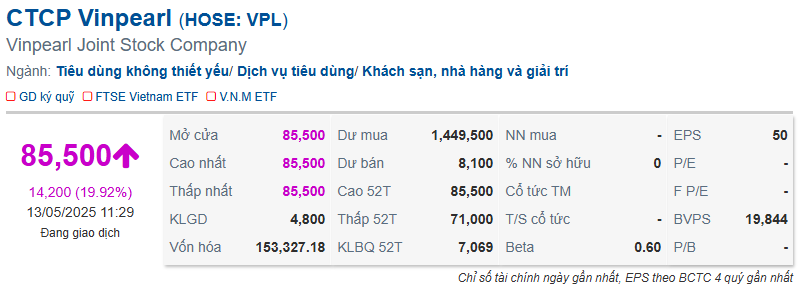

While the trading volume was modest at 4,800 shares, the buy surplus of over 1.4 million shares indicates strong investor interest in this stock.

|

Trading results of VPL stock in the morning session

Source: VietstockFinance

|

According to the prospectus, Vinpearl Joint Stock Company was formerly known as Hon Tre Tourism, Trade, and Service Development Co., Ltd., established in July 2001.

Vinpearl’s current core business focuses on accommodation services, amusement and entertainment services, restaurant and culinary services. After 23 years of operation, the company owns, manages, and operates a chain of 5-star hotels, resorts, spas, convention centers, culinary centers, and golf courses, as well as internationally-standard amusement parks located in famous tourist destinations in Vietnam such as Phu Quoc, Nha Trang, Danang, and Ha Long, among others.

Vinpearl’s entertainment and resort system comprises 48 facilities across 18 provinces and cities nationwide, including 31 hotels and resorts with a capacity of over 16,100 rooms, 4 theme parks, 5 amusement parks, 1 wildlife conservation and care park, 1 water park, 1 horse academy, 4 golf courses, and 1 convention and culinary center.

Some of Vinpearl’s notable brands and projects include Vinpearl Landmark 81 Hotel, Autograph Collection, Vinpearl Resort & Golf Nam Hoi An, and the complex of hotels, resorts, golf courses, amusement parks, and wildlife conservation and care parks in Phu Quoc.

Vinpearl aims to become a leading and trusted brand in the entertainment, tourism, and resort industry in Vietnam and worldwide.

Targets net profit of VND 1,700 billion in 2025

In terms of financial performance, according to the audited consolidated financial statements, Vinpearl Joint Stock Company (VPL) reported impressive business results for 2024, with a net profit of VND 2.6 trillion, 3.8 times higher than the previous year.

The company’s consolidated revenue in 2024 was 1.5 times higher than the previous year, mainly due to real estate transfer revenue of nearly VND 5.9 trillion, almost 10 times higher than the previous year.

In 2024, Vinpearl inaugurated VinWonders Cua Hoi, the largest entertainment complex in North Central Vietnam, and Vinpearl Vu Yen Horse Riding Academy. Several new products were also launched, including Vinpearl Harbour, a complex of entertainment, culinary, and shopping experiences in the Indochine commercial street; Stunt Show, an action-packed live performance on the sea; and Aquafield Nha Trang, a spa and sauna complex.

One of Vinpearl’s most notable products in the past year was 8Wonder, which hosted the 8Wonder Winter Festival featuring the world-renowned rock band Imagine Dragons, helping to boost the brand awareness of Vinpearl and VinWonders.

Entering 2025, VPL sets its business plan with expected net revenue from production and trading activities of about VND 14,000 billion and net profit of about VND 1,700 billion.

To achieve these goals, the company prioritizes five business orientations: market diversification, improving sales channel efficiency, developing the MICE segment (meetings, incentives, conferences, exhibitions), promoting multi-generation tourism, and expanding its ecosystem.

In terms of market diversification, Vinpearl continues to target international markets, including traditional markets such as South Korea, China, and Russian-speaking countries. Additionally, the company is exploring new emerging markets with high potential, such as Mongolia, India, the Middle East, long-haul flight markets, and Southeast Asia. This strategy aims to increase the proportion of international customers while maintaining a double-digit growth rate in the domestic market.

To expand its ecosystem, Vinpearl plans to develop its infrastructure in 2025 by opening new hotels, amusement parks, and golf courses.

In addition to revenue growth, the company aims to optimize energy costs, management and operational expenses, and personnel costs. Vinpearl also maintains cooperation and collaboration with reputable brands that align with the company’s development goals.

| In the first quarter of 2025, Vinpearl recorded net revenue from core business activities (including hotel, tourism, amusement, and related services) of VND 2,435 billion and gross profit of VND 450 billion, increases of 45% and 83%, respectively, compared to the same period last year. |

– 11:53 13/05/2025

“Vingroup’s Total Value Surges to Nearly $43 Billion as Tycoon Pham Nhat Vuong Drops His 5th Billion-Dollar ‘Blockbuster’ IPO”

With a staggering valuation of $5 billion, Vinpearl has cemented its place among Vietnam’s most valuable companies, securing a spot in the top 15 on the stock exchange. This achievement places them just behind VPBank and ahead of notable non-banking giants such as Vinamilk, GVR, and Masan.

The Pearl of Vietnam’s Stock Market: Vinpearl’s HoSE Listing Leaves Rivals in the Dust

With a valuation of approximately 128 trillion VND, Vinpearl has surpassed veteran brands such as Vinamilk, ACB Bank, and the Masan Group to become one of the top-capitalized companies on the Vietnamese stock exchange.