Young Homebuyer Loans: A Comprehensive Overview of Vietnam’s Top Bank Offers in May 2025

For young homebuyers seeking attractive loan packages, TPBank stands out with its competitive interest rates starting from 3.6%/year for borrowers under 35 years old. The bank offers up to 100% of the required loan amount with a tenure of up to 35 years, and borrowers are exempt from principal repayments for the first five years or pay only 5% of the principal during this period.

Eximbank follows suit with its home loan package, offering an introductory rate of 3.68%/year for 36 months to borrowers aged 22-35. LPBank also enters the fray with an impressive 3.88%/year interest rate and a tenure of up to 35 years.

Woori Bank and SHB Bank are also in the fray with competitive offerings. Woori Bank presents a package with interest rates starting from 3.9%/year, while SHB Bank introduces a VND 16 trillion credit package designed specifically for young homebuyers, featuring interest rates as low as 3.99%/year and a principal grace period of up to 60 months.

HDBank unveils a VND 30 trillion credit package for individuals and households looking to purchase property in 24 major cities, catering especially to young buyers with interest rates from 4.5%/year. The loan tenure can extend up to 50 years, and borrowers benefit from a five-year grace period on principal repayments.

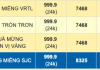

Illustration: Bank offers attractive home loan interest rates (Image for illustrative purposes).

ACB joins the fray with its attractive loan package, offering an impressive interest rate of 5.5%/year for borrowers aged 18-35, with a tenure of up to 30 years.

Other prominent banks, including Vietcombank, VIB, VPBank, HDBank, and MB, are also actively promoting their competitive credit packages. These packages feature introductory rates as low as 3.88% or 3.99%, or a fixed rate of 5.5% for the initial 2-3 years.

Notably, HDBank stands out with its unique offering of a 50-year tenure for social housing loans, enabling individuals with a monthly income of less than VND 15 million to own a home with daily installments as low as VND 200,000, thus effectively supporting borrowers in managing their finances.

According to surveys, state-owned banks (Agribank, Vietcombank, Vietinbank, and BIDV) offer attractive home loan interest rates ranging from 5% to 7%/year. In May 2025, commercial banks adjusted their home loan interest rates downward to stimulate demand. Existing loans will see a slower reduction, ranging from 1% to 2%.

While these promotional packages present opportunities, borrowers must remain vigilant about the floating interest rates that will apply after the promotional period. The fine print reveals that post-promotional rates are determined by adding a margin of 3.5%-5% to the 12-month deposit interest rate, resulting in an annual rate of 11%-13%. With home loans typically spanning over 20 years, floating rates can significantly impact borrowers’ financial obligations if not carefully considered.

Financial expert, Dr. Nguyen Tri Hieu, cautions borrowers about the challenges posed by floating rates. He emphasizes that the repayment burden can increase significantly after the promotional period, especially for households with limited incomes.

Dr. Hieu advises borrowers to ensure that their total debt repayments (principal and interest) do not exceed 50%-60% of their monthly income to mitigate risks. If this ratio climbs to 70%-80%, borrowers may face substantial financial strain should floating rates surge unexpectedly.

“Borrowers must carefully study the terms and conditions, including interest rate adjustment mechanisms, prepayment penalties, and other associated costs, to avoid falling into an interest rate ‘trap,’ ” Dr. Hieu stressed.

According to the State Bank of Vietnam, home loan interest rates currently stand at 5-6%, a decrease of 3-4 percentage points compared to the COVID-19 era. Housing credit extended by banks in the first two months of the year grew by 1.15% compared to the end of 2024, reaching VND 1,098,000 billion, accounting for approximately 28% of total credit outstanding.

Of this, loans for social housing, commercial housing, and other types of housing amounted to over VND 600,000 billion, reflecting an increase of 0.67% from the end of 2024 and a year-on-year growth of 7.39%. The growth rate of housing credit outpaced the overall credit growth.

Stabilizing Businesses for the Lunar New Year Holiday with Special Loan Interest Rates

Meeting capital needs and providing banking services, especially maintaining lending rates lower than the common rate and the same term lending rates of credit institutions, have significantly contributed to the market stabilization program, especially during the Lunar New Year period.