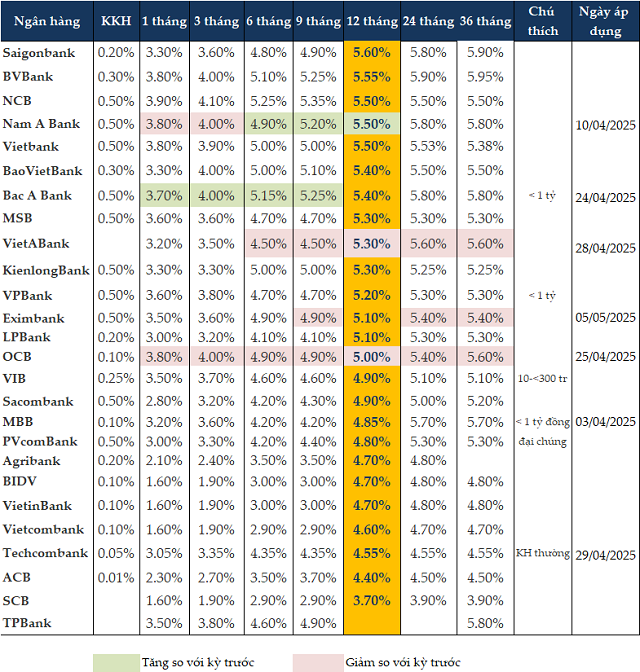

Since the beginning of May 2025, some commercial banks have started to slightly increase deposit interest rates for 6-12-month terms (usually by 0.1-0.3 percentage points), especially in medium and small-sized joint-stock commercial banks. This situation has occurred after a long period of deep reductions in deposit interest rates from the end of 2023 to the first quarter of 2025, with the expectation of stimulating credit and supporting the economy.

At the adjustment period on April 28, 2025, VietABank decreased the deposit interest rate for terms of 6 months or more by 0.1 percentage points. As a result, the interest rates for 6-9 month terms dropped to 4.5%/year, 12-month terms decreased to 5.3%/year, while terms over 12 months are now at 5.6%/year.

Eximbank also reduced deposit interest rates for some terms starting May 5, 2025. The bank decreased the 9-month term rate by 0.1 percentage points to 4.9%/year, and the rate for terms over 12 months was reduced by 0.2 percentage points to 5.4%/year. OCB reduced interest rates for all terms by 0.1-0.2 percentage points starting April 25, 2025. The bank now offers a 1-month term rate of 3.8%/year, 3-month terms at 4%/year, 6-9 month terms at 4.9%/year, and 12-month terms at 5%/year.

From April 10, 2025, Nam A Bank decreased the interest rate for 1-3 month terms by 0.1 percentage points to 3.8-4%/year; while increasing the rate for 6-12 month terms by 0.2 percentage points to 4.9-5.5%/year; the rate for terms over 12 months remains unchanged at 5.8%/year.

Bac A Bank increased interest rates for terms below 12 months by 0.2 percentage points starting April 24, 2025. For savings accounts with a balance of less than VND 1 billion, the bank offers a 1-month term rate of 3.7%/year, 3-month terms at 4%/year, 6-month terms at 5.15%/year, and 9-month terms at 5.25%/year.

As of May 12, 2025, interest rates for savings accounts with terms of 1-3 months remain at 1.6 – 4.1%/year, 6-9 month terms are at 2.9 – 5.35%/year, and 12-month terms are within the range of 3.7 – 5.6%/year.

For the 12-month term, Saigonbank offers the highest interest rate at 5.6%/year, followed by BVBank at 5.55%/year. NCB, Nam A Bank, and Vietbank all offer rates of 5.5%/year for this term.

NCB maintains the highest interest rate for the 6-month term at 5.25%/year, followed by Bac A Bank at 5.15%/year and BVBank at 5.1%/year.

For the 3-month term, NCB offers the highest rate at 4.1%/year. Bac A Bank, BVBank, BaoVietBank, Nam A Bank, and OCB all offer competitive rates of 4%/year for this term.

|

Deposit interest rates at banks as of May 12, 2025

Source: Consolidated

|

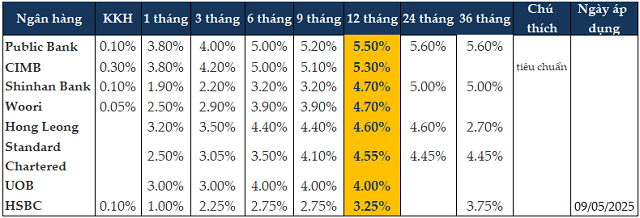

Foreign bank groups have not changed their interest rate tables as of the beginning of May. Public Bank offers the highest interest rate for 12-month terms at 5.5%/year, while both Public Bank and CIMB offer a rate of 5%/year for 6-month terms.

|

Deposit interest rates at foreign banks as of May 12, 2025

Source: Consolidated

|

This is not a race to increase interest rates

According to Mr. Nguyen Quang Huy, CEO of Finance and Banking, Nguyen Trai University, the trend of slightly increasing deposit interest rates since the beginning of May 2025 is not just a temporary fluctuation, but an indicator reflecting the intertwined effects of system liquidity, credit growth targets, policy management expectations, and global macroeconomic fluctuations.

The reason for banks starting to increase interest rates again stems from a mix of two main drivers. Overall system liquidity remains abundant, as evidenced by the low interbank interest rates (around 0.8-1.2% in early May), while the State Bank of Vietnam (SBV) continuously net withdrew through bills and offered OMO.

However, some small and medium-sized banks have shown signs of “tiring” in medium and long-term capital mobilization, especially due to the pressure of the ratio of short-term capital for medium and long-term loans reduced to 30% from October 1, 2024, according to Circular No. 08/2020/TT-NHNN. Therefore, they had to proactively increase deposit interest rates to balance their capital sources.

In addition, banks are gearing up for the peak season for credit growth. As of April 2025, credit growth reached about 2.8-3%, lower than the same period in 2024. Many banks have been granted higher credit limits and need to prepare capital early to accelerate disbursement from the second and third quarters, especially when lending rates are now in an attractive low range for borrowers. A slight increase in deposit interest rates could be a strategic “call for capital,” preparing resources for a breakthrough in credit growth in the peak months from June onwards.

Moreover, there are expectations that the US Federal Reserve (Fed) and the ECB may cut interest rates from the third quarter of 2025, allowing Vietnam to continue its loose monetary policy if domestic inflation is controlled. However, pressure on exchange rates (USD/VND slightly increased from mid-April) and rising gold, oil, and commodity prices could increase inflation expectations, prompting banks to retain VND capital by slightly increasing deposit interest rates.

Mr. Nguyen Quang Huy believes that the current situation is not a system-wide race to increase interest rates as in 2022, but a technical adjustment selectively made by banks aiming to reposition their capital structure to serve sustainable credit growth plans.

With the basic interest rate unchanged and inflation under control, the slight increase in deposit interest rates also signals expectations for stronger credit growth in the future, rather than a warning sign of a liquidity crisis.

Sharing the same view, Dr. Nguyen Tri Hieu, Economic Expert, said that since the beginning of the year, credit growth has consistently outpaced capital mobilization. If this situation continues, banks may not have enough funds to lend. Therefore, in the second half of the year, banks may have to increase deposit interest rates to supplement capital and enhance credit activities.

The probability of an increase in deposit interest rates in the coming time is relatively high, about 60%. Banks will boost lending to achieve the 16% credit growth target set by the SBV.

Additionally, with other investment channels becoming more attractive than bank deposits, including gold, securities, and soon real estate, banks may have to offer higher interest rates to absorb more capital.

“Up to now, there are still no positive signs about the tariff situation from the US. If tariffs remain high, it will affect the economy. In this case, lowering interest rates will push up the exchange rate, thereby affecting imports and macroeconomic balance. So, we are in a difficult phase to promote economic growth through interest rate cuts,” Mr. Hieu further analyzed.

According to the second-quarter 2025 economic outlook report of KBSV Securities Company (KBSV) published on April 18, 2025, the US tariff policy is expected to have a negative impact on global economic growth and trade activities. KBSV predicts that the USD/VND exchange rate may increase by approximately 4% compared to the end of 2024. In times of exchange rate tension, the SBV will intervene through measures such as selling foreign exchange reserves, issuing bills, and raising operating interest rates.

Lending rates and deposit rates are expected to remain stable during the 90-day tax deferral period or when the post-negotiation tax policy is announced with a minimal negative impact on the exchange rate. In the event of a significant increase in exchange rates and inflation, maintaining low-interest rates will become a challenge. KBSV forecasts that deposit rates may increase by 1-2%, and lending rates will increase slightly and lag behind deposit rates (0.5-1%).

– 08:00 13/05/2025

“Vietnam Stock Market: Real Estate Shines Amidst Dull April Performance”

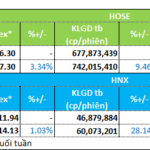

The Ho Chi Minh Stock Exchange (HOSE) ended the trading session on April 30, 2025, with key indices, including the VN-Index, VNAllshare, and VN30, posting losses compared to the end of March. Sectoral indices also witnessed declines, with the exception of the real estate sector, which managed to stay afloat.

The Rising Dollar: A Sustained Surge

“The US dollar continued its upward trajectory last week, bolstered by two key factors: The Federal Reserve’s decision to maintain interest rates and the US-UK trade deal which eased concerns about global trade tensions. This week’s forex review highlights the greenback’s resilience and sets the stage for an interesting period ahead as markets react to these developments.”