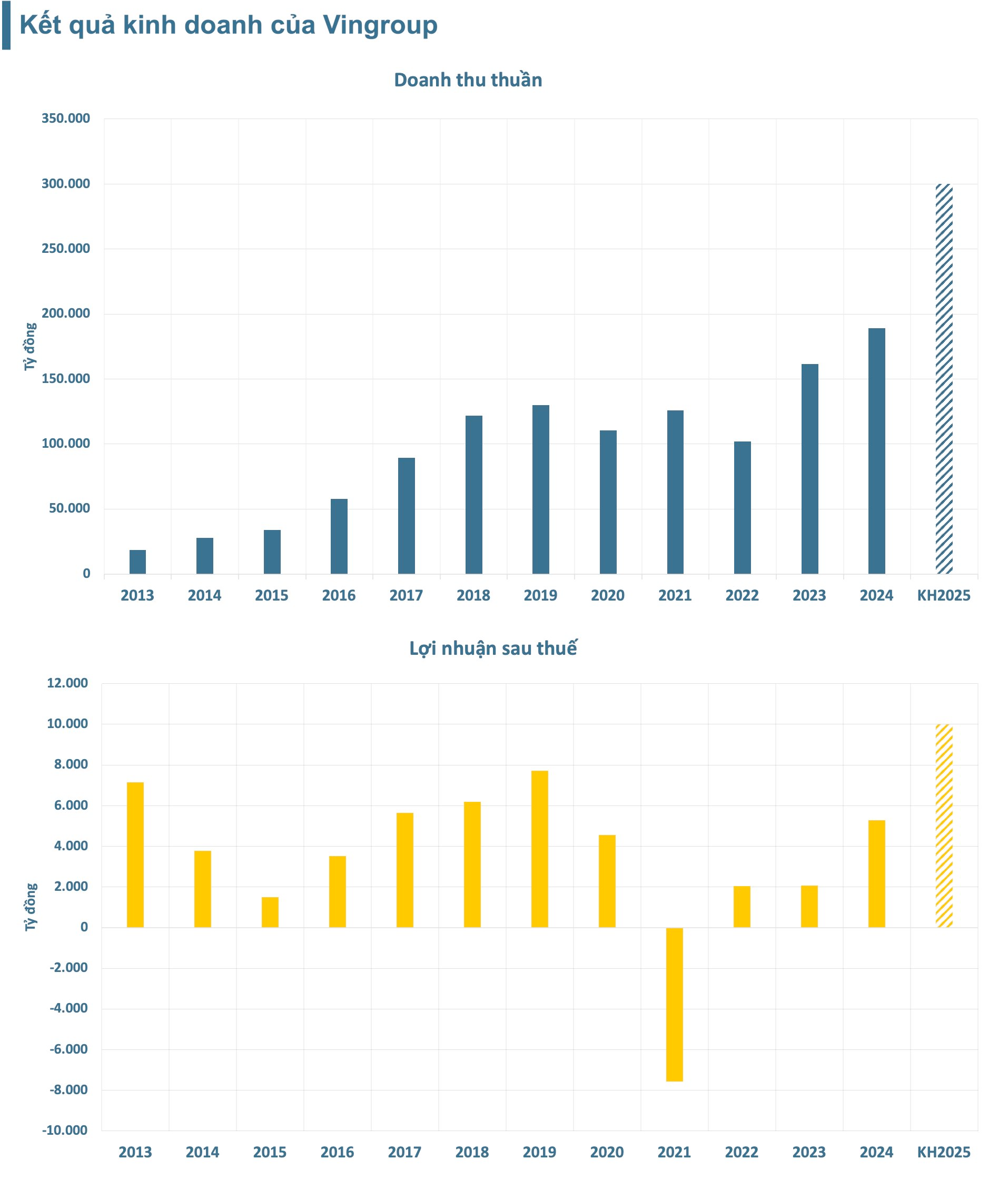

For the full year 2025, the conglomerate of billionaire Pham Nhat Vuong aims for a consolidated net revenue of approximately 300,000 billion VND from its core business operations, with an expected net profit of 10,000 billion VND. These targets represent a 56% and 90% increase, respectively, compared to the previous year’s performance. With these impressive first-quarter results, Vingroup has already achieved 28% of its revenue target and 22% of its net profit goal.

Focusing on Vinpearl, the enterprise reported a net revenue of 2,971 billion VND for the first quarter of 2025, a substantial increase of 76.6% compared to the same period last year. This includes a net revenue of 2,437 billion VND from its core business operations in hotel services, tourism, entertainment, and related services, marking a 45% growth. Additionally, the company generated 535 billion VND in revenue from its real estate activities, resulting in a net profit of 90 billion VND.

Looking ahead, Vinpearl has set ambitious targets for 2025, aiming for a net revenue of approximately 14,000 billion VND and a net profit of roughly 1,700 billion VND. With the results achieved in the first quarter, Vinpearl has accomplished approximately 21% of its revenue target and 5% of its net profit goal for the year.

The Ultimate Guide to Captivating Copy: “Bamboo Capital Fined: A Turnover in Leadership”

Bamboo Capital is in hot water with a fine of 92.5 million VND and their stock, BCG, now under control of HOSE due to a series of information disclosure violations. In the midst of this turmoil, the company has appointed a new CEO – the second time in just 2 months.

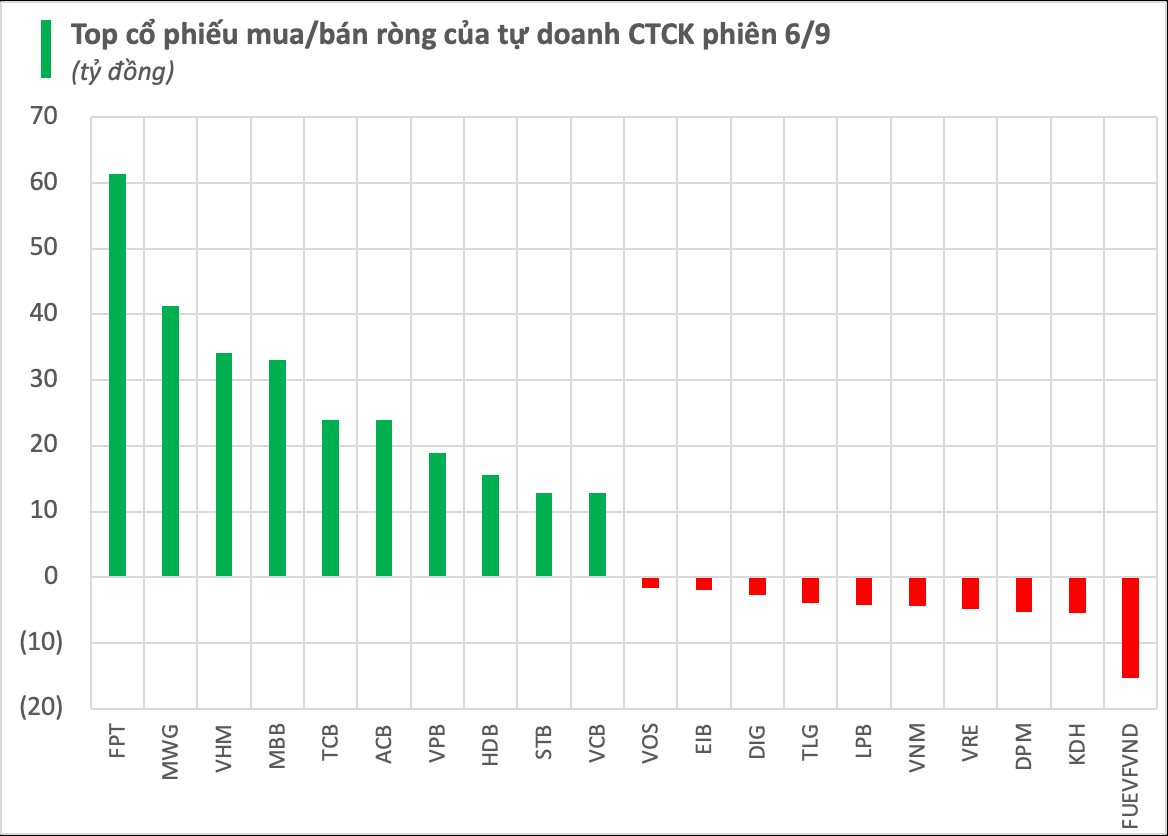

The Big Buy: Foreign Investors Snap Up Nearly a Trillion Dong, Targeting Blue-Chip Stocks

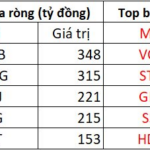

In the afternoon trading session, MBB stock witnessed a significant surge in buying activity, making it the most actively bought stock across the market. The value of the net buying reached an impressive peak of VND 348 billion.

The Bank Stock Boom: Foreign Capital Sweeps In

“The market was stunned this afternoon by the sheer volume of foreign investor purchases. HoSE alone saw an additional 3.4 trillion VND injected, with a net buy of nearly 1,153 billion VND on top of the already substantial 1,112 billion VND net buy in the morning. This marks the highest net buying session since November 29, 2022. Notably, the VN30 basket of stocks witnessed an additional net buy of approximately 531 billion VND…”