Commenting on the macroeconomic outlook and the stock market, Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS), shared his insights. Recalling the events of early April, he noted that President Donald Trump escalated trade tensions to an unprecedented level, imposing unimaginable tariffs on various countries.

According to statistics, the volume of imports into the US declined rapidly, with a significant drop in container port traffic and a sharp fall in tourist arrivals from Canada, Europe, South America, and Asia. This indicates that the US economy is feeling the impact of escalating trade tensions.

In response, China has shifted its crude oil imports away from the US to Canada. By the end of March, crude oil imports from the US had plummeted, causing losses for American exporters. Simultaneously, US agricultural producers, such as soybean and beef farmers, are facing challenges as China turns to Mexico and Brazil for these products. China has also halted the import of Boeing aircraft, affecting the American aerospace industry.

These actions have clear repercussions for the US economy, and their full impact may be felt in the coming months of May and June. Therefore, de-escalation of trade tensions would positively affect US trade with other nations.

By the end of March, US imports from China had drastically decreased, while imports from other countries rose. Recently, to curb price increases, the US reduced tariffs on certain products, such as electronic equipment, to near zero. These items are manufactured by American companies in China and then imported back into the US. In contrast, China maintains a tariff rate of around 10% on these products.

The trade agreement between the US and the UK further demonstrates a de-escalation of tensions. Under this agreement, tariffs on cars imported from the UK to the US have been reduced from 27% to 10%, while tariffs on steel, aluminum, engines, and aircraft parts have been eliminated entirely.

In contrast, the UK has committed to purchasing $10 billion worth of Boeing aircraft and paying a 10% tariff on other goods. The volume of imports from China into the US has also witnessed a steep decline of approximately 18% by the end of March. Imports of machinery, textiles, basic metals, plastics, and rubber have decreased by 14-33%. These figures are expected to drop even lower in April.

As of March, only 8.6% of US imports originated from China, the lowest level since the 2008 recession and equivalent to the levels seen in 2001-2002. The trade relationship between the US and China is at a critical juncture, and there are expectations for agreements that ensure a return to normal production levels and potentially lower tariffs from the current 200% rate.

Domestically, bank stocks have made a comeback this week, with TCB, TPB, and other bank stocks leading the market surge during the trading session on May 12th.

Several bank stocks have rebounded and are now in an uptrend. From a mid to long-term perspective, bank stocks remain attractively valued. If the State Bank of Vietnam continues its accommodative monetary policy to support the market, credit growth will remain robust. Bank stocks, particularly those of leading banks, have strong growth prospects, driven by expanding credit growth, revenue, and profit.

In the recent past, the net interest margin (NIM) of some banks has narrowed, as evident in the first-quarter financial reports. This trend is understandable as banks share profits and contribute to the economy’s recovery by offering reasonable loan interest rates. Historically, as the economy rebounds, bank stocks tend to be favored and exhibit strong growth potential.

This year, if trade negotiations proceed smoothly and Vietnam’s economy overcomes challenges, bank stocks are expected to remain attractive to investors.

Secondly, investors may consider deeply discounted stocks that have formed a bottom and are now rebounding in the technology and telecom sectors, such as FPT and CTR. With the US and its major trading partners returning to the negotiating table, this could be an opportune time for these stocks to recover and regain upward momentum.

Additionally, for those seeking new buying opportunities, it is advisable to focus on stocks in the industrial real estate sector that have already bottomed out and are still far from their pre-April correction levels. This strategy can be described as “buying at a discount to catch the rebound.”

Mr. Son emphasized that, in the short term, bank stocks are likely to remain the leading sector. During the recent holiday break, bank stocks experienced a pause in their upward momentum, but they have since regained their upward trajectory. This sector has the potential to push the VN-Index beyond the 1,280-point mark and fill the gap created by the sharp decline on April 2nd and 3rd.

The Ultimate Guide to Vietnam’s ‘Saltwater Treasure’: Why It’s a Hit in China, Boasting a 2000% Export Increase and Generating Tens of Millions of USD

This Vietnamese product boasts superior quality and competitive pricing compared to many other markets.

Spending Spree: Vietnam Spends $5.6 Billion on US Imports in Four Months

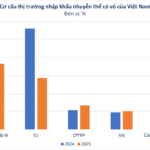

In the first four months of this year, Vietnam spent approximately $5.6 billion on imports from the United States, marking a significant 25.8% increase compared to the same period last year. Notably, this includes a substantial rise in the import of high-tech equipment and raw materials, indicating Vietnam’s proactive efforts to boost imports from the US and strive for a harmonious trade balance.

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

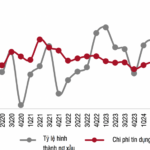

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

Are Non-Performing Loans on the Rise Again for Banks, Yet No Proactive Provisions Made?

The notable highlight of the quarter is the banks’ restrained approach to provisioning for bad debts, despite a decline in asset quality as evidenced by the mismatch between credit costs and the pace of non-performing loan formation.