The average lending interest rate refers to the average interest rate applied to loans extended during a specific period. However, the actual lending rates offered to customers can vary depending on their risk profile, financial strength, and collateral…

According to experts, the lending rate can also be influenced by the bank’s strategic focus and target customer segment. Banks that cater to wholesale clients, such as large corporate borrowers with production and business loans or working capital needs, tend to have lower average lending rates…

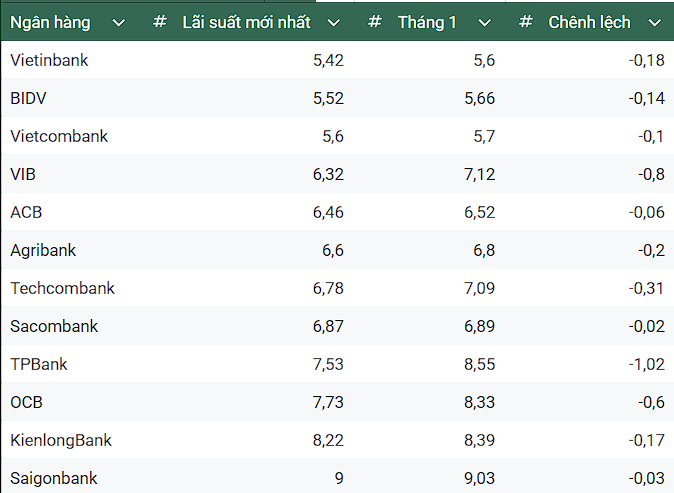

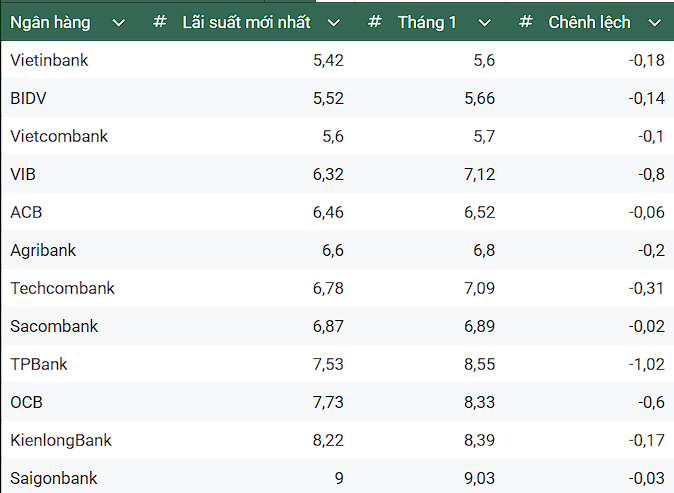

Latest average lending rates at select banks. Unit: %/year

Banks with a wholesale lending strategy, focusing on large corporate borrowers and short-term production and working capital loans, or lending to prioritized sectors as directed by the government at preferential rates, will naturally have lower average lending rates…

In contrast, retail-focused banks that cater mainly to individual borrowers will have higher average lending rates. These banks typically offer consumer loans, mortgages, and auto loans with longer repayment terms, as well as unsecured personal loans…

Nonetheless, customers should be aware that the advertised average lending rates may not reflect the exact rate applied to their specific loan. It is advisable to contact the bank branch or transaction office for detailed information on credit programs and promotional offers…

In 2024, the Prime Minister directed commercial banks to publicly disclose their average lending rates to facilitate easier access to credit for individuals and businesses. This initiative also aimed to effectively implement preferential credit packages tailored to the characteristics of each credit institution and targeted at critical sectors…

According to the latest announcement from the State Bank of Vietnam, the average lending rate of domestic commercial banks for new and outstanding loans in March was 6.6-9.0%/year, slightly lower than the 6.7-9.0%/year recorded in January…

Based on our research and the latest updates on lending rates published on the websites of credit institutions, the market leaders in terms of average lending rates currently include VietABank at 9.71%/year, BAOVIET Bank at 9.29%/year, and Saigonbank at 9.0%/year…

State-owned commercial banks offer the lowest lending rates in the market, with some even reducing their rates compared to the beginning of the year. Specifically, VietinBank’s lending rate is 5.42%/year, a decrease of 0.18% from January; BIDV’s rate is 5.52%/year, down by 0.14%; Vietcombank’s rate is 5.6%/year, a 0.1% reduction; and Agribank’s rate stands at 6.6%/year, a significant drop of 0.2%…

Additionally, several joint-stock commercial banks have also announced substantial rate cuts. For instance, TPBank’s average lending rate has been reduced to 7.53%/year, a notable decrease of 1.02% from the 8.55%/year rate at the beginning of the year. Similarly, VIB has lowered its rate to 6.32%/year, an 0.8% reduction from the previous 7.12%/year…

The Power Sector is in the Red, Yet Monopoly Persists: Why?

“There are sectors such as coal and electricity that are heavily loss-making yet remain state-owned monopolies,” said the National Assembly delegate.

“VietinBank Boosts Credit Package, Invests in Forestry and Fisheries”

“Following the directives of the Government and the Prime Minister’s Resolution No. 46/NQ-CP dated March 8, 2025, and Directive No. 05/CT-TTg dated March 1, 2025, VietinBank, in alignment with the guidance of the State Bank of Vietnam, has introduced a preferential credit program for the forestry and aquatic product sectors. With a scale of up to VND 12,000 billion, this initiative aims to alleviate challenges faced by businesses and individuals, ultimately driving economic growth.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)